Profile

The EU27 chemical industry, encompassing base, specialty, and consumer chemicals, is vital to the European economy, supplying diverse sectors and employing 1.2 million people. While specialty chemicals contribute significantly to sales, the industry faces challenges due to China’s dominance, holding over 40% of global sales and leading in innovation. Europe’s market share has declined due to factors such as an aging population, market maturity, high energy and labor costs, regulatory burden, and an increasingly competitive global market.

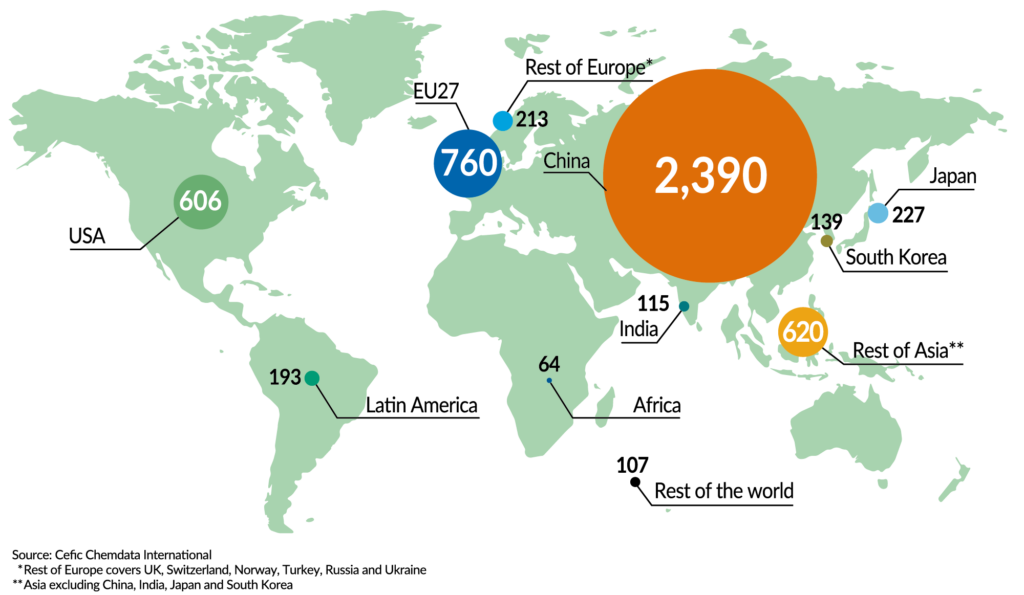

Europe is the second largest chemicals producer in the world

World chemical sales 2022, €5,434 billion

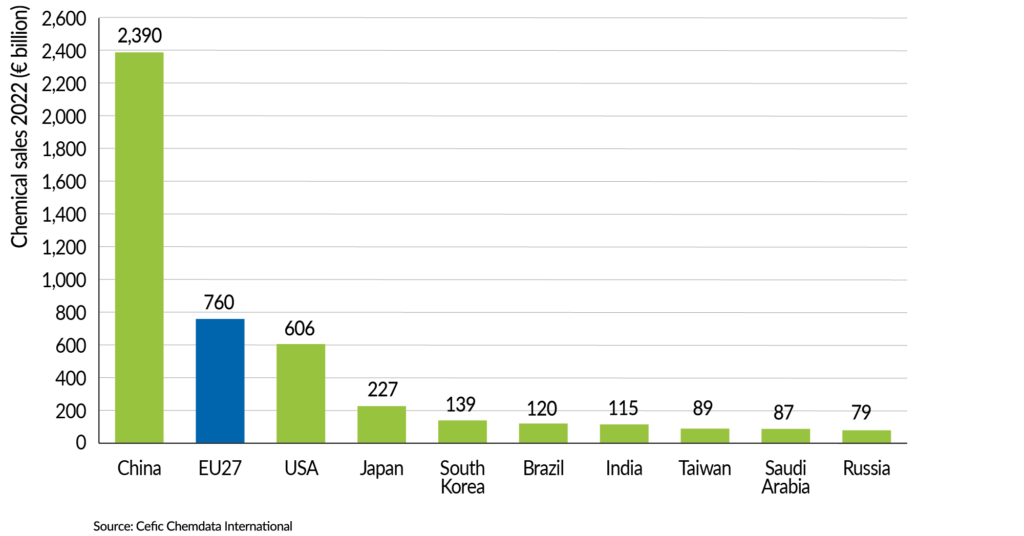

China dominates chemical sales globally

World chemical sales : top 10 countries

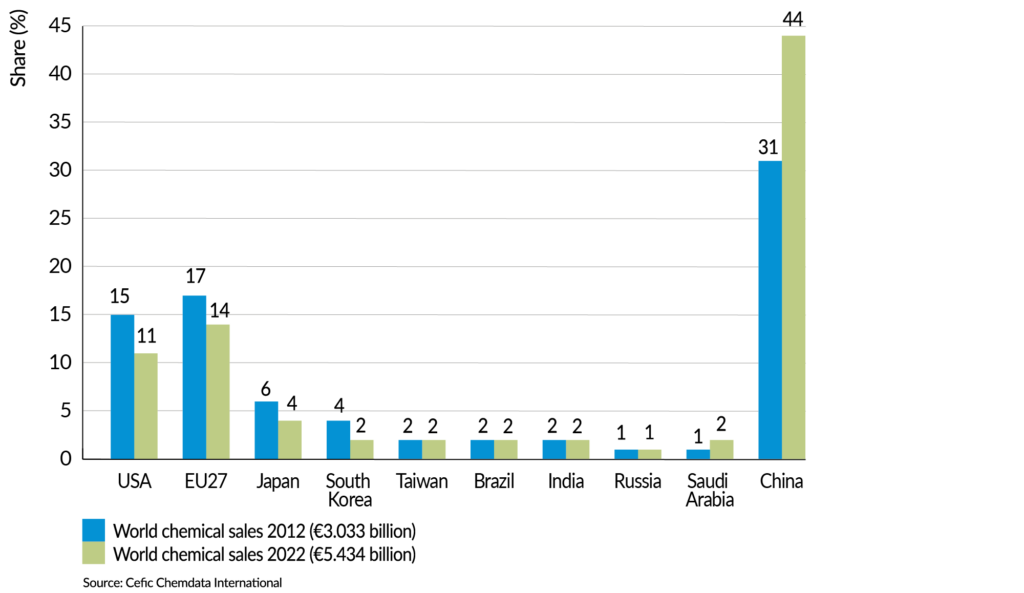

EU27 market share dropped significantly

World chemical sales by comparaison: top 10 countries

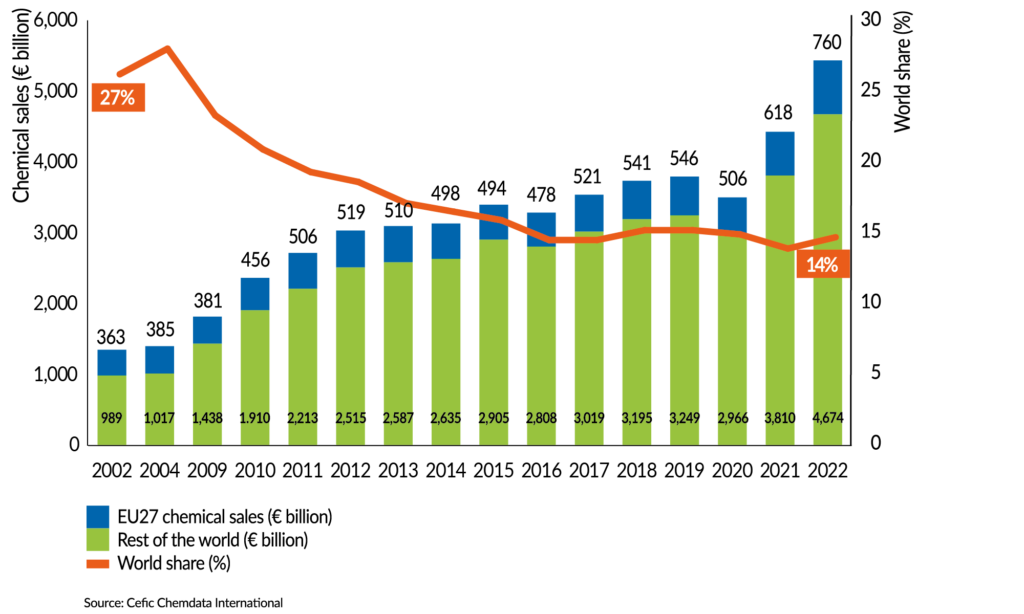

Over 20 years, the world market share of EU27 chemical sales drops sharply

EU27 share of global chemical market

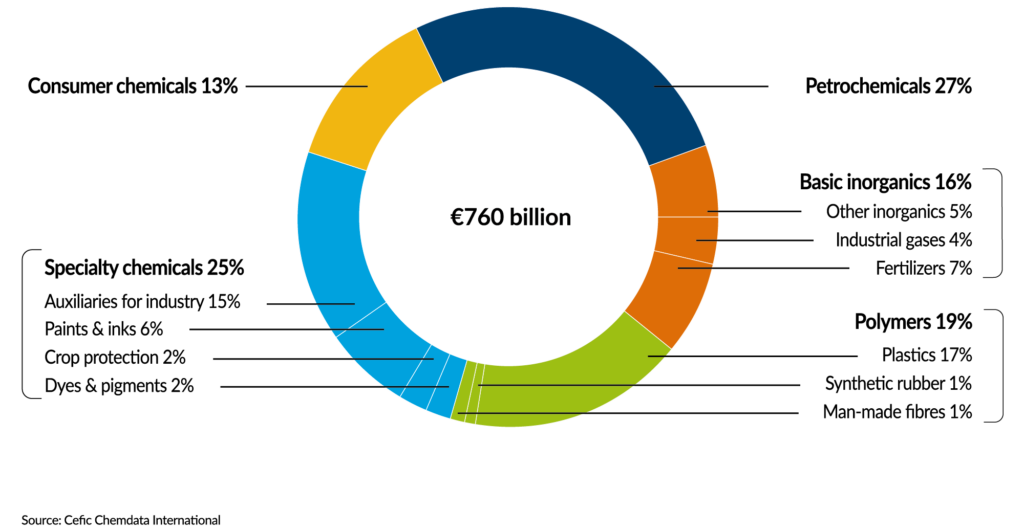

Petrochemicals account for more than one fourth of EU27 chemical sales

EU27 chemical sales 2022 (€760 billion)

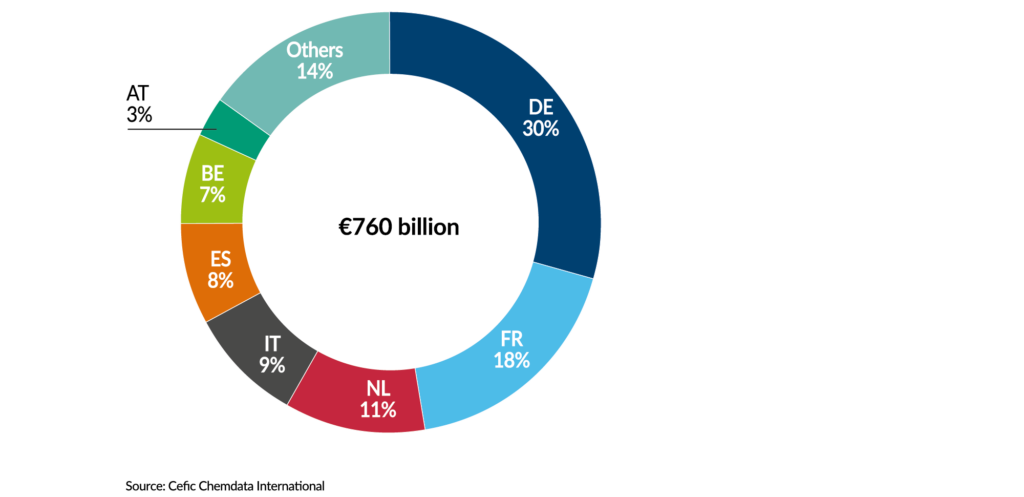

Two thirds of EU27 chemical sales generated in four Member States

EU27 chemical sales broken down by country (2022)

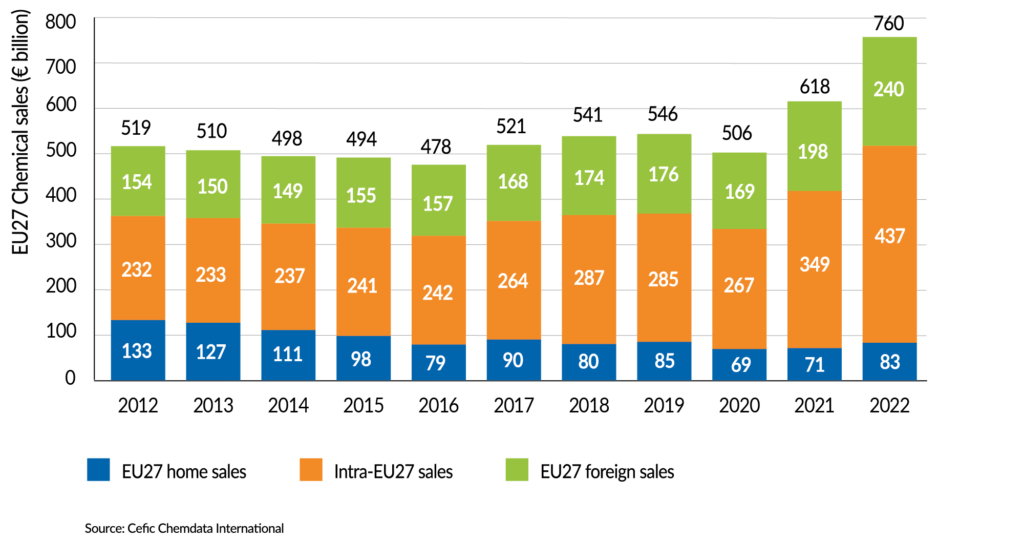

EU27 chemical sales significantly increased in 2022

EU27 chemical sales structure (€ billion)

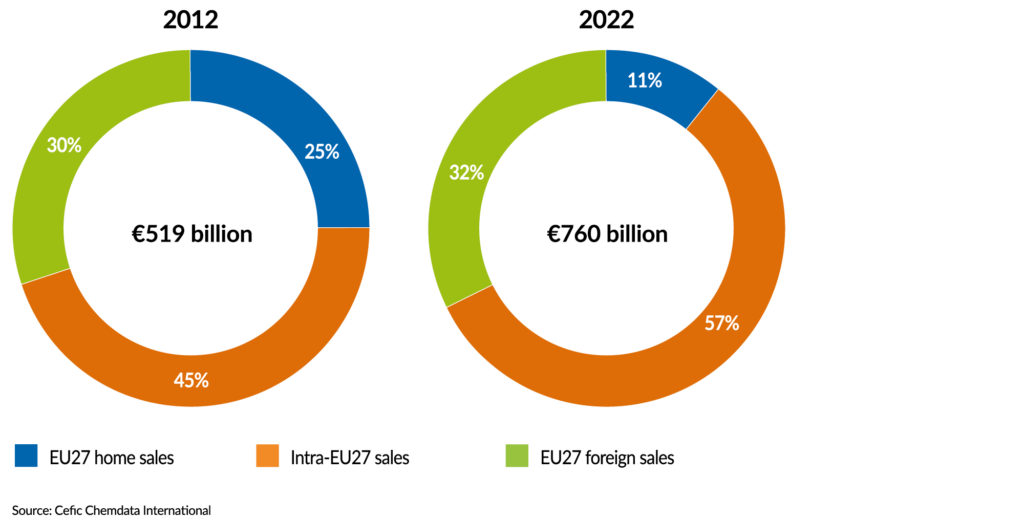

Nearly one third of EU27 chemical sales is generated from exports

EU27 chemical sales structure (%)

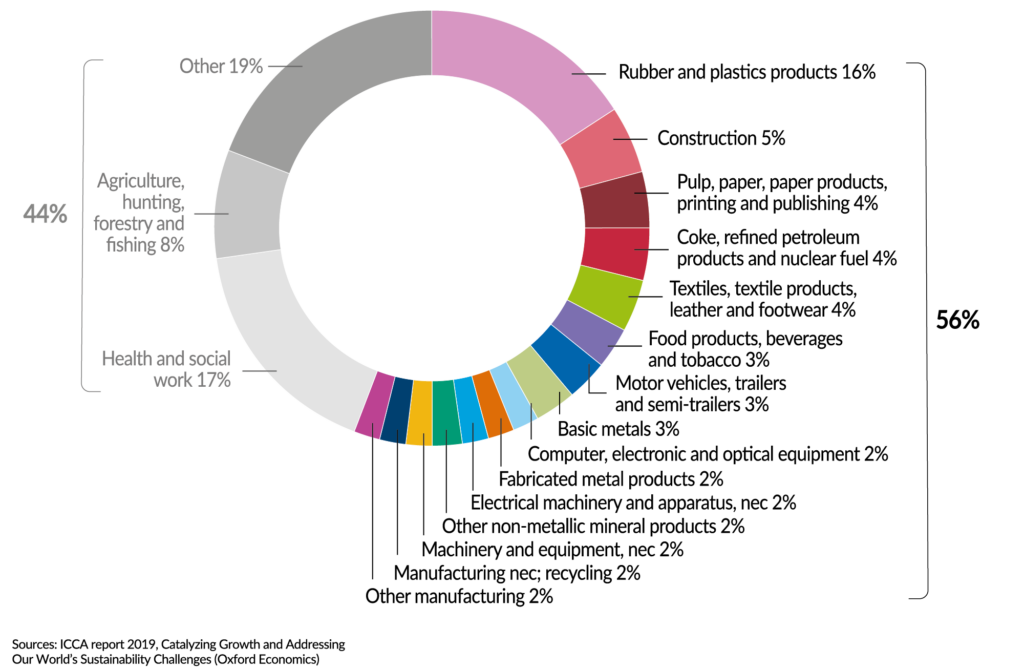

More than half of EU chemicals are supplied to the industry

Customer sectors of the EU27+UK chemical industry (2017)

Navigate the other chapters

Trade Development – Growth And Competitiveness – Our Contribution To EU27 Industry – Energy Consumption – Capital & R&I Spending – Environmental Performance

SHARE