United Kindgom

Key facts

Turn over

£62 billion

Capital spending

£7.2 billion

R&D investment

£9.8 billion

Number of companies

4,090 (4,665 local units – counting all sites individually)

Direct employees

137.000

National contact

Chemical Industries Association (CIA)

Stephen Elliott

Chief Executive

elliotts@cia.org.uk

CHEMICAL INDUSTRY SNAPSHOT

The second-biggest industry

With over £54 billion of exports and £30.7 billion of value added to the UK economy, 2021 saw the chemicals & pharmaceuticals industry as the UK’s second largest manufacturing industry behind machinery & transport equipment.

Offering a full product range

The UK industry is active in all key areas: basic inorganics, petrochemicals, polymers, agrochemicals, paints, detergents and personal care products, in specialties such as adhesives, flavours and fragrances, and in a host of industrial specialties including lubricants, fuel additives, construction chemicals and catalysts. It is also a global leader in pharmaceuticals.

Employing and investing

The UK chemical and pharmaceutical industry has a workforce of over 140,000 people and across the country the equivalent to 33,000 fulltime people work on chemical and pharmaceutical R&D. The workforce is on an average weekly salary of over 34% higher than the rest of the manufacturing sector and nearly 50% higher than the average across the economy. Focusing on the gender breakdown, 33.2% of the workforce are women which, when comparing to other manufacturing sectors, puts the chemical industry in the top third for female employment. Chemical and pharmaceutical businesses are also at the heart of multiple high value supply chains and are estimated to support a further 350,000 jobs – many in poorer economic regions of the UK.

The sector is a national leader when it comes to research and development (R&D) spend with an annual investment of over £8.0 billion which accounts for over 17% of the UK’s total business spend and equivalent to 0.4% of national income. It is therefore key when it comes to the government’s pledge to spend 2.4% of GDP on public and private research and development by 2027.

On top of this huge spend on R&D, the industry spent a further £5.8 billion in 2021 on business investment into areas such as buildings, vehicles and machinery. This accounts for 17.2% of private sector manufacturing’s spend.

UK chemical industry performance through 2022

The two year period prior to 2022 was a challenging one to do business as companies had to navigate pandemic related lockdowns, severe trade friction, and soaring raw material prices. In spite of this, a consumer pivot to goods over services, elevated pharmaceutical demand, a beneficial chemical industry subsector structure, and stockpiling before the end of the Brexit transition period boosted demand for chemicals. UK chemical output increased 5.3% and 3.7% in 2020 and 2021 respectively, one of the only industries to increase output in both years.

UK chemical production entered 2022 at near record highs. The industry has faced considerable headwinds throughout 2022. The high price of energy, largely due to Russia’s invasion of Ukraine has resulted in a cost of living crisis. Labour and raw material shortages combined with considerable price increases, have led to a downturn in the industry. Chemical output in September 2022 was 11.7% lower than the level in January 2022, although still 0.8% above pre-pandemic levels. The UK chemical industry is in recessionary territory having contracted in the last three quarters. The CIA forecasts that on an annual basis UK chemical production will fall 3.75% in 2022 followed by a more modest fall in 2023.

Current challenges faced by the industry

The UK chemical industry is facing a number of current and long-term challenges. Data gathered from CIA membership through regular business surveys shows that the largest current challenge is the cost of energy, specifically gas. Unlike other industries, gas is not just an energy source but is also a feedstock, this intensifies the industry’s exposure to rising prices. The energy crisis, triggered by Russia’s invasion of Ukraine, is adversely impacting the UK chemical industry in three main ways:

- Direct cost: The clearest impact is that on the cost of production. The UK chemical industry is energy intensive and uses gas as a feedstock. Industrial gas prices are volatile and depend on market conditions. However prices are consistently elevated compared to levels just 18 months ago. The UK Government has stepped in to support businesses between October 2022 and March 2023 by capping the wholesale cost of gas and electricity at £75 and £211 per MWh respectively. Although welcomed, the supported price remains substantially higher than where it was 18 months ago. The UK CIA continue to advise the Government on required support measures beyond April 2023.

- Indirect – demand: It is an economic reality that with households spending significantly more of their disposable income on energy less is available for discretionary spend elsewhere. This creates the potential for an economic recession across the UK and Europe. Production declines within the EU chemical industry – the UK’s largest customer is starting to impact upon demand for UK chemicals.

- Indirect – competitiveness: the cost of energy in China is 6.2 times cheaper than in Europe, including the UK. A similar competitive disadvantage is experienced against the US and Japan is not as exposed on energy as the EU +1. The disparity in energy costs is reducing the UK’s international competitiveness at a time when the UK is reliant on global demand.

The cost of energy is not the only challenge facing UK chemical producers. Domestic producers identify the challenge surrounding raw material shortages and price increases. Production in China has been impacted by the Zero Covid policy which has led to plant shutdowns and delivery issues. As the global economy emerged from Covid the price of raw materials spiked to record levels. Not surprising as energy costs are passed through supply chains as somebody (all) end up having to foot the bill. This has been a persistent challenge for the industry over the last two years and one that has been exacerbated by the energy crisis and global inflation.

The final major short term challenge facing the UK chemical industry is the availability of skilled staff, recruitment and retention. A workforce with an adequate skillset has been an underlying challenge for the UK chemical industry for a number of years. The pandemic has exacerbated some of the challenges but an unhelpful immigration policy and an ageing workforce have delivered a perfect storm of workforce related issues Labour shortages are a challenge across the UK economy, UK employment rate remains 1.1 percentage points lower than pre-pandemic due to an increase in the number of people who are economically inactive. economically inactive describes those aged between 16-64 who are not in or actively seeking work. Predominantly, the increase in the economically inactive are people aged between 50-64 and are long-term sick, some have retired early and many with critical skills from within the chemical sector. This overall fall in labour supply has squeezed the manufacturing workforce. Currently there are 3.6 job vacancies in the manufacturing sector per 100 jobs, significantly above the long-run trend of 1.7 and pre-pandemic peak of 2.6. The CIA works closely with UK Universities, skills organisations and those providing critical apprenticeship training to help ensure a future pipeline of skills is available to the industry.

In the mid-to-long term the industry faces challenges surrounding UK REACH and the net zero transition.

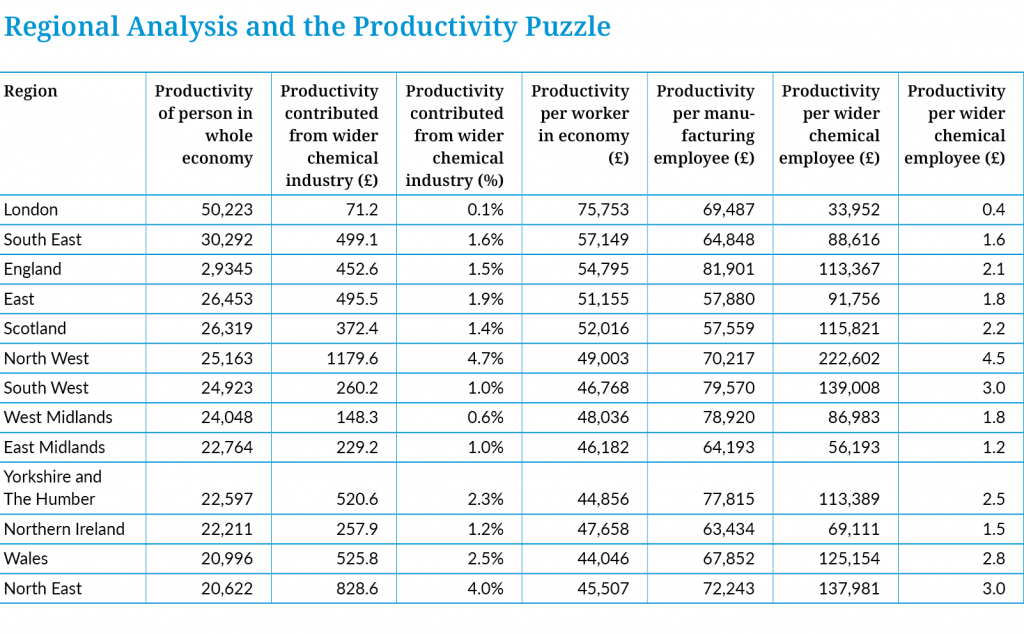

Regional Analysis and the productivity puzzle

Productivity improvements are important to all economies and all industries and are vital for sustainable growth. The UK has struggled with productivity growth since the global financial crisis and although being overshadowed by the pandemic and energy crisis, productivity remains an important area of focus. ‘Figure two’ below illustrates the gross value added (GVA) per employee in GBP – a key productivity measure – for the whole economy, manufacturing sector and chemical industry, broken down by region. Figure two demonstrates that workers outside of London in the chemical industry are between 1.2 and 4.5 times more productive than workers in the wider economy. Moreover, these differences are largest in the typically poorest economic areas of the UK such as the North West and North East of England where productivity in the chemical industry is 4.5 and 3 times greater than the wider economy in these regions. The chemical industry is therefore uniquely placed to support the UK government’s levelling up agenda while at the same time investing in the vital technical advancements that will be needed for the net zero economy of the future.

Revitalising pharmaceuticals

Production of pharmaceuticals, for decades one of the fastest-growing sectors, fell sharply between 2009 and 2014 as companies sought to counter increased R&D and regulatory costs and fewer blockbuster drugs by moving production elsewhere. This led to outsourcing of active ingredient production both elsewhere in Europe, including Ireland, but also to industrializing nations with or near large consumer populations, including India, China and Singapore.

However, this outsourcing trend has been called into question – driven by higher-than-expected costs, extended supply chains, poor quality control in some new production locations and most fundamentally national vulnerability in the face of Covid-19. At the time of writing the UK government – like many around the world – is working to improve its national resilience and, in particular, manufacturing capability for key raw materials and products. This includes a focus on Active Pharmaceutical Ingredients and Personal Protective Equipment capability.

The UK’s strong science base has helped R&D spending stay high but the country has struggled to attract significant manufacturing investment – a situation we hope is alleviated with clarity over Brexit, emergence from Covid-19 and practical support (including sufficient public investment) to deliver the technology and infrastructure required to enable industry to respond to the UK’s net zero commitments.

Strong in the North

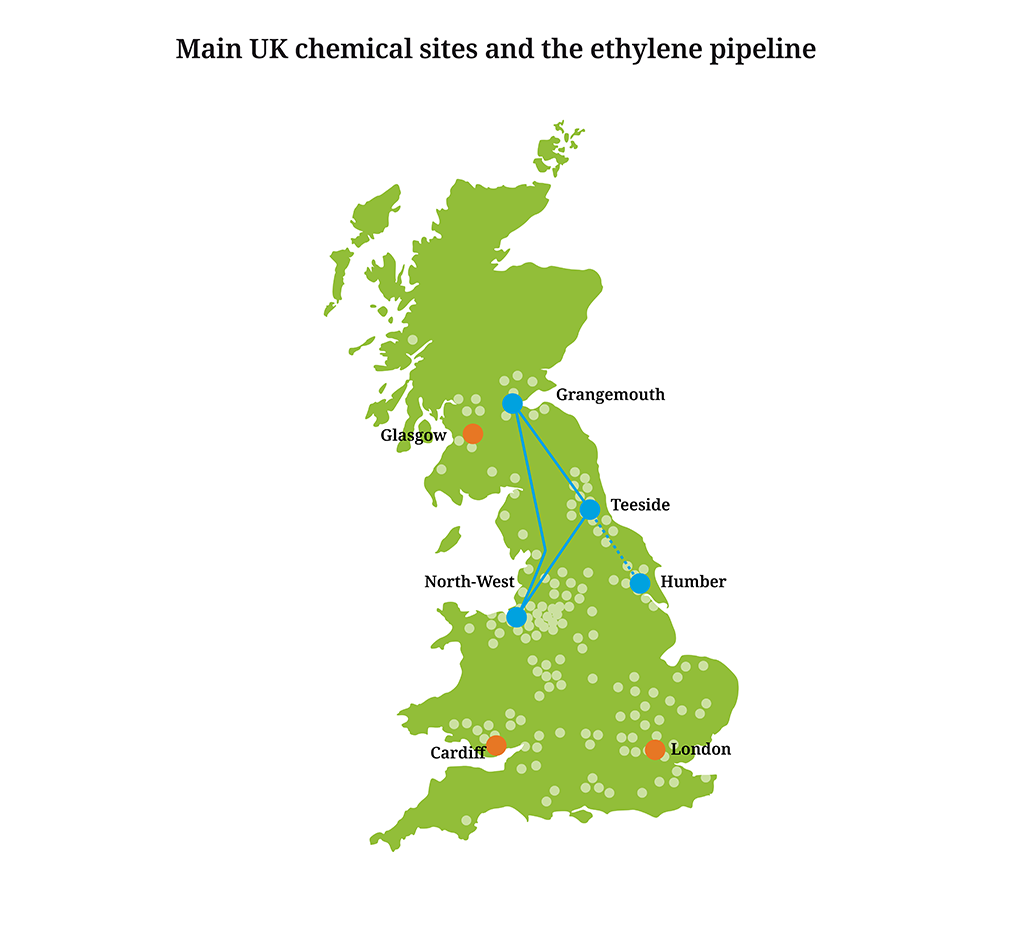

There are chemical manufacturing sites in all UK regions. Primary commodity chemicals are produced mainly in Scotland and Northern England. Feedstocks include hydrocarbons (mainly gas and refined petroleum fractions), minerals and vegetable or animal-derived oils and fats.

Clustered with customers

Sequential processing is the norm, with co-located processing clusters adjacent to industrial customers in other industries.

Close to feedstocks

North West England is the leading chemical producer, followed by Scotland, North East England and the Yorkshire/Humber areas, whilst South Wales, the South East and East of England regions also rank highly. Locations often depend upon availability of feedstocks such as North Sea hydrocarbons, salt and limestone, and energy (originally coal).

Handy for ports

Though peripheral to the centre of the European market, all chemical-producing regions have access to good ports and many benefit from an ethylene pipeline network, while Liquefied Natural Gas (LNG) re-gasification terminals complement natural gas supplies from the North Sea and Europe. The UK has established 10 Freeports across England with similar facilities approved in Scotland, Wales and in Northern Ireland. The Freeports offer tax and employment advantages to business within scope.

Investing for the future

Over recent years, the import of cheap ethane from the US, landed in Grangemouth and Teesside, has helped underpin the long-term viability of the UK’s petrochemical industry. Most recently, the announcement of a multi-million pound investment in Sabic’s Wilton facility should help secure the future of its UK steam cracker and the wider Teesside industrial cluster. In addition, October 2021 also saw INEOS announce a €2 billion investment in green hydrogen production, with the first plants to be built in Norway, Germany and Belgium and investment also planned in the UK and France.

Building on knowledge

Speciality chemicals and pharmaceuticals are more widely distributed. In recent years pharmaceutical R&D has increased in South-East and Eastern England, close to the renowned universities of Oxford and Cambridge.

HOW ARE WE DOING?

Strengths

- Ethane import infrastructure and three crackers able to use ethane as a feedstock

- LNG import and re-export facilities

- Several closely integrated clusters

- An extensive ethylene pipeline network

- Modern chlor-alkali and derivatives production based on membrane technology

- Strong exports to geographically diverse markets

- High resource efficiency

- Strong pool of highly-skilled researchers and staff

- Highly innovative, backed by exceptional research and university infrastructure

- Good labour relations

- Strong safety and responsibility culture and performance in production and distribution

- Able to satisfy sophisticated consumer demands

- Improving public perception

- Heightened political recognition and value driven by industry’s criticality to the economy and broader society in tackling Covid-19

Weaknesses

- Ongoing disruption linked to Brexit and the medium to long-term impact on investment

- Uncertainty over the design and implementation of UK REACH

- Fragmented ownership of plants within clusters can lead to non-optimal long- term strategies

- Energy prices are globally uncompetitive, driven up by EU and UK climate policies while US, Middle East and China rivals access cheap hydrocarbons

- Mature European market: growth is faster in Asia and the US

- Scarcity of skilled craft workers because of ageing workforce and competition from other sectors

- Historic strength in some key customer industries – e.g. aerospace and automotive – now challenged by ongoing Brexit disruption and stronger growth in non-European markets

OUR CONTRIBUTION TO A COMPETITIVE EUROPE

Strengthening strategic planning

Over recent years, a long-established industry/government strategic partnership, known as the Chemistry Council, has seen its progress restricted by a combination of Brexit, Covid and, most recently, supply chain tensions and cost of living challenges driven by the war in Ukraine. March 2023 will see the restart of the Council’s work, addressing the key challenges to long term growth with a focus on tackling decarbonisation and broader sustainability through competitive energy; reinforced and new supply chains and collaborative innovation. The strategy to address this was published in November 2018, and the March restart of the Council will see a review of this strategy as well as composition of the Chemistry Council. Whilst the Chemistry Council’s progress has been restricted over recent years, the industry has, however, congregated around a collective ambition to halve emissions by 2034 and by 90% by 2050, all based on sufficient access to hydrogen, carbon capture and storage and clean electricity. The country’s ability to minimise emissions as quickly as possible is best demonstrated through our chemical clusters – especially Humberside, Teesside, the north west, the Solent region and Scotland (Grangemouth).

Putting science to work

The UK government wants the UK to be the world’s most innovative economy and through the Industrial Strategy, has committed to reaching the target of 2.4% of GDP investment in Research and Development (R&D) by 2027. As a first step to reaching the target, the Government announced an additional investment of £7bn for R&D over 5 years (from 2017-18 to 2021-22) as part of the National Productivity Investment Fund. This raises public investment in R&D from around £9.5bn per annum in 2016-17 to around £12.5bn per annum in 2021-22 – the biggest ever increase in public funding of R&D.

Navigating Brexit

With 60% of UK chemical exports destined for the EU and 75% of chemical imports originating from the EU, it was very reassuring that tariffs were avoided and supportive Rules of Origin agreed as part of the UK/EU Trade and Cooperation Agreement. The challenge remains to deliver a long-lasting solution over the Northern Ireland Protocol. Success on the Protocol should enable the UK and EU to advance the work of the technical committees and, in particular, the agreed chemicals annex addressing future regulatory cooperation.