Growth and Competitiveness

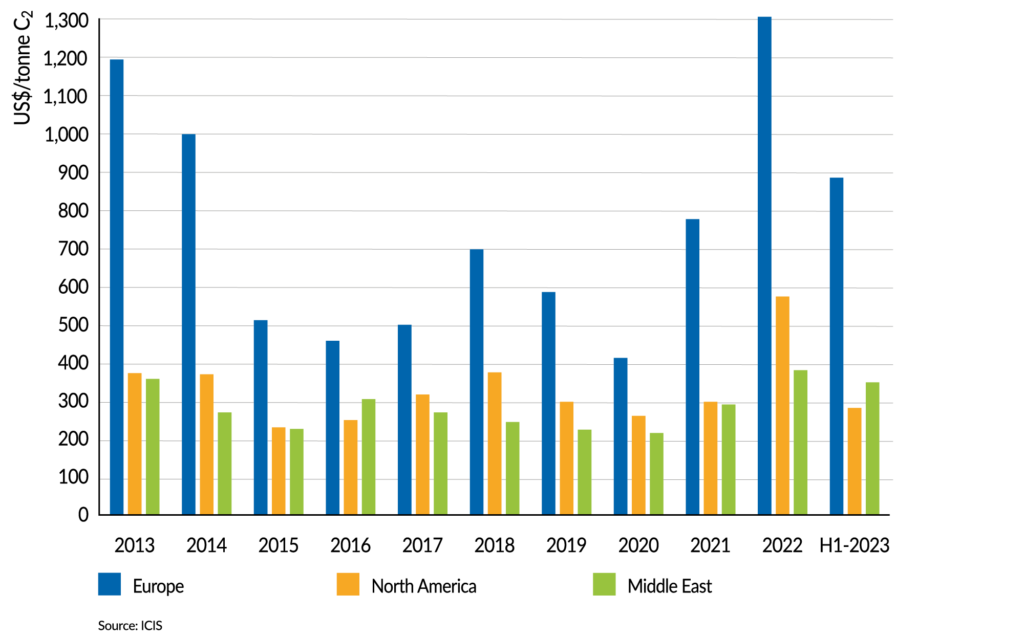

Energy costs are the Achilles’ heel of the European chemical industry, especially when compared to the United States and the Middle East. This, along with high feedstock costs, is causing the industry to lose its competitive advantage in global chemical markets.

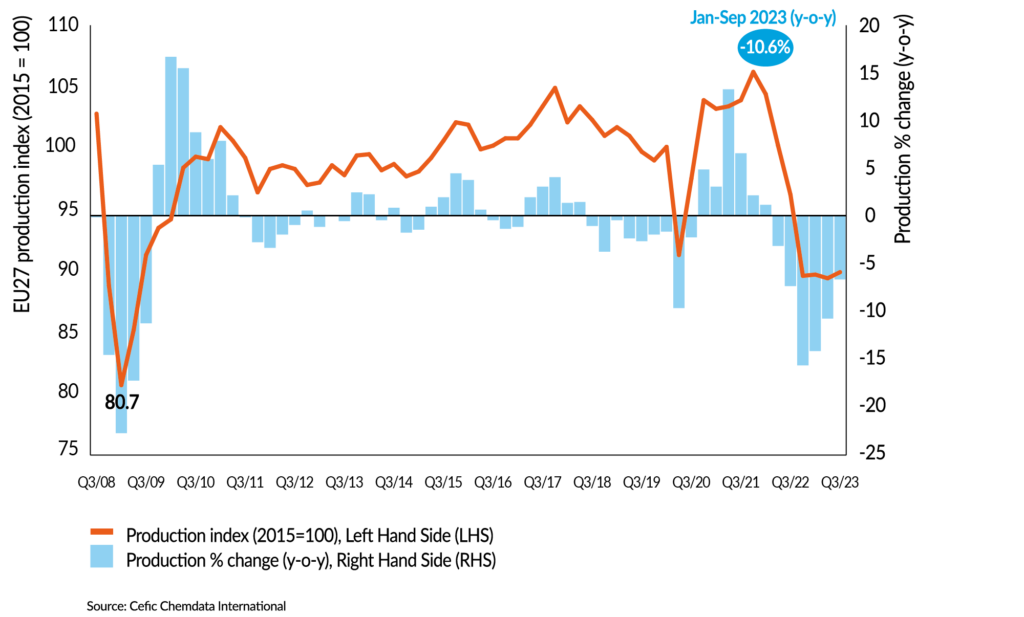

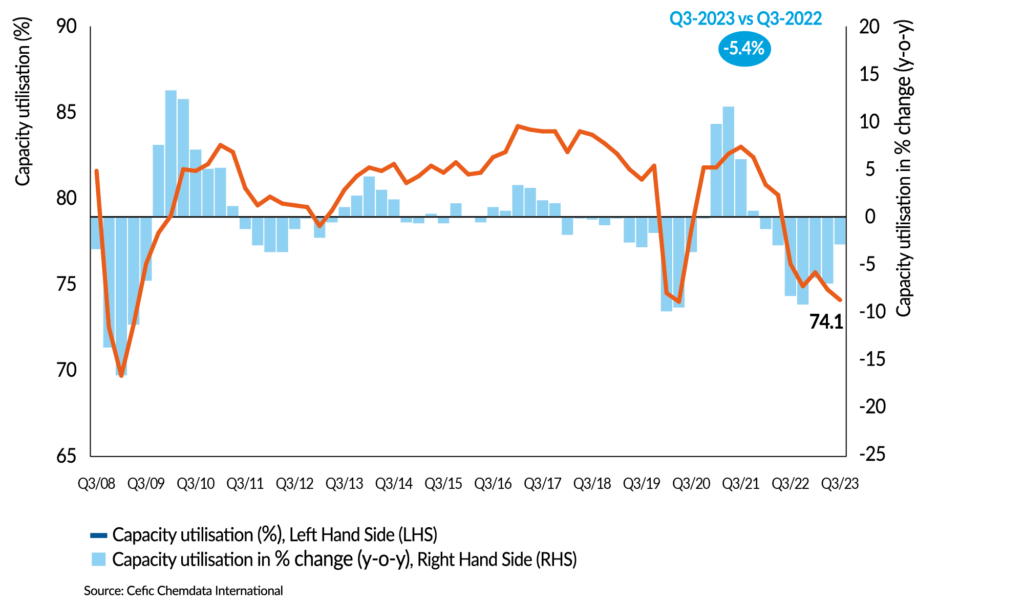

With a 10.6% decline, the EU27 chemical industry reported the third-largest drop in production in 2023 (Jan-Sep). Capacity utilization in the EU27 chemical industry declined once more and was at 74.1% in the third quarter of 2023. Producing ethylene – the basic feedstock for plastics, detergents, coatings, and many other materials – in Europe was 3.2 times more expensive than in the USA in the first half of 2023.

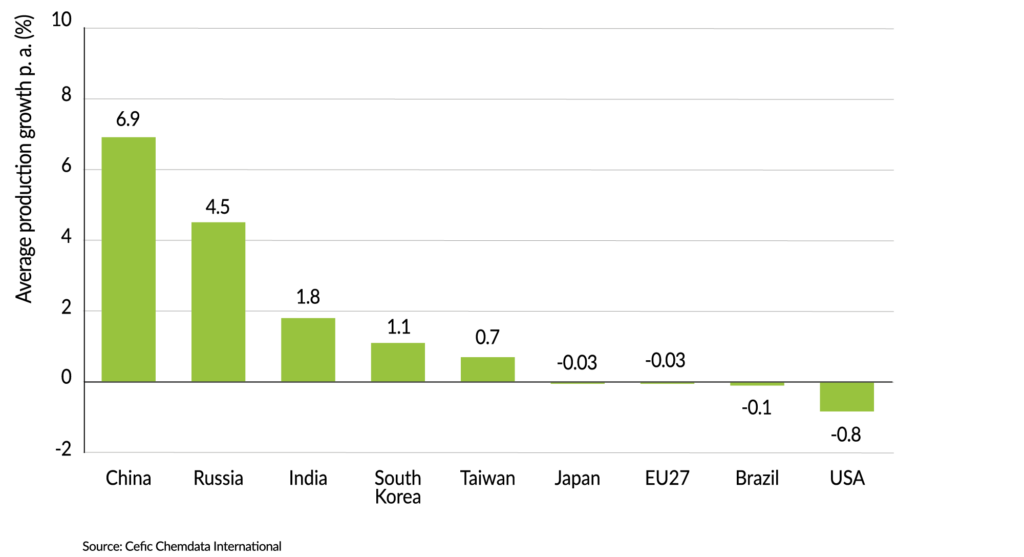

Key emerging economies are growing faster than the EU27 and the US, with China outpacing all others. The shift of manufacturing to Asia and the associated higher chemical output growth, an aging population in Europe, and the shift of petrochemical production to resource-rich countries are a few reasons why Europe is lagging behind Asia. In absolute terms, the industry may continue to grow, but only at a slower pace.

EU27 CHEMICALS OUTPUT, far BELOW THE PREVIOUS YEAR’S LEVEL

EU27 chemical industry production

EU27 capacity utilisation below its long-term average

EU27 chemical capacity utilisation

Europe at a competitive disadvantage compared to the North america and the Middle East

Ethylene cash cost of regional steam crackers (2013 – H1 2023)

Key emerging economies grow faster than the EU27 and the USa

Average chemicals production growth per annum (2012-2022)

Navigate the other chapters

Profile – Trade Development – Our Contribution To EU27 Industry – Energy Consumption – Capital & R&I Spending – Environmental Performance