The European chemical industry can become central to Europe’s circular economy, offering innovative solutions from design to end-of-life, benefiting the sector itself and its value chain. The chemical industry focuses on alternative designs and continuous improvements that enhance resource efficiency throughout the production process, use-phase, and end-of-life stages. This improved efficiency is reflected in better water and waste management, which are crucial steps towards a circular economy and lower GHG emissions.

By transforming waste into valuable raw materials and using circular feedstock, the industry plays a crucial role as recycler for the circular society, contributing to achieve the Sustainable Development Goals, notably SDG 9 and SDG 12.

Contribution to the EU Green Deal

The European Green Deal aims to boost resource efficiency by transitioning to a clean, circular economy, stopping climate change, reversing biodiversity loss, and cutting pollution. The chemical industry supports these goals by focusing on the efficient use and reuse of resources, such as water and waste, aligning with EU waste policy to extract high-quality resources from waste.

The 2nd European Commission’s Circular Economy Action Plan (CEAP), adopted in March 2020, outlines Europe’s agenda for sustainable growth by targeting design, circular economy processes, and sustainable consumption. The chemical industry contributes to the CEAP by prioritising recycling and reuse of resources, utilising alternative feedstock, and incorporating circularity as a criterion in designing chemicals and materials for various applications.

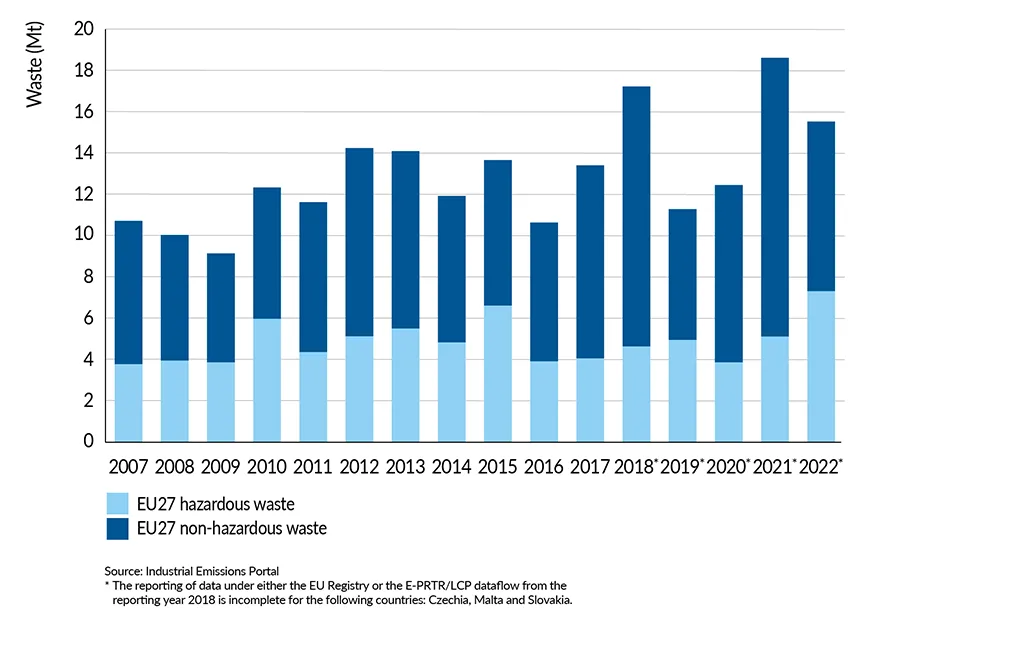

Industrial hazardous and non-hazardous waste

Resource efficiency of production processes, gaining both economic and ecological benefits, is also reflected in the amount of waste produced. Waste prevention has been, is, and will remain a priority within the chemical industry, with increased attention given to stimulating reuse and recycling, both important steps towards a successful circular economy.

The total amount of industrial waste transferred by the chemical industry varies each year, with 26% to 48% of it being hazardous. The global economic recession in 2008-2009 led to a reduced amount of transferred waste. This amount increased during the period from 2009 to 2013.

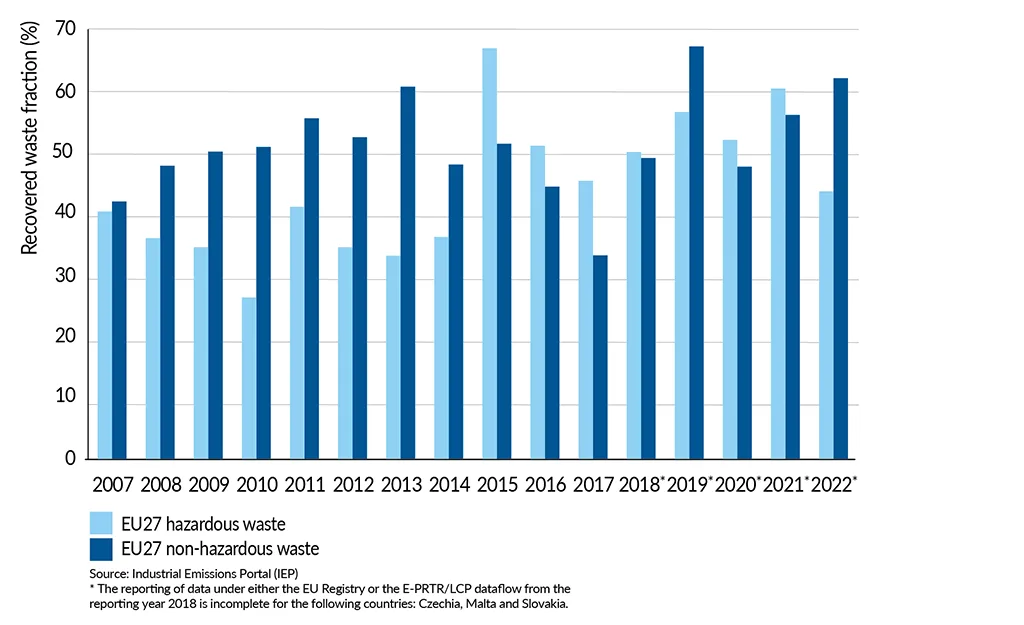

The recovered fractions of hazardous and non-hazardous waste have been fluctuating between 2007 and 2022 without a clear trend. The recovered waste includes a wide range of treatments, such as waste that is reused, recycled, or incinerated with energy recovery. The fraction that has not been recovered is defined as disposed waste.

Waste transferred by the EU27 chemical industry

Waste destined for recovery by the EU27 chemical industry

Use of alternative feedstock

One of the key pathways to a successful transition towards a climate neutral circular economy is the use of alternative and more circular feedstocks, such as (plastic) waste, captured CO2, and biobased materials.

According to Eurostat, in 2023, the chemical and petrochemical industry consumed 44.2 Mt of oil and petroleum products as raw materials, with 54% of this being naphtha. In the same year, the industry consumed 449,576 TJ of natural gas for non-energy purposes.

The chemical industry aims to increase the use of alternative feedstock in its processes. In the European Commission’s Communication on Sustainable Carbon Cycles, an aspirational target on the share of sustainable non-fossil carbon in chemical and plastic products of 20% has been set. In parallel, it is important to assess the carbon and environmental footprint of these alternatives and their impact on performance and functionality of end products to compare it to those of current fossil-derived products. For instance, the use of alternative feedstock might come with decreased material & energy efficiencies that should be evaluated against the feedstocks which are deployed today.

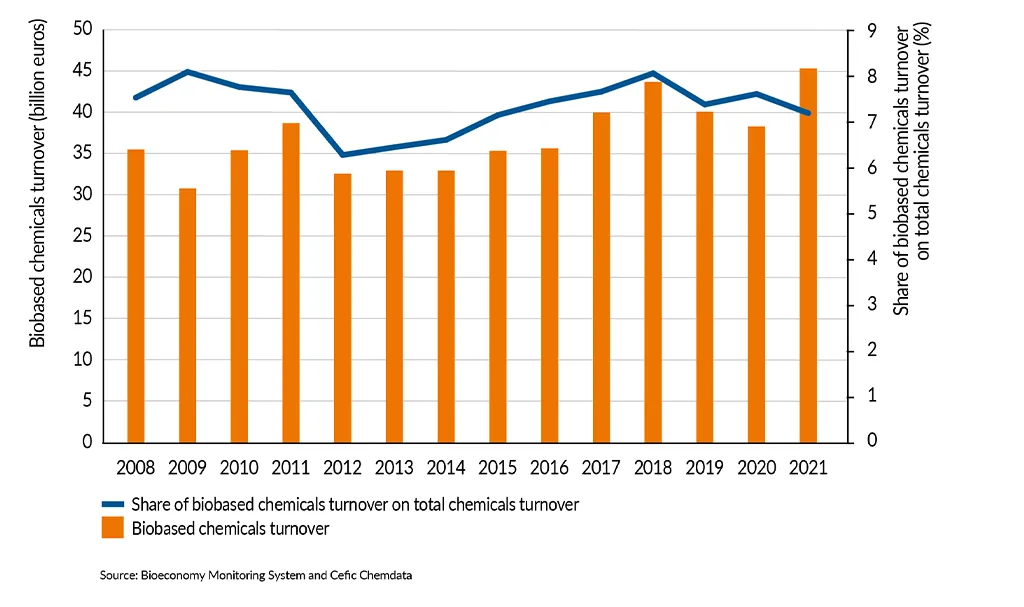

Biobased feedstock

The turnover of biobased chemicals fluctuated between 30 and 45 billion over the period 2008-2021. The share of biobased chemicals turnover on total chemicals turnover varies between 6% to 8%.

Using biobased materials as feedstock requires consideration of competition with other land uses, which may need to be prioritised from a public policy perspective, such as food supply and ecosystem services like carbon storage and biodiversity. When deploying biomass as an industrial feedstock, a constant supply needs to be guaranteed, supply and production infrastructure need to be adjusted, while the quality of biobased products needs to remain constant and high.

Biobased chemicals (excluding biofuels) production (share and turnover)

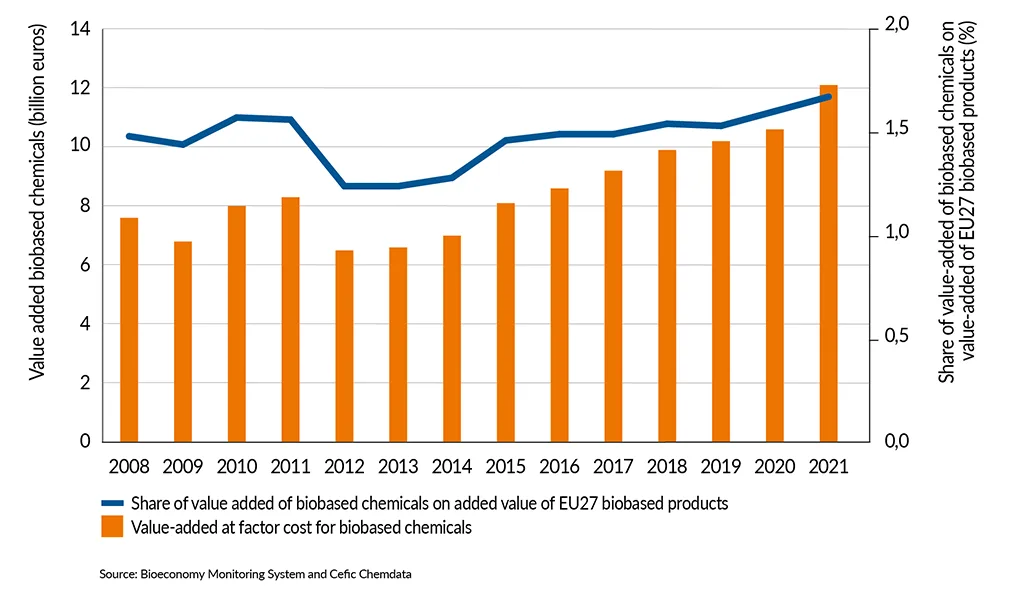

The value added of biobased chemicals, which is around 1.5% of the total biobased value-added, fluctuated before 2012. Since then, due to an increasing focus on high value added products (IEA, 2020), an increase of the added value is observed from 6.5 to 10.5 billion euro.

Value-added biobased chemicals by the EU27 chemical industry

Waste based feedstock

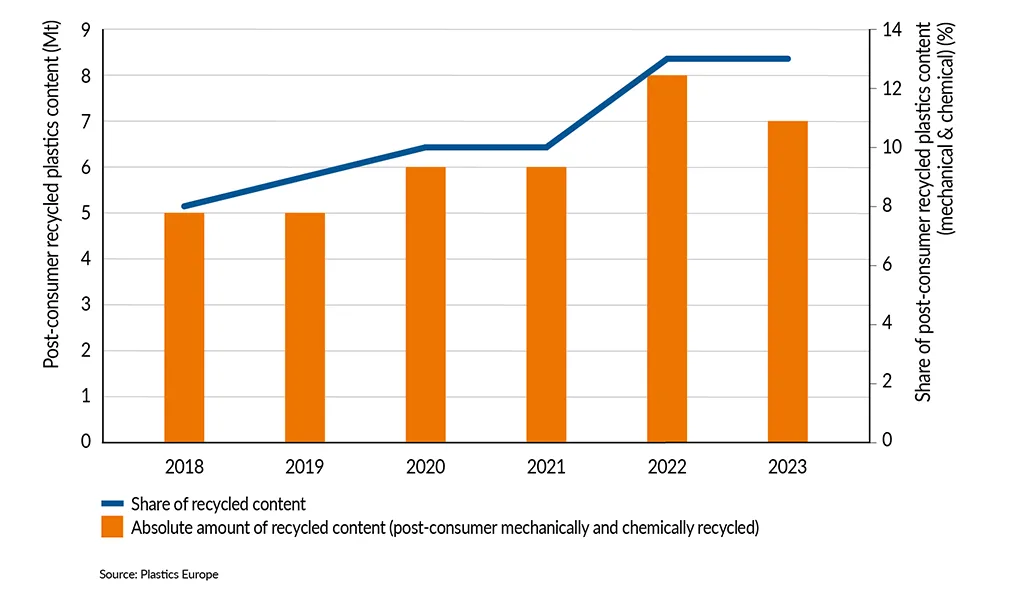

Recycling of waste is getting more importance as alternative feedstock source for the chemical sector. This is most advanced in the plastic cycle, where the absolute amount and share of recycled content in new products has reached 7.1 Mt and 13% of total feedstock, respectively. Recycling of plastic waste plays also a major role in keeping carbon in the loop, as described in Cefic’s Sustainable Carbon Cycles.

European recycled plastics production