Capital & R&I Spending

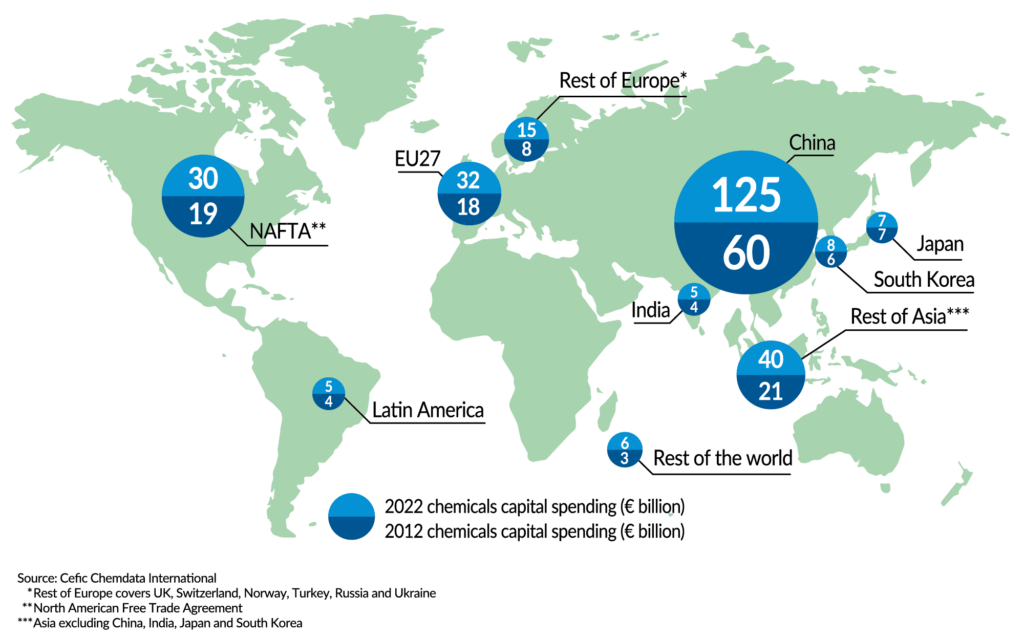

Chemical companies globally have substantially increased their capital investment by almost 80% over the past decade, with China alone contributing 46% to the overall global investment. In 2022, the EU27 reported capital spending of €32 billion, constituting 12% of the world’s chemicals investment. Capital investment plays a pivotal role in ensuring the future development and sustainability of the chemical industry. It is imperative for the European chemical sector to invest in both its existing infrastructure and new production facilities to guarantee a viable and dynamic future.

Furthermore, a critical investment for maintaining competitiveness and addressing societal challenges lies in Research and Development (R&D). In 2022, R&D spending in the EU27 chemical industry reached €11 billion, marking the highest figure to date. The European chemical industry is committed to enhancing its overall sustainability performance and recognizes the importance of both disruptive technologies and the continuous improvement of existing technologies. Investments from European innovation funding programs, along with contributions from the sector itself, are catalyzing collaboration among all relevant stakeholders.

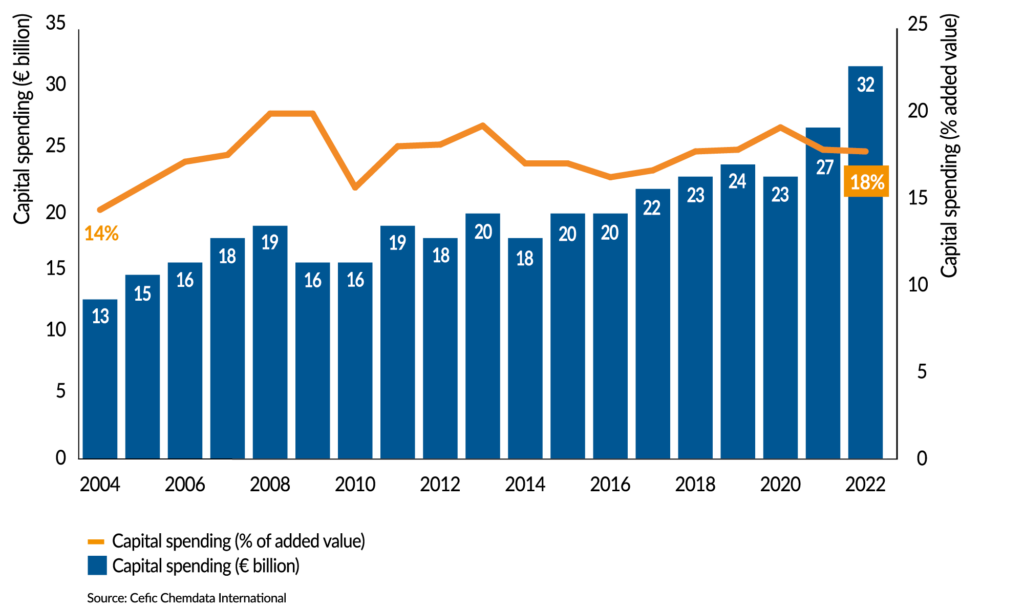

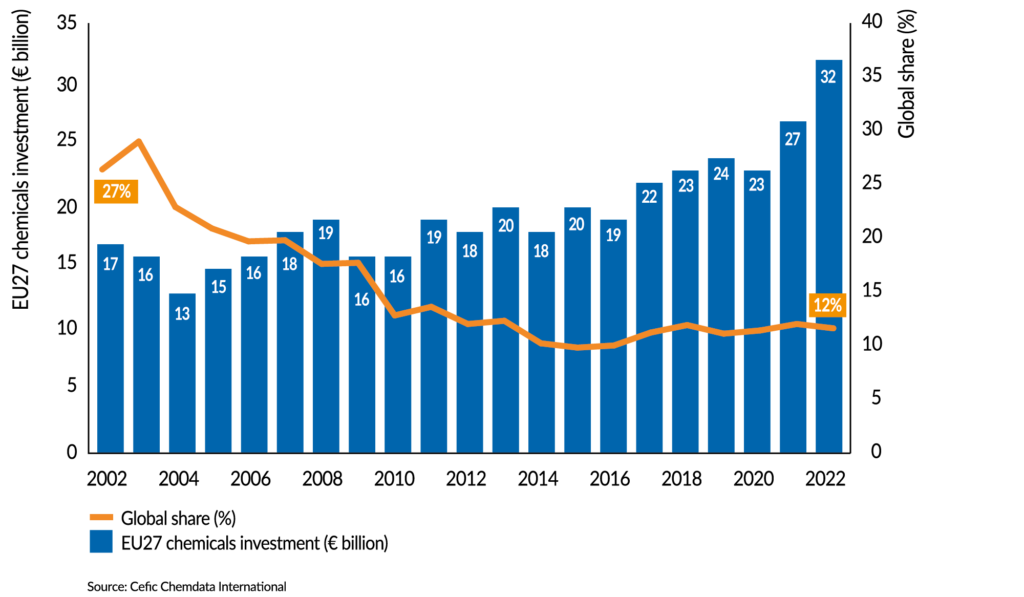

EU27 capital spending increased significantly in 2021

Capital spending in the EU27 chemical industry

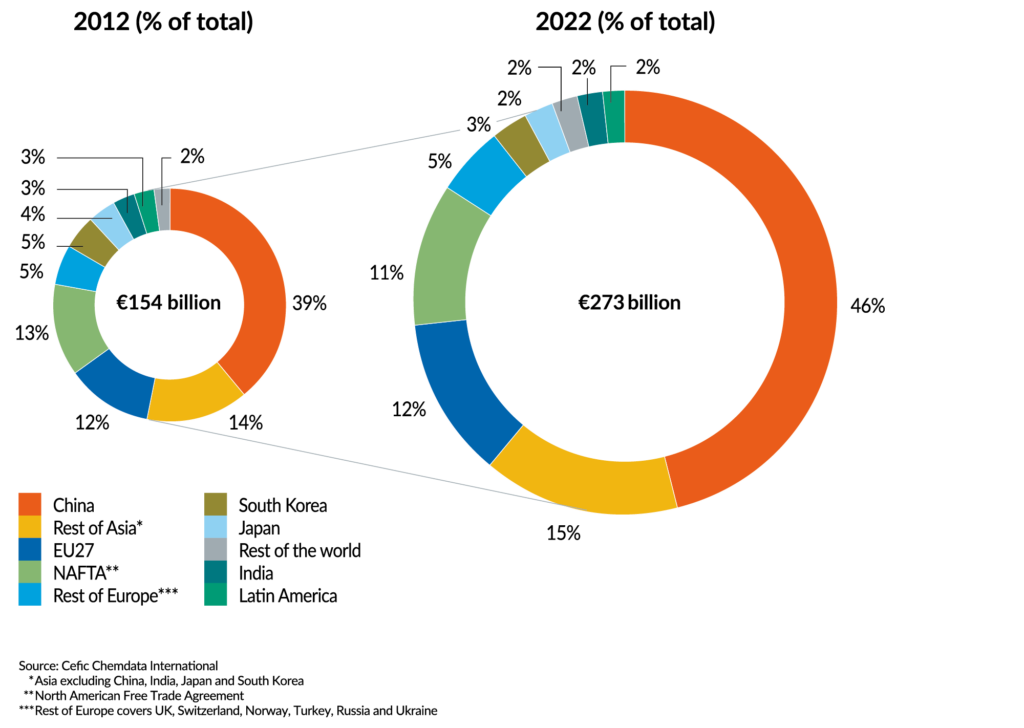

China leads the global chemicals investment

Capital spending by region (2021 vs 2011)

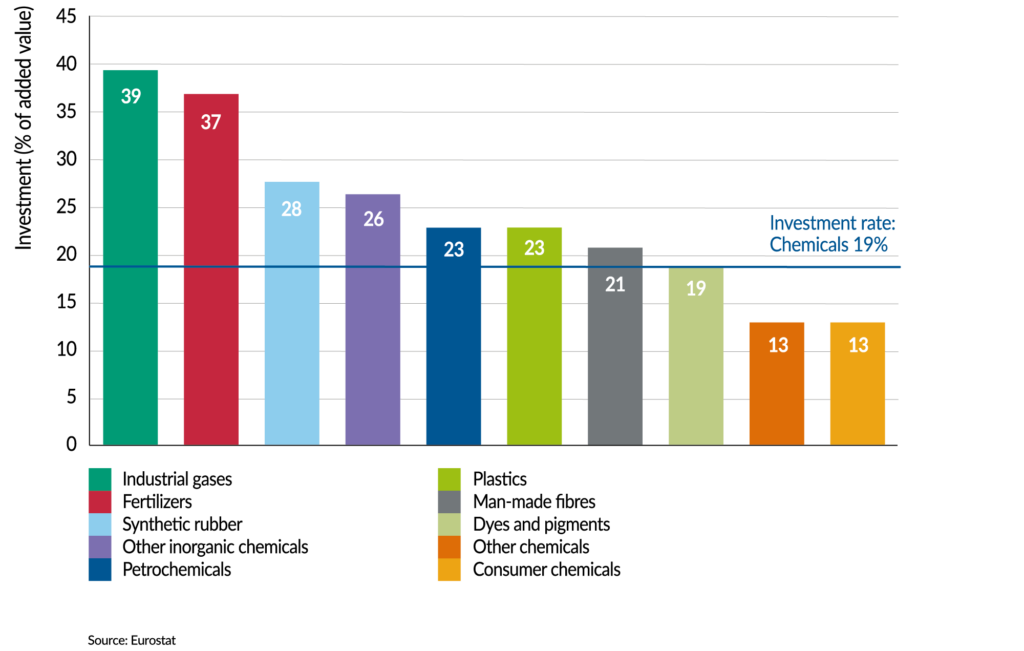

High capital intensity in the EU27 chemical sector

Capital intensity in the EU27 chemical industry

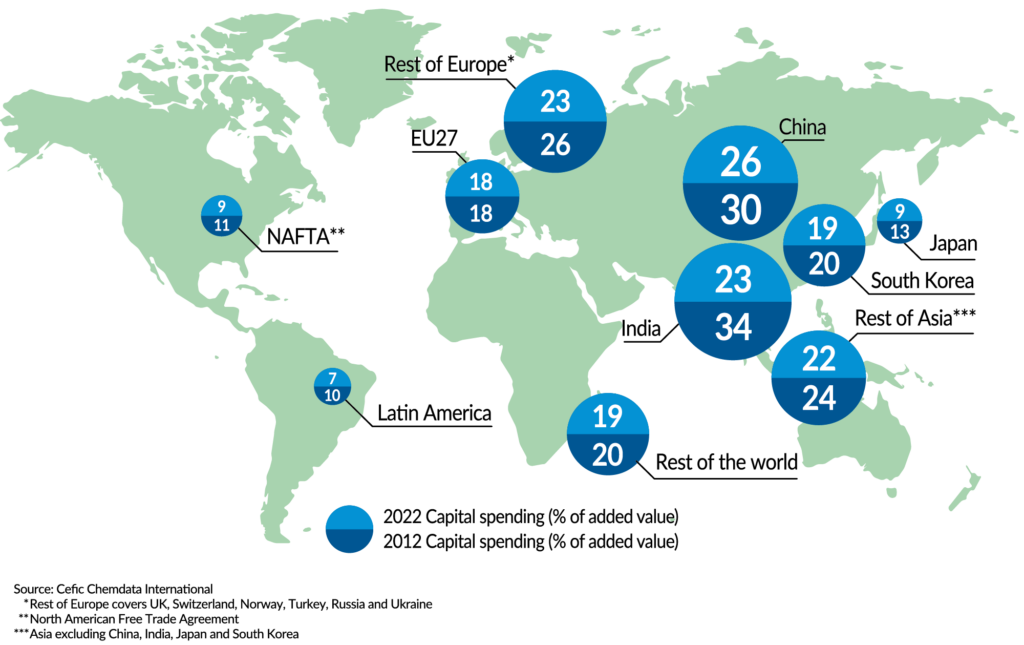

EU27 CAPITAL INTENSITY BELOW CHINA AND INDIA ECONOMIES

Capital spending (% of added value, 2022 vs 2012)

EU27 loses more than 50% of its original market share

EU27 share of global chemicals investment

Decreasing share of chemicals capital spending for the EU27

Chemicals capital spending by country (2012 vs 2022)

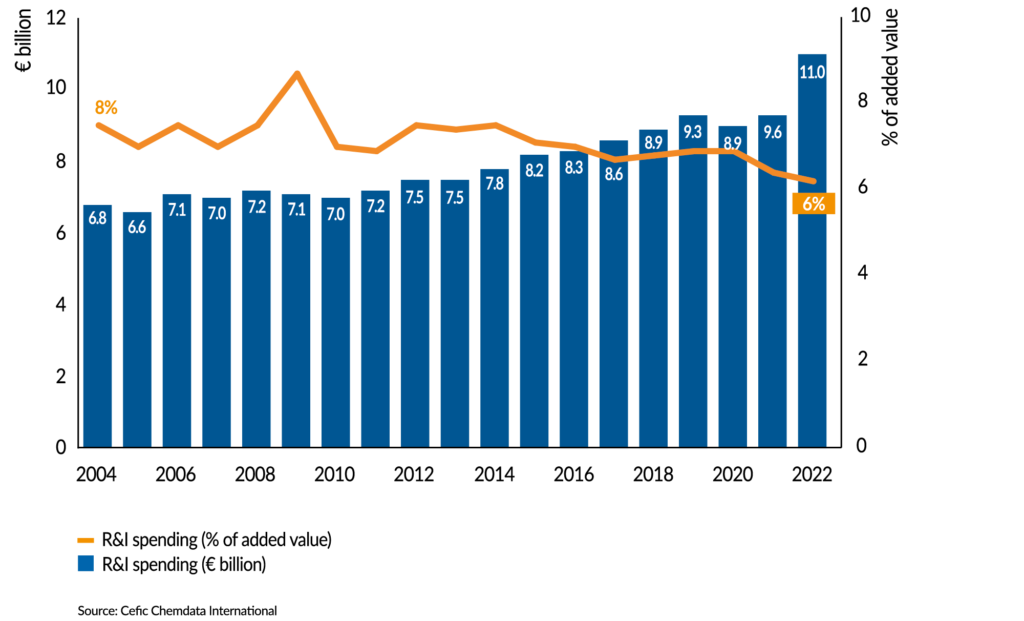

EU27 R&I spending reaches the highest level in 2022

R&I spending in the EU27 chemical industry

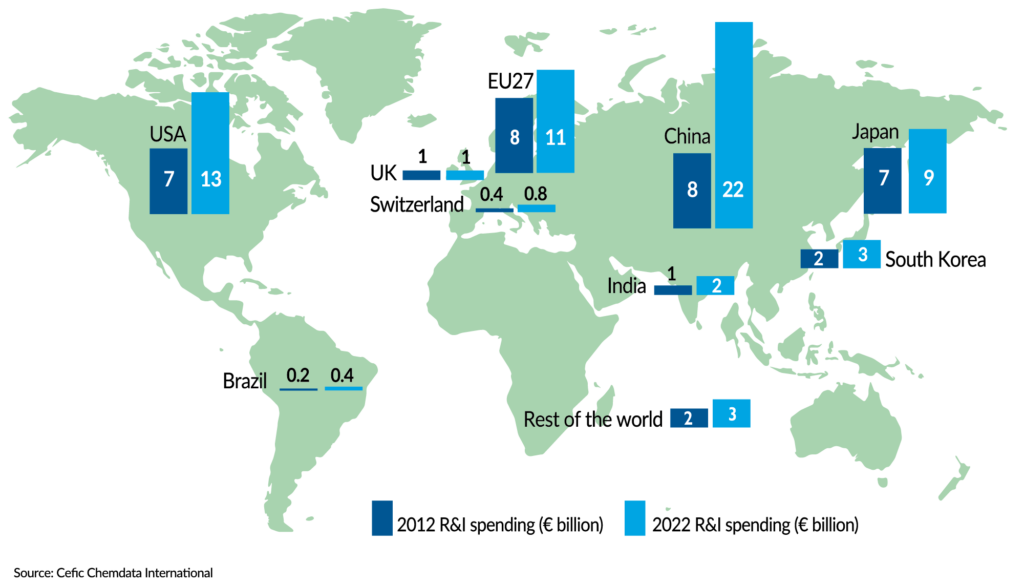

EU27 is the second largest R&I investor in the world

R&I spending in the chemicals industry by region (2012 vs 2022)

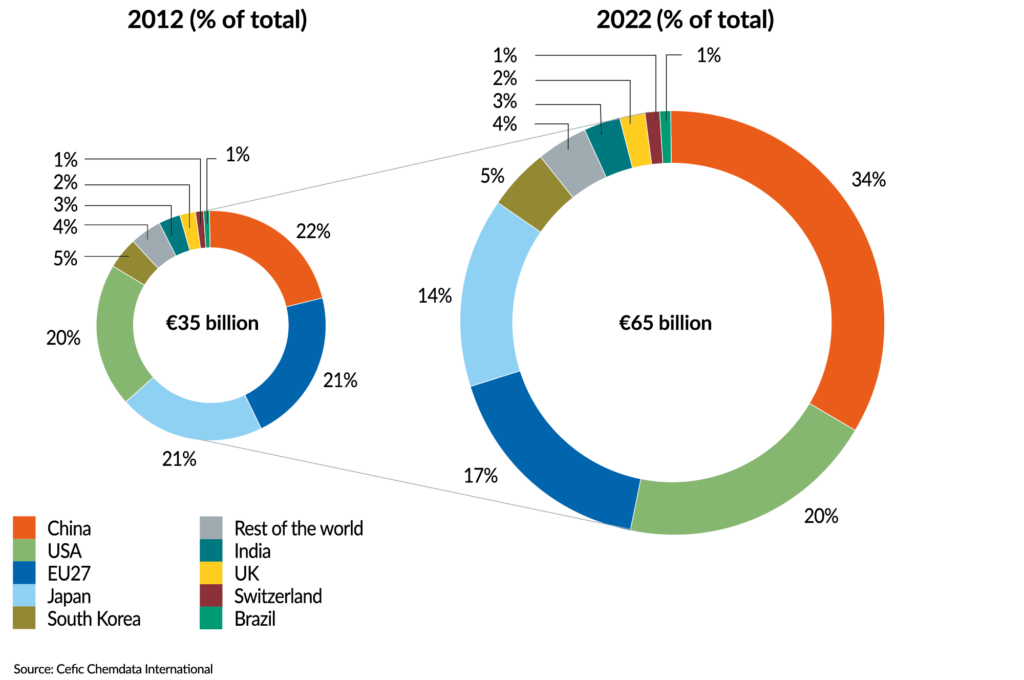

Decreasing share of chemicals R&I spending for the EU27and Japan

Chemicals R&I spending by country (2012 vs 2022)

Navigate the other chapters

Profile – Trade Development – Growth And Competitiveness – Our Contribution To EU27 Industry – Energy Consumption – Environmental Performance