Chemical industry snapshot

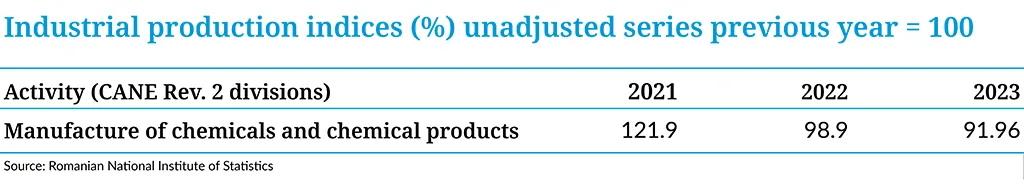

Industrial production indices (%) unadjusted series previous year = 100

In 2023, the chemical industry from Romania invested 3,3 million Euro in research and development. Most of the R&D investments were carried out in order to mitigate the impact of their activity on the environment or to develop new technologies or more sustainable products, and mostly were done by few big companies in the market.

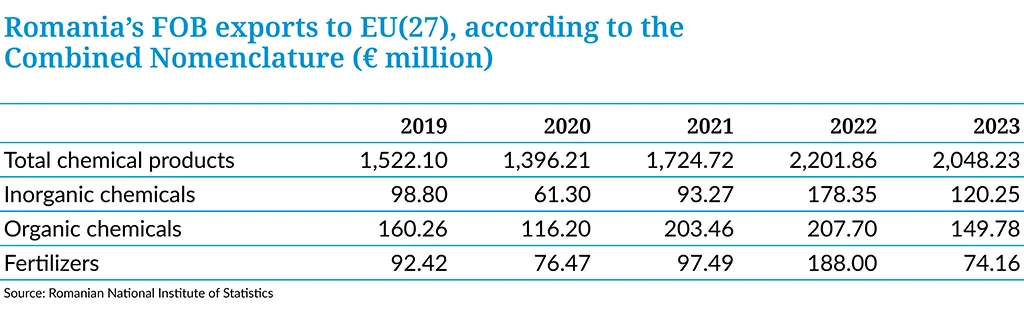

Romania’s FOB exports to EU(27), according to the Combined Nomenclature (euro million)

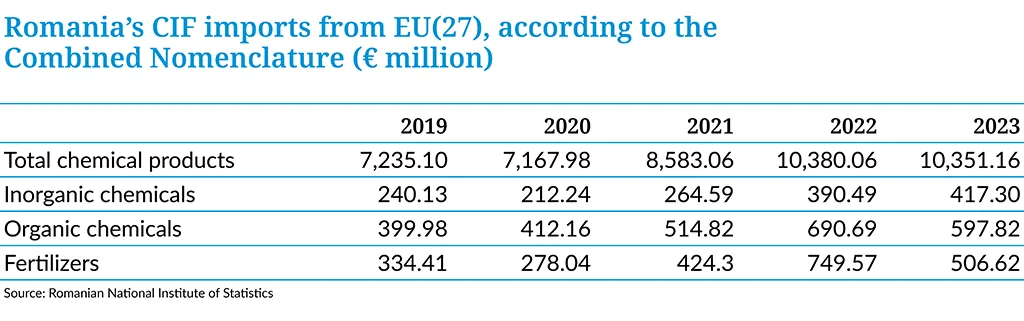

Romania’s CIF imports from EU(27), according to the Combined Nomenclature (euro million)

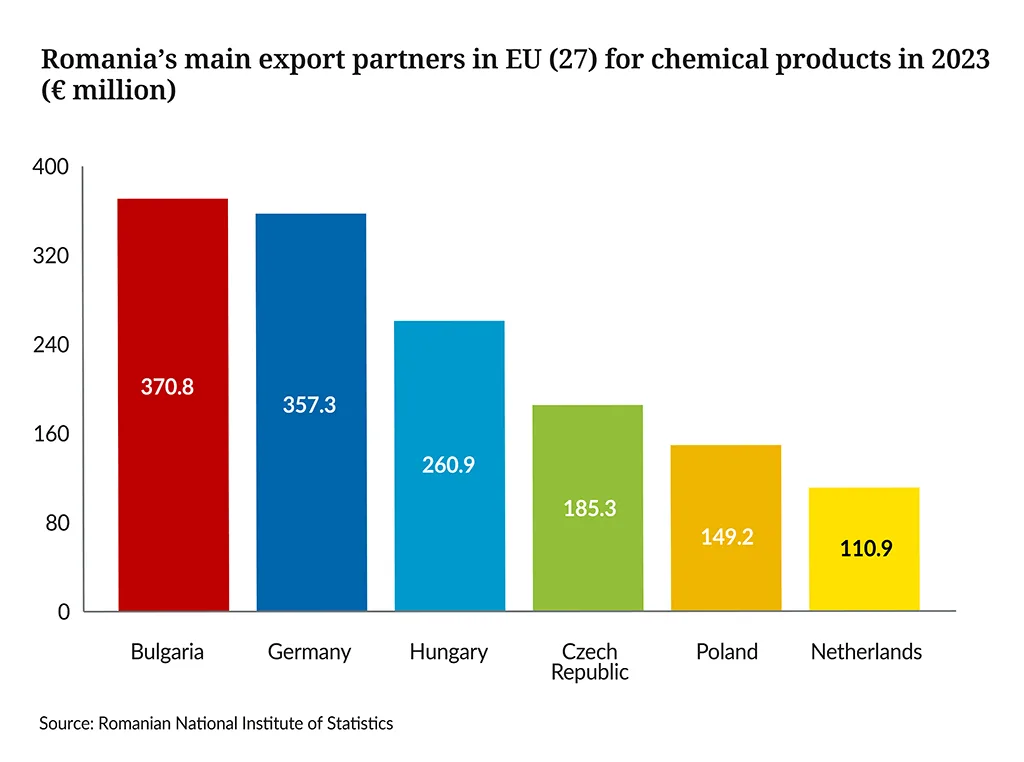

Romania’s main export partners in EU (27) for chemical products in 2023 (euro million)

These 6 main export partners represent 70% of the total amount.

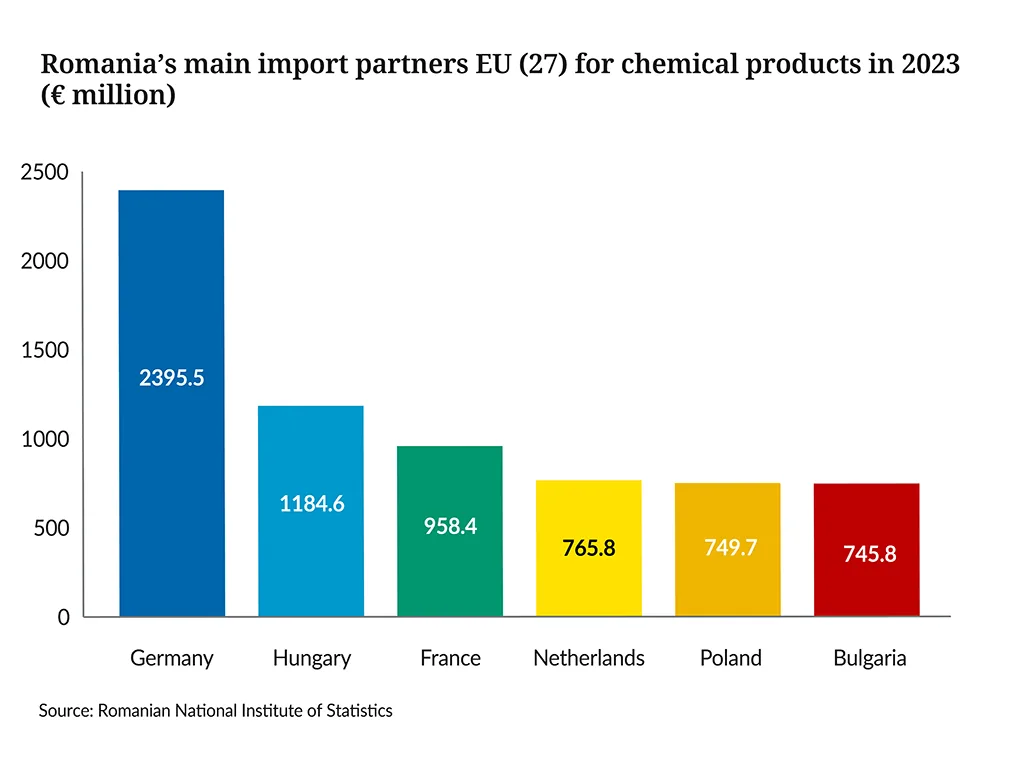

Romania’s main import partners EU (27) for chemical products in 2023 (euro million)

These 6 main import partners represent 65,7% of the total amount.

How are we doing?

In 2022, the chemical industry from Romania invested 2,43 million Euro in research and development. Most of the R&D investments were carried out in order to mitigate the impact of their activity on the environment or to develop new technologies or more sustainable products.

Strengths

- A strong petrochemical base

- Abundant natural resources (raw materials and energy)

- Available processing capacity

- Strategic location for production and distribution

- Long tradition of chemical production

Challenges

- Low level of innovation and specialization

- Relatively small local players

- The industry is fragmented in many associations

- Low level of value added local processing (export of raw materials and import of processed goods)

- Lack of integrated value chains

- Lack of a national development concept

Opportunities

- Potential for cooperation with universities, research institutes in the area of R&D and talent development

- Explore more markets outside EU for export

- Foreign Direct Investment (FDI) potential

- EU membership

- Market size and growth potential

- Develop strategic programs within the frame of the Green Deal

- Create synergies among the key players in Chemical Industry – including partnerships with related Associations

Threats

- High competition, especially for smaller companies

- Inconsistent public policies

- The chemical sector is not seen as an essential sector

- Ageing population

- Energy prices

- Migration of workforce abroad

- Vulnerability to external shocks

- Poor transport infrastructure

- Lack of capacity of Romanian Authorities to facilitate major investment programs

Our contribution to a competitive Europe

Economic enabling strategies have been developed, aligned to the EU’s 2020 strategy. These include national industrial policy, export strategy, Mining Strategy 2017-2035, Romania’s Energy Strategy 2016-2030, with perspectives for 2050 and the competitiveness and Innovation strategy.

The government sets overall horizontal framework conditions across energy, research, education, and infrastructure, but these strategies are sometimes of more political than practical relevance.