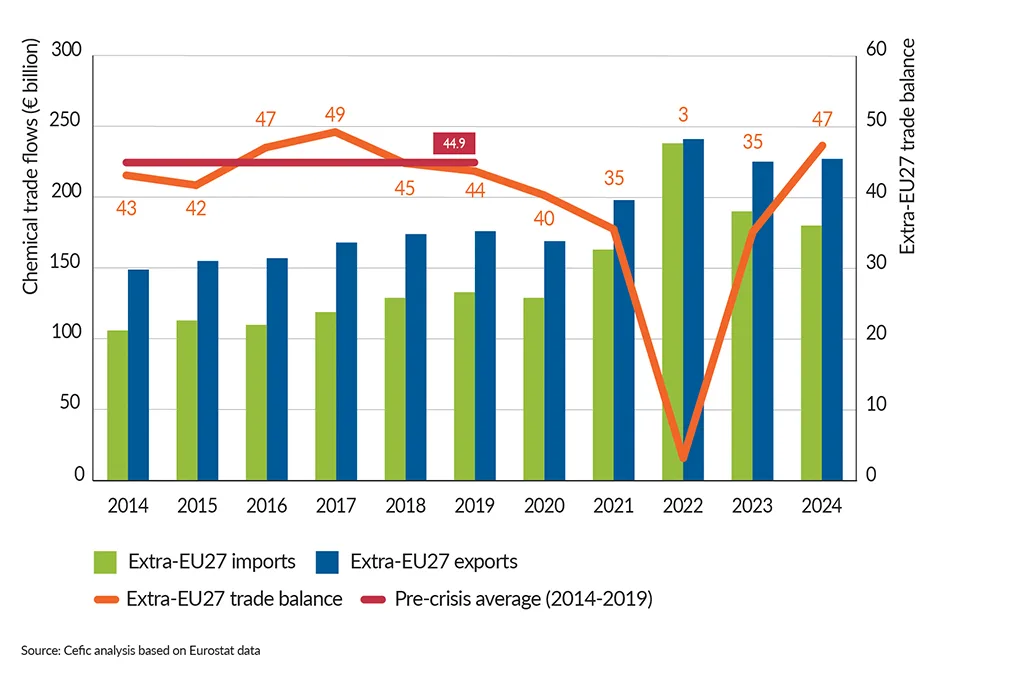

The global trade of chemicals benefits all partners and citizens by stimulating competition, innovation, and production efficiency. The EU27 chemical industry, a key player in the global market, has historically enjoyed a significant trade surplus, averaging €43 bn in the past decade (2011-2021). In the past years, EU27 chemicals surplus has experienced dramatic fluctuations; having plummeted from €35.5 billion in 2021 to €3.2 billion in 2022, before bouncing back to €35.1 bn in 2023, reaching almost 2021 levels. 2024 showed better results, and the EU27 chemicals trade surplus amounted to €47.3 bn.

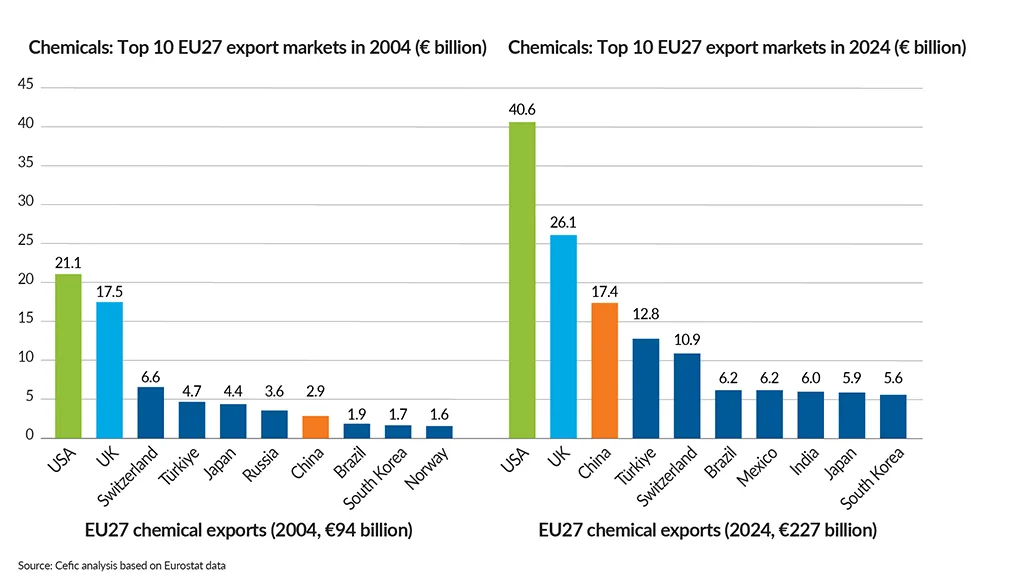

Europe’s reliance on foreign suppliers has increased: While the US is the first export destination for EU27-made chemicals, China is the first source of imports to the EU27 area for chemicals: between 2014 and 2024, the share of chemicals from China in EU27 imports has increased from about 9% to 18%.

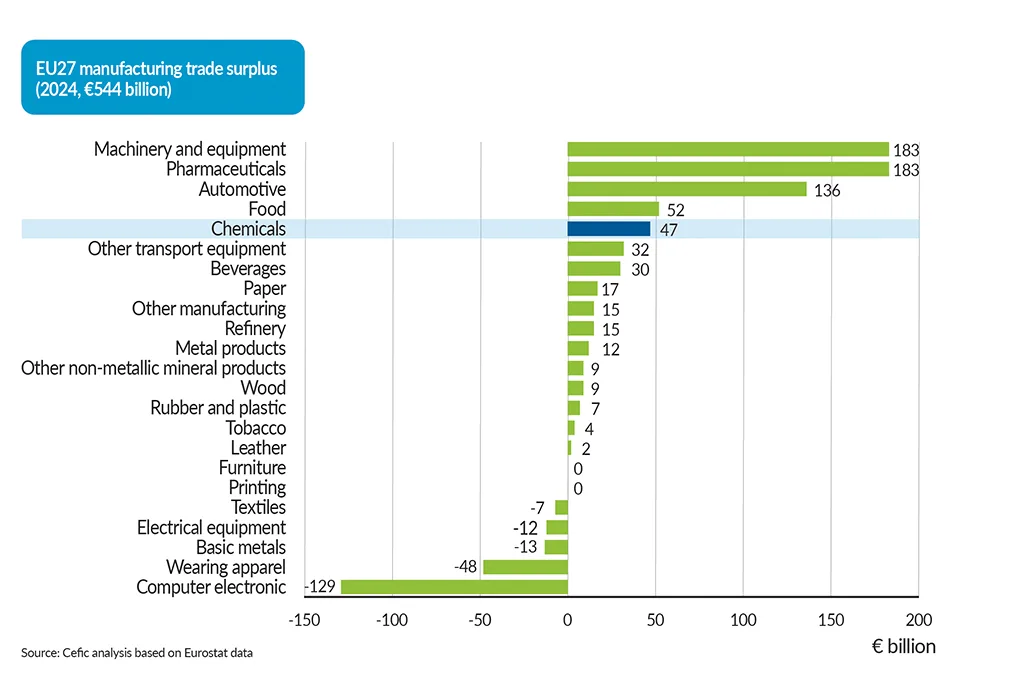

Chemicals are a key contributor to EU27’s trade balance (€47 bn)

Extra-EU27 manufacturing trade balance by sector (2024,€ billion)

EU27 chemical trade surplus slightly above pre-crisis levels (2014-2019)

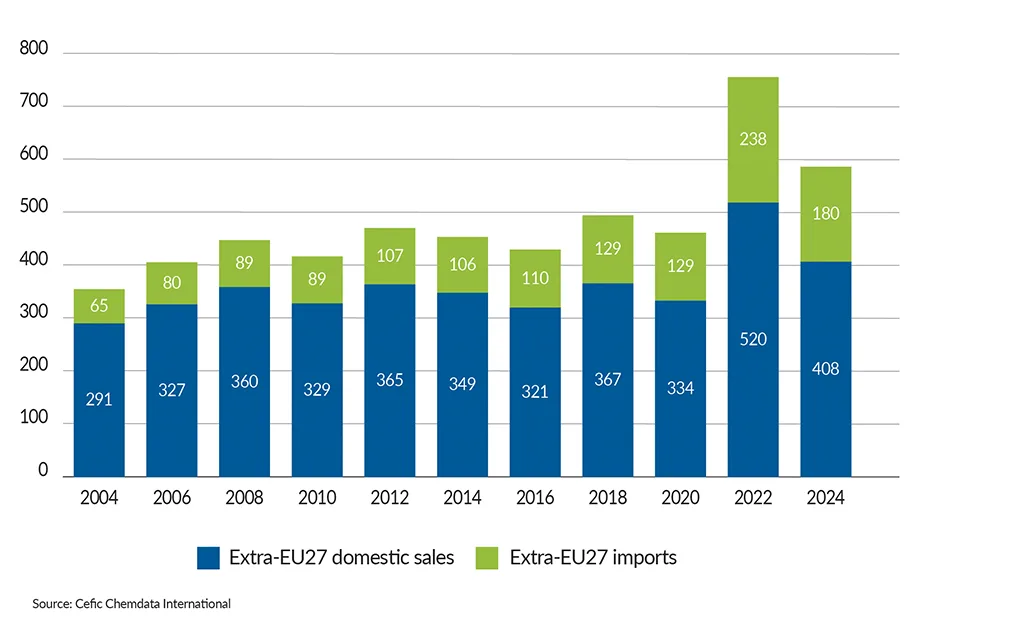

Extra-EU27 chemicals trade flows (€ billion)

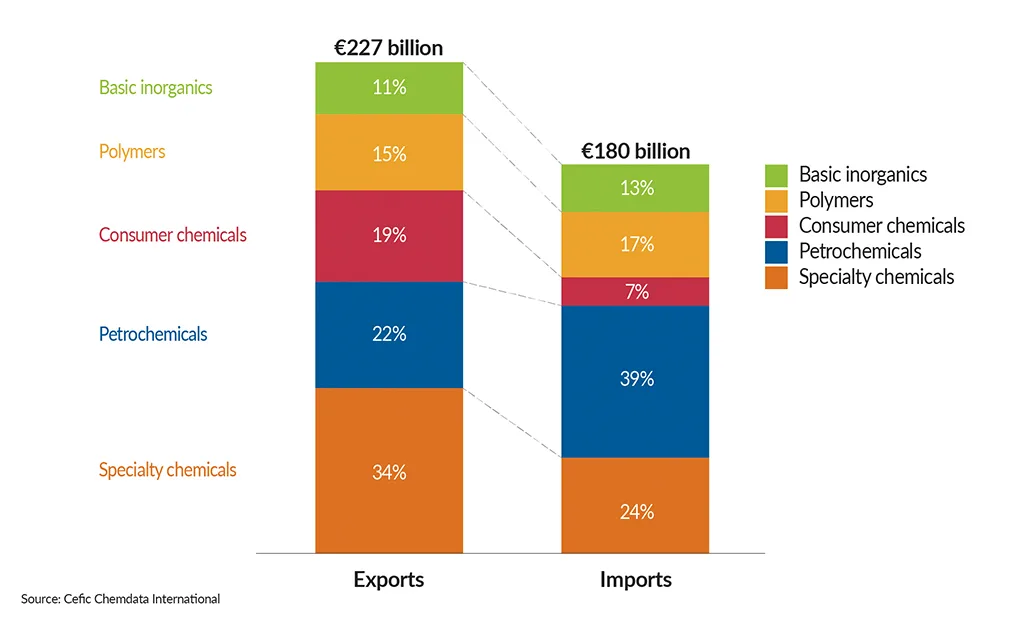

Specialty chemicals dominates export & petrochemicals dominates import in 2024

Extra-EU chemicals trade flows by sector (2024)

In 2024, US remains the primary export country for the EU27

Chemicals: Top 10 EU27 export markets 2004 vs 2024

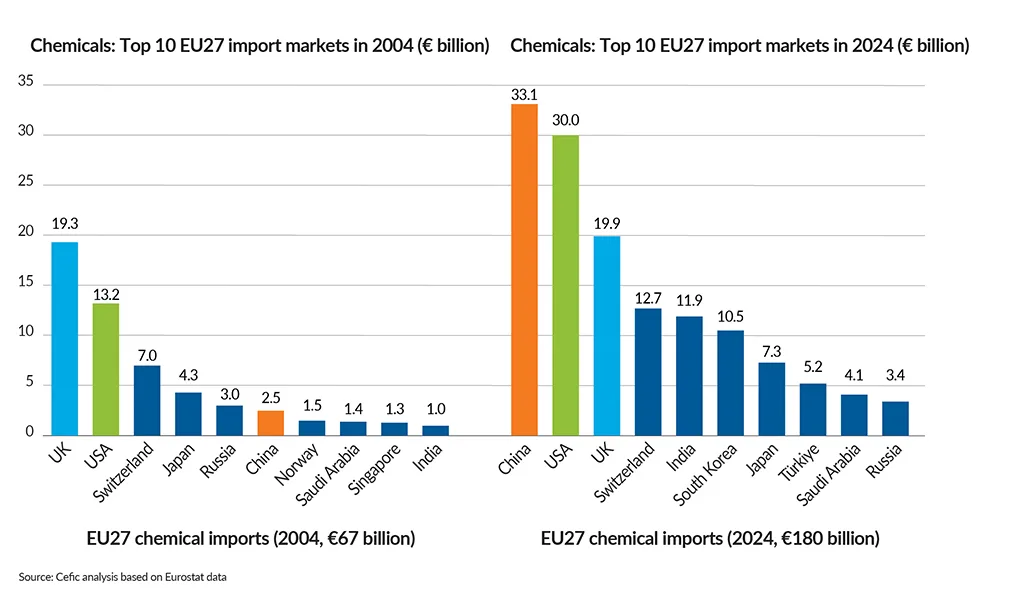

In 2024, China is now the primary import country for the EU27

Chemicals: Top EU27 import markets 2004 vs 2024

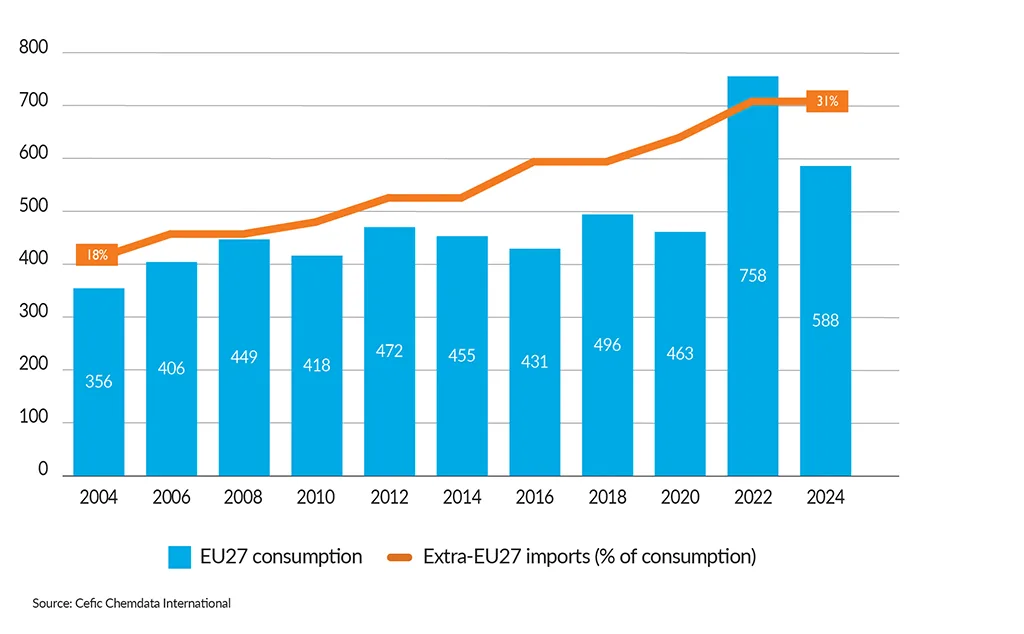

Share of imports in EU27 market grew significantly

EU27 chemical consumption (€ billion)

EU27 chemical consumption (€ billion)

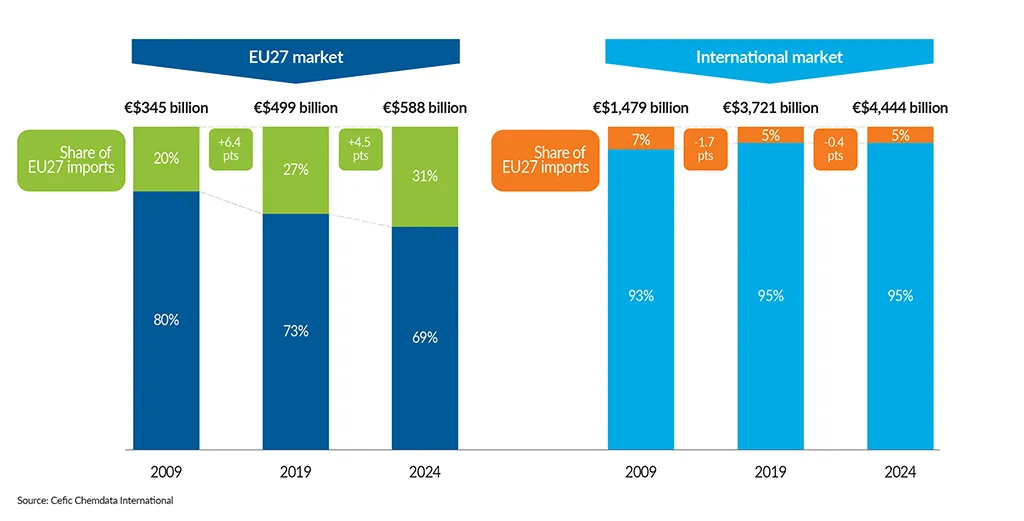

Europe has lost ground both domestically and globally

Extra-EU chemicals trade balance

China’s share of global chemical exports continues to rise

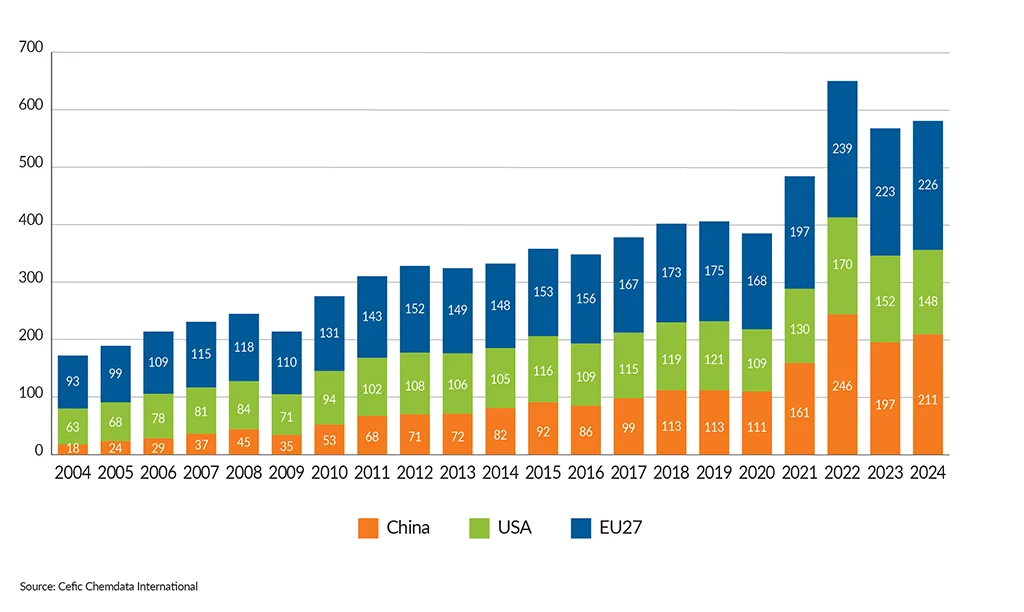

Chemical exports in € billion

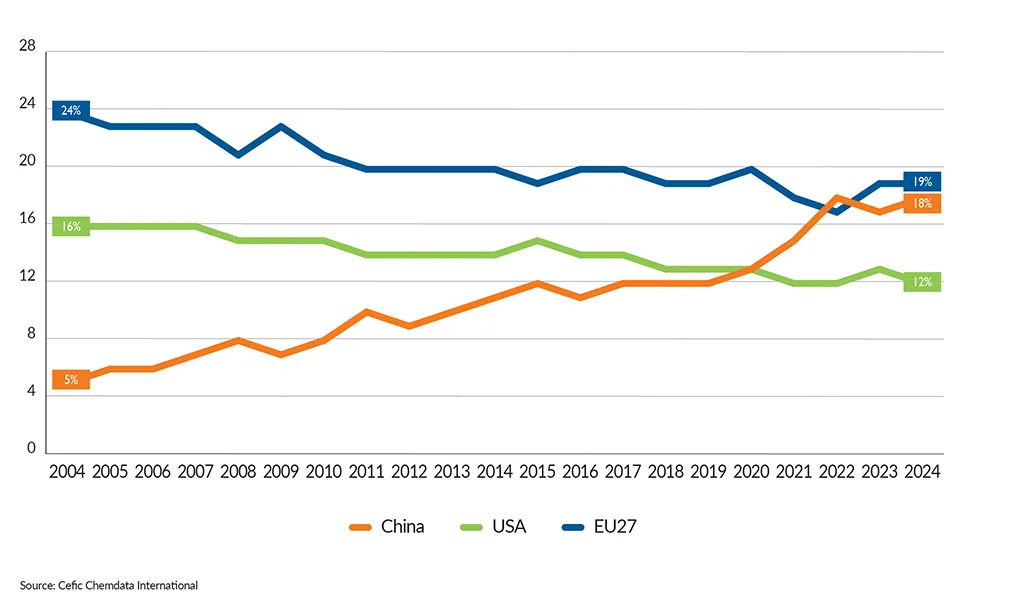

Share of world chemicla exports

The trade position of upstream sub-sectors shows signs of serious deterioration

Extra-EU27 Trade analysis (2022-2024) versus (2014-2019)