Trade Development

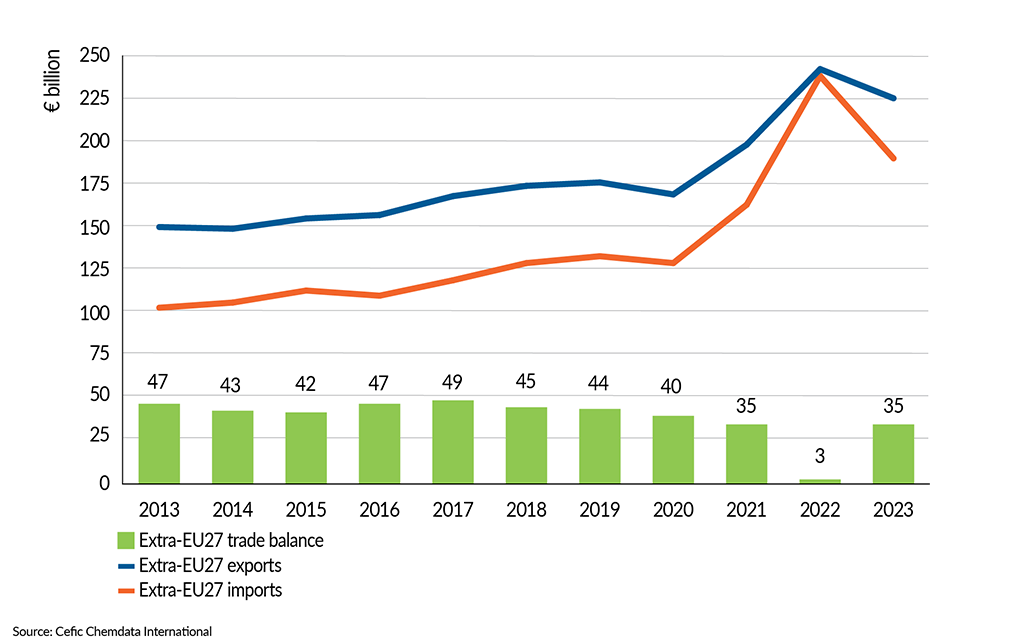

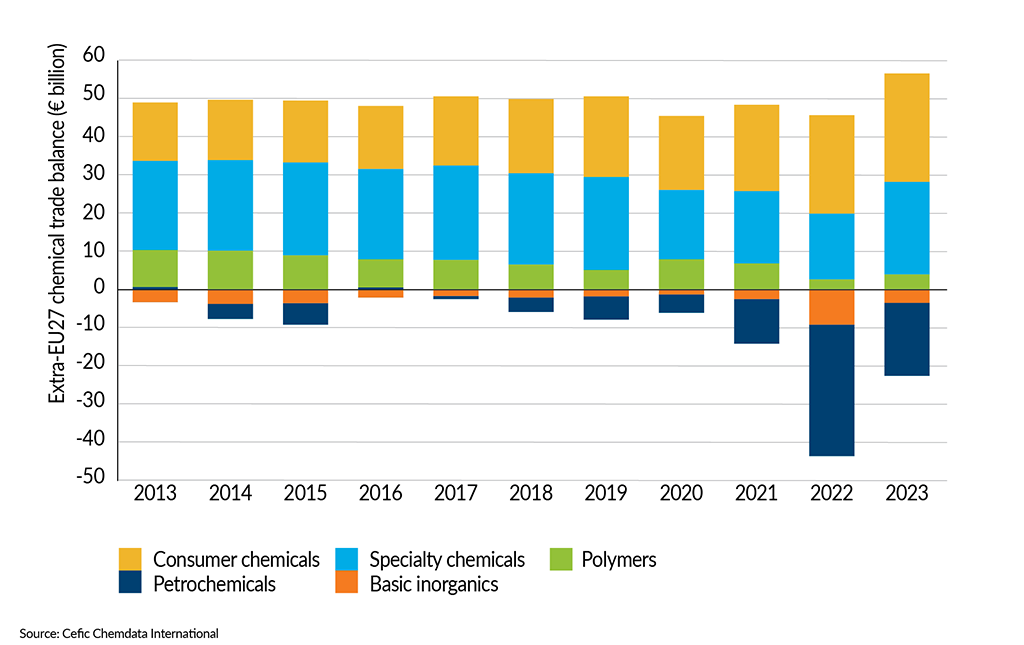

The global trade of chemicals benefits all partners and citizens by stimulating competition, innovation, and production efficiency. The EU27 chemical industry, a key player in the global market, has historically enjoyed a significant trade surplus, averaging €43 bn in the past decade (2011-2021). In the past years, EU27 chemicals surplus has experienced dramatic fluctuations; having plummeted from €35.5 billion in 2021 to €3.2 billion in 2022, before bouncing back to €35.2 bn in 2023, reaching almost 2021 levels.

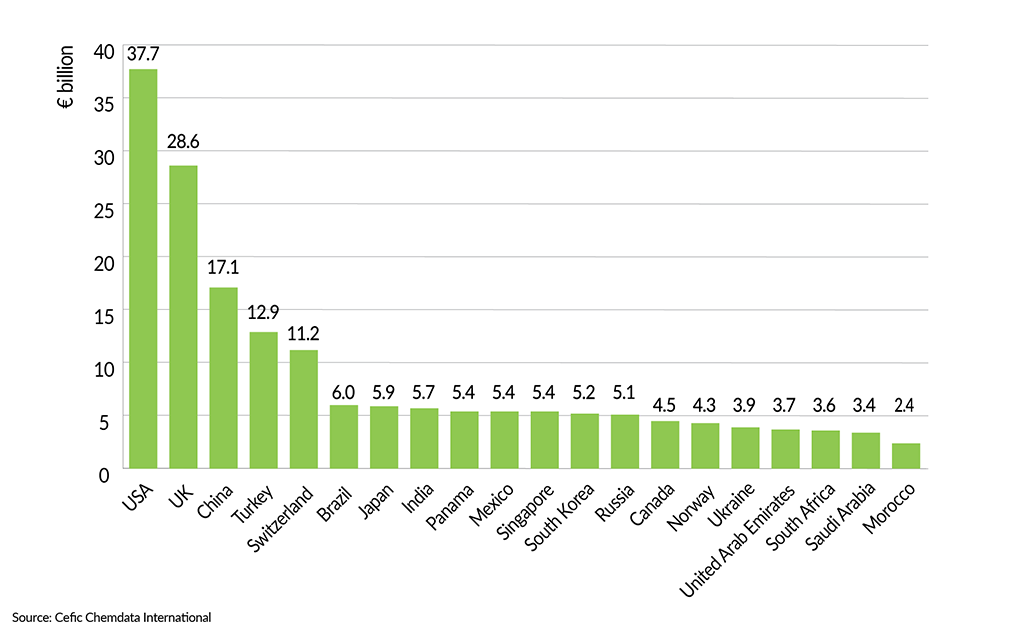

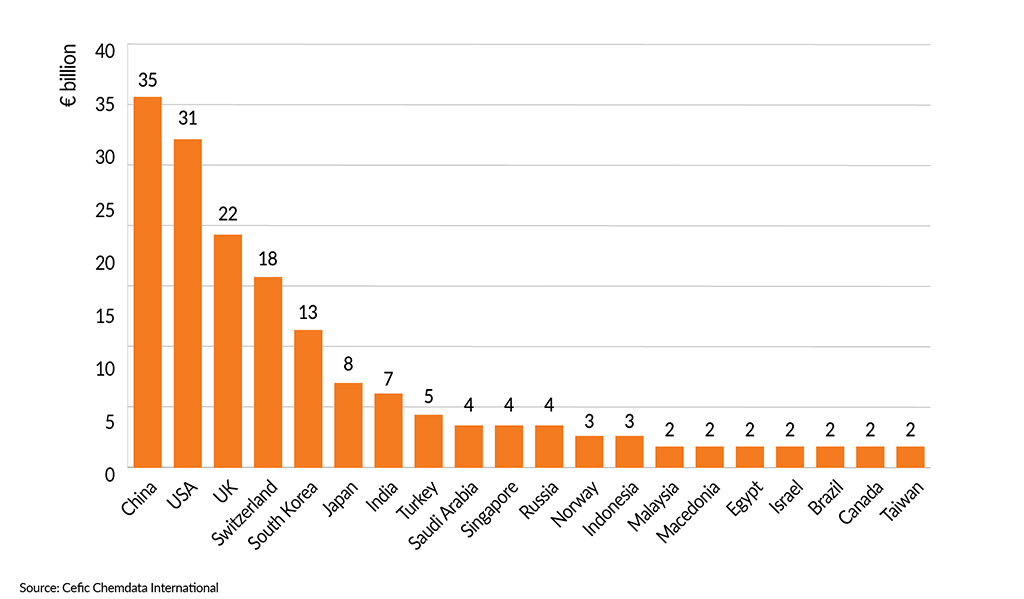

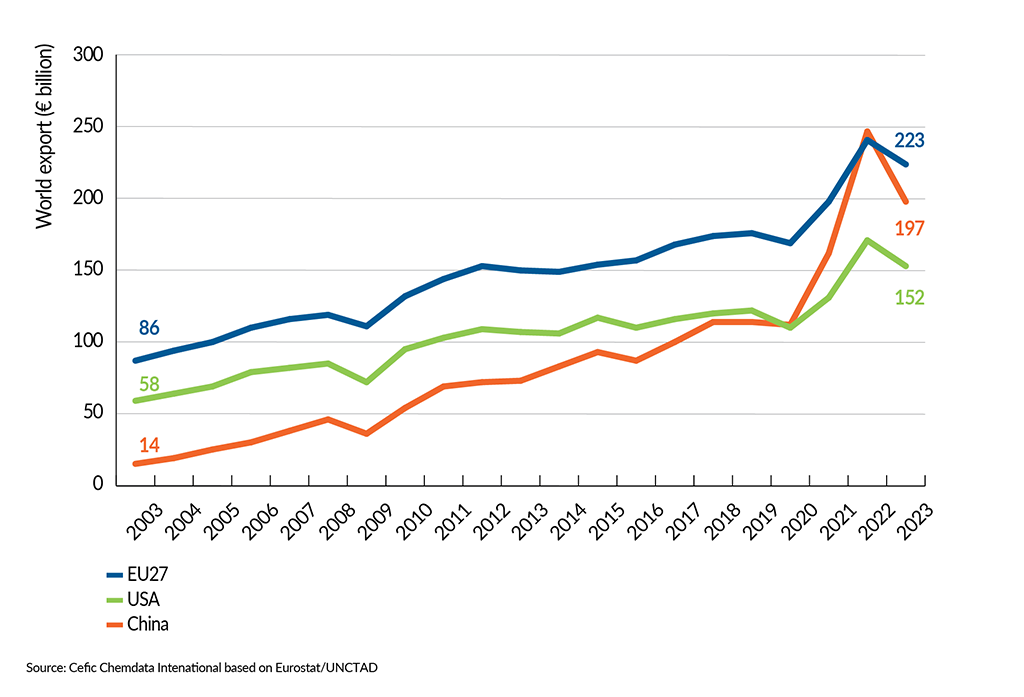

Europe’s reliance on foreign suppliers has increased: While the US is the first export destination for EU-made chemicals, China has become the first source of imports to the EU27 area for chemicals: between 2013 and 2023, the share of chemicals from China in EU27 imports has increased from about 8% to 18%.

EU27 chemicals trade surplus bounced back to 2021 levels

Extra-EU27 chemicals trade balance

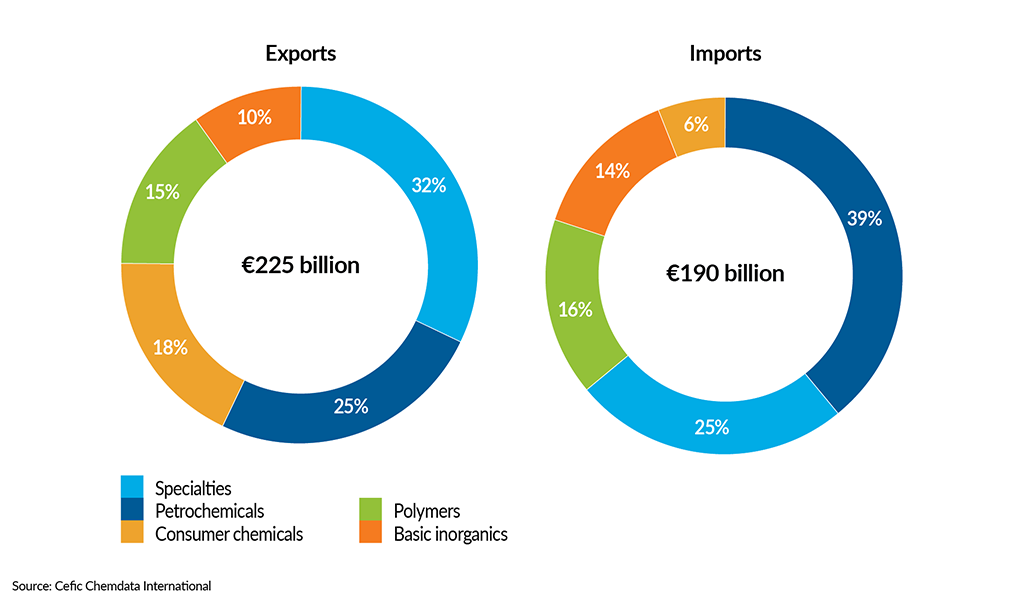

Petrochemicals dominates import & specialty chemicals dominates export in 2023

Extra-EU27 chemicals trade flows by sector (2023)

in 2023, US is the first export country for the eu27

EU27 chemicals trade flows with top 20 partners (2023)

in 2023, china is the first import country for the eu27

EU27 chemicals import flows with top 20 partners, (2023)

Consumer chemicals contribute most to EU27 chemical trade surplus

Extra-EU27 chemicals trade balance

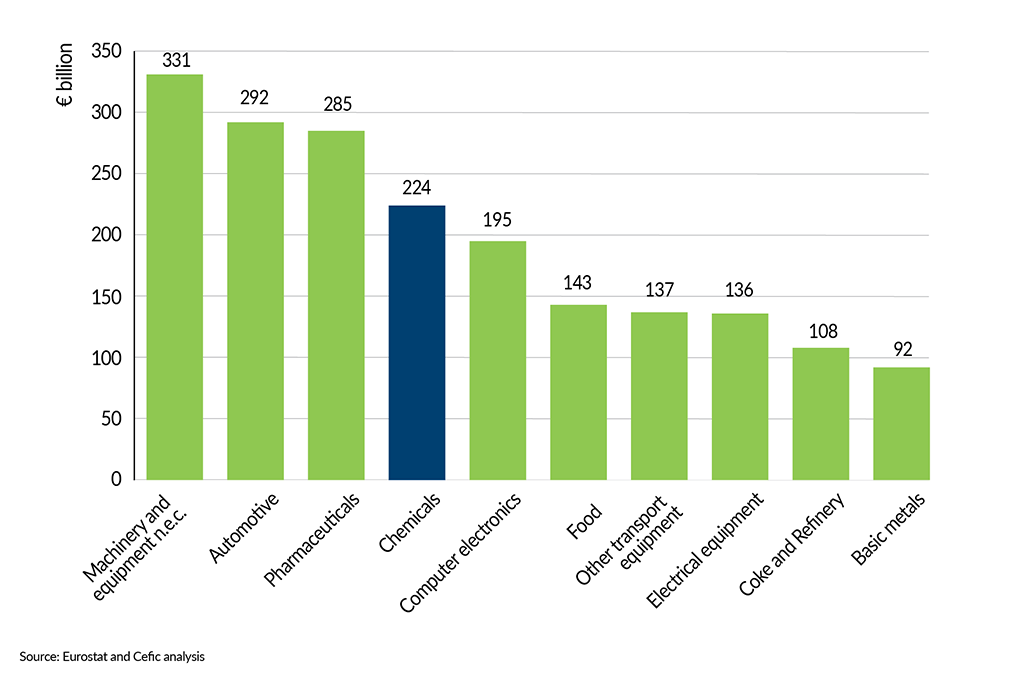

Chemicals accounts for 9.3% of eu27 manufacturing exports

Top 10: extra-EU27 manufacturing exports by sector (2023, €bn)

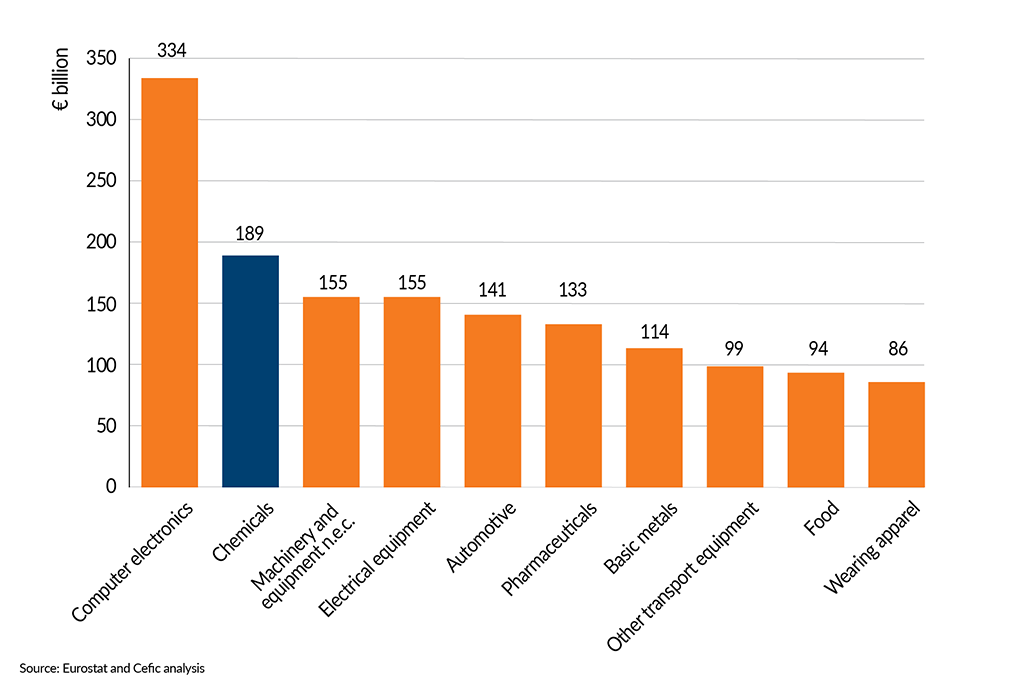

Chemicals accounts for 9.9% of eu27 manufacturing imports

Top 10: extra-EU27 manufacturing imports by sector (2023, €bn)

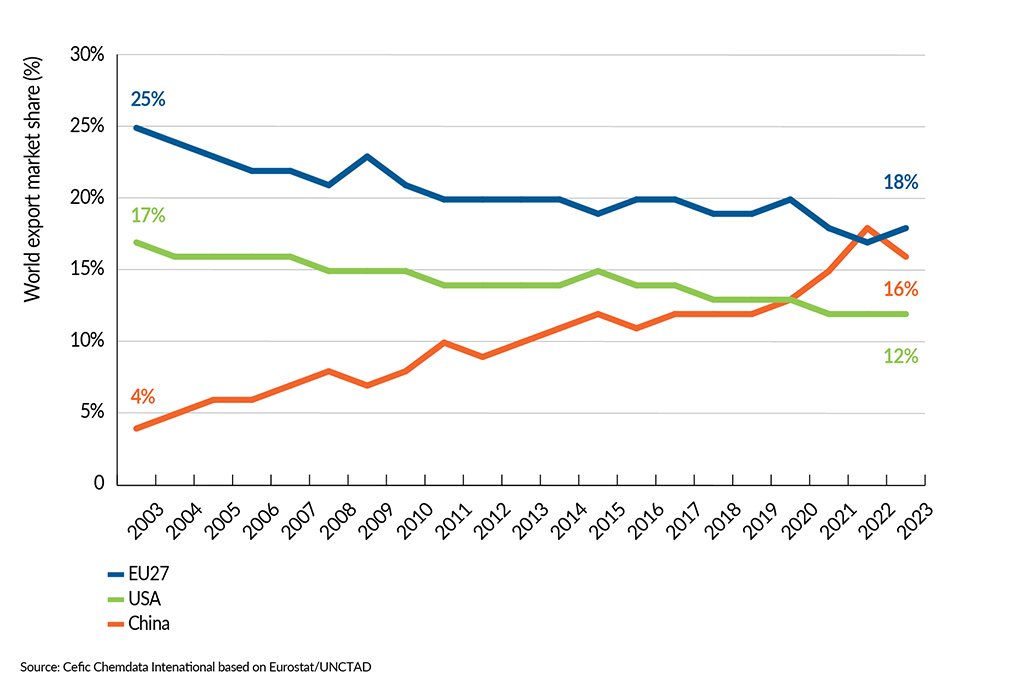

china continues to gain share in the global chemicalm export

Chemical exports by region: EU27, china and USA

china continues to gain share in the global chemicalm export

Share of world chemical exports: eu27, China and USA

Navigate the other chapters

Profile – Growth And Competitiveness – Our Contribution To EU27 Industry – Energy Consumption – Capital & R&I Spending – Environmental Performance