Trade Development

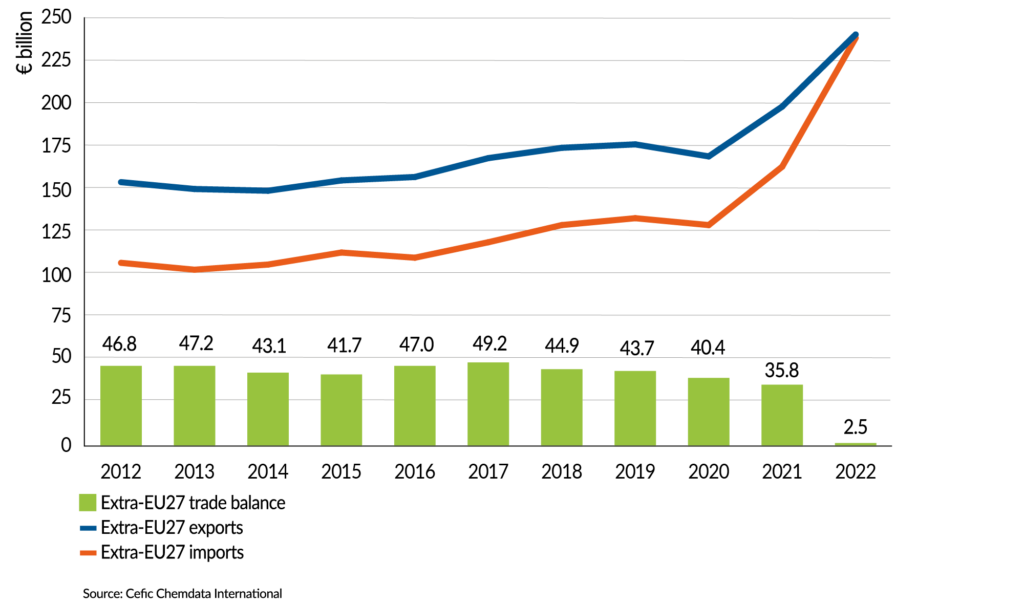

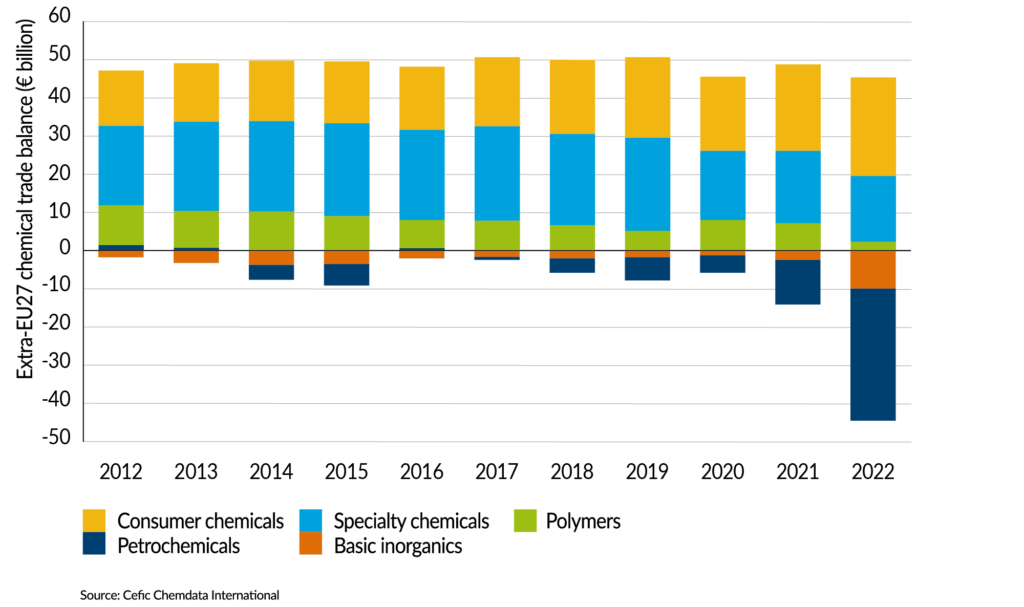

The global trade of chemicals benefits all partners and citizens by stimulating competition, innovation, and production efficiency. The EU27 chemical industry, a key player in the global market, has historically enjoyed a significant trade surplus, averaging over €40 billion in the past decade. However, the 2022 energy crisis severely impacted this surplus, causing a sharp decline in both exports and imports. The EU27’s chemical trade surplus plummeted from €35.8 billion in 2021 to €2.5 billion in 2022, marking the fourth consecutive annual decline since 2017.

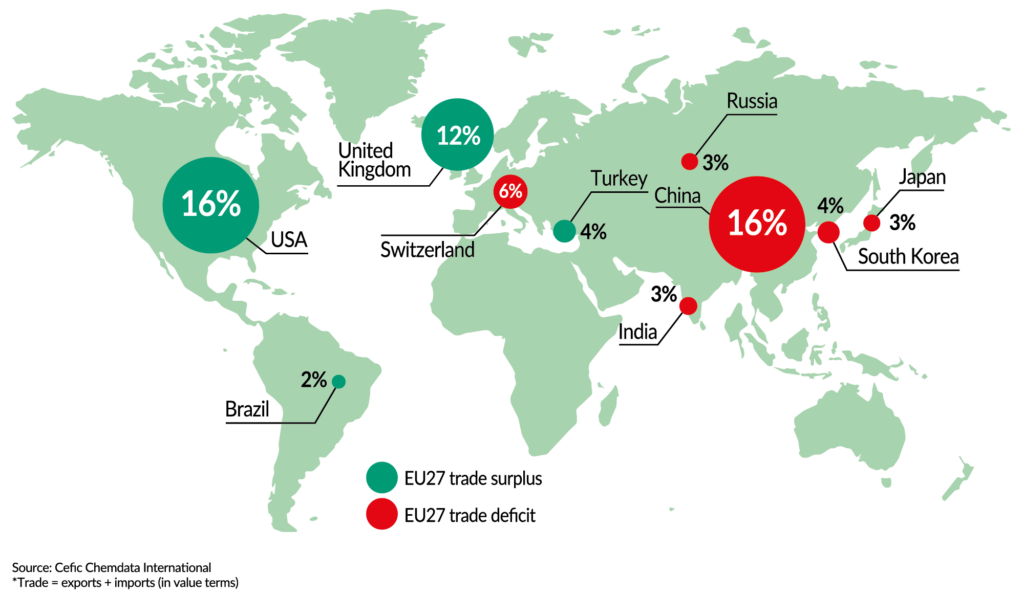

The industry’s reliance on free trade and interconnected global value chains is evident. The top 10 EU27 trading partners account for over two-thirds of its chemical trade, with the U.S., China, and the UK being the largest. The U.S. shale gas boom and China’s growing market are significant factors in the changing dynamics of chemical trade.

EU27 chemicals trade surplus reaches a lower level in 2022

Extra-EU27 chemicals trade balance

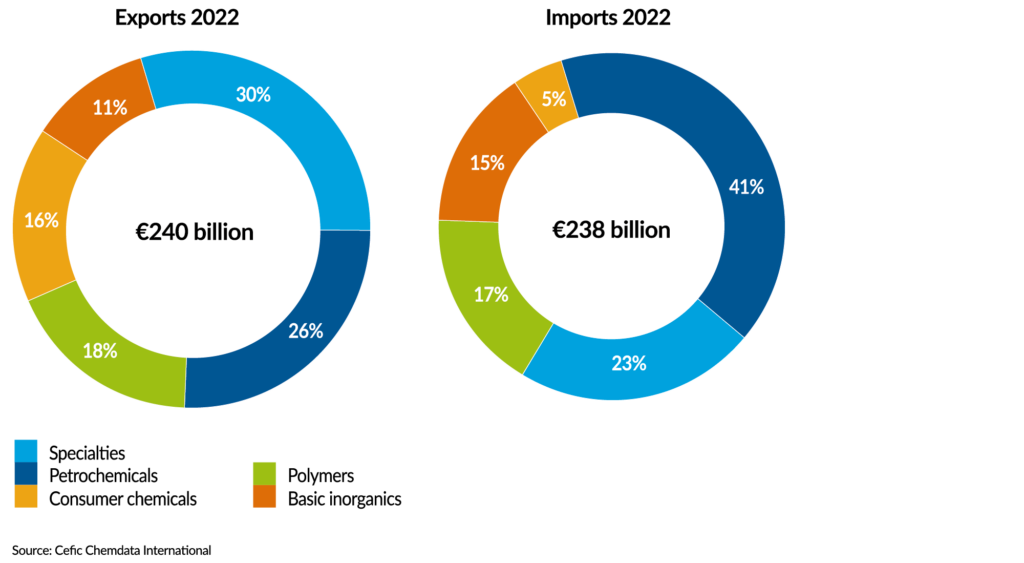

Petrochemicals contributes most to EU27 chemical trade

Extra-EU27 chemicals trade flows by sector

Top 10 EU27 partners account for two thirds of EU27 chemical trade

EU27 chemicals trade* flows with top 10 partners (2022)

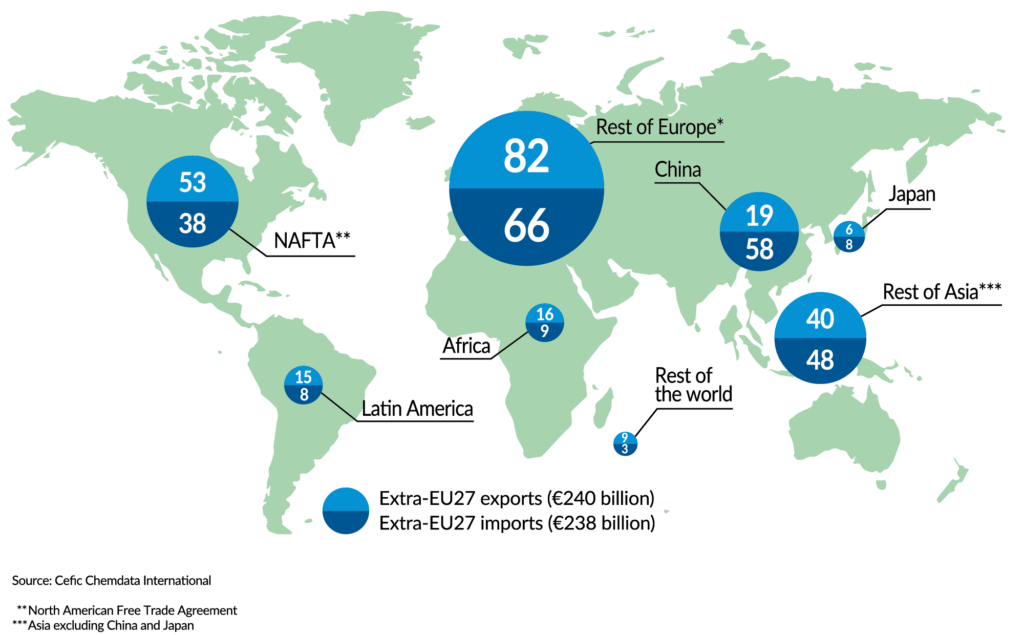

EU27 holds trade surplus with top competing regions

EU27 chemicals trade flows with major geographic blocs (2022)

Consumer chemicals contribute most to EU27 chemical trade surplus

Extra-EU27 chemicals trade balance by sector

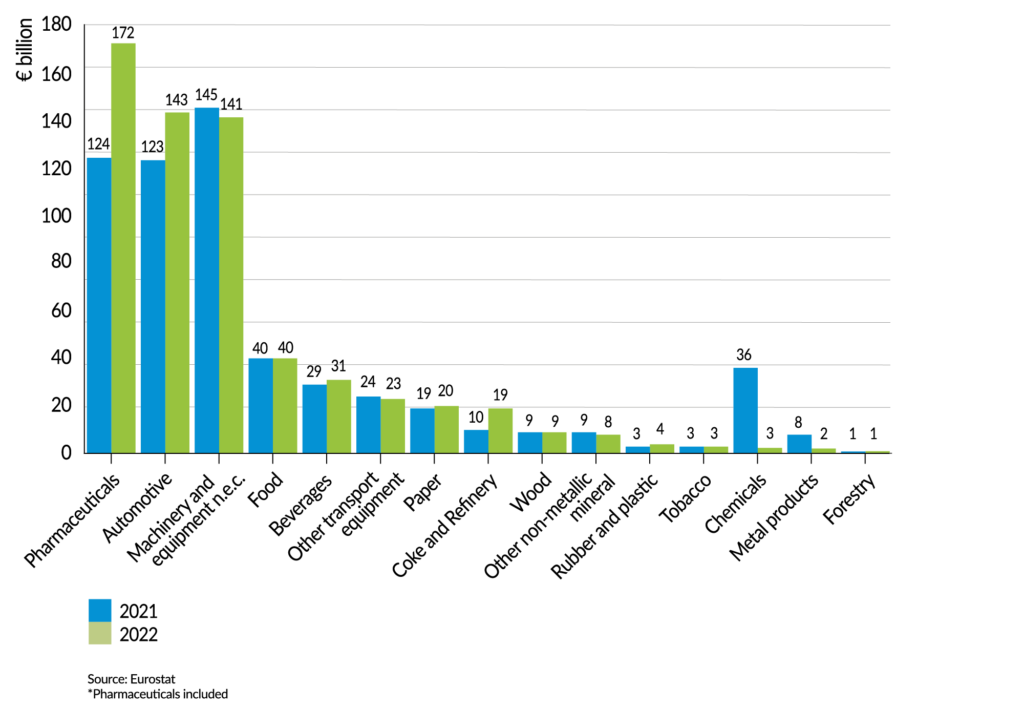

Chemicals generates one of the lowest surplus in the European Economy

EU27 trade surplus in the European Economy (2021-2022): top 15

Navigate the other chapters

Profile – Growth And Competitiveness – Our Contribution To EU27 Industry – Energy Consumption – Capital & R&I Spending – Environmental Performance