Portugal

Key facts

Turnover

€6.588 billion

Direct employees

16,397

Number of companies

958

National contact

APQuimica – Associação Portuguesa da Química, Petroquímica e Refinação

Carla Pedro

Director General

carla.pedro@apquimica.pt

CHEMICAL INDUSTRY SNAPSHOT

According to the latest available data, in 2021, the Portuguese chemical sector (NACE 20 + NACE 211) experienced a significant increase in turnover, reaching record-high numbers and resuming its growth trend following the COVID19 pandemic period.

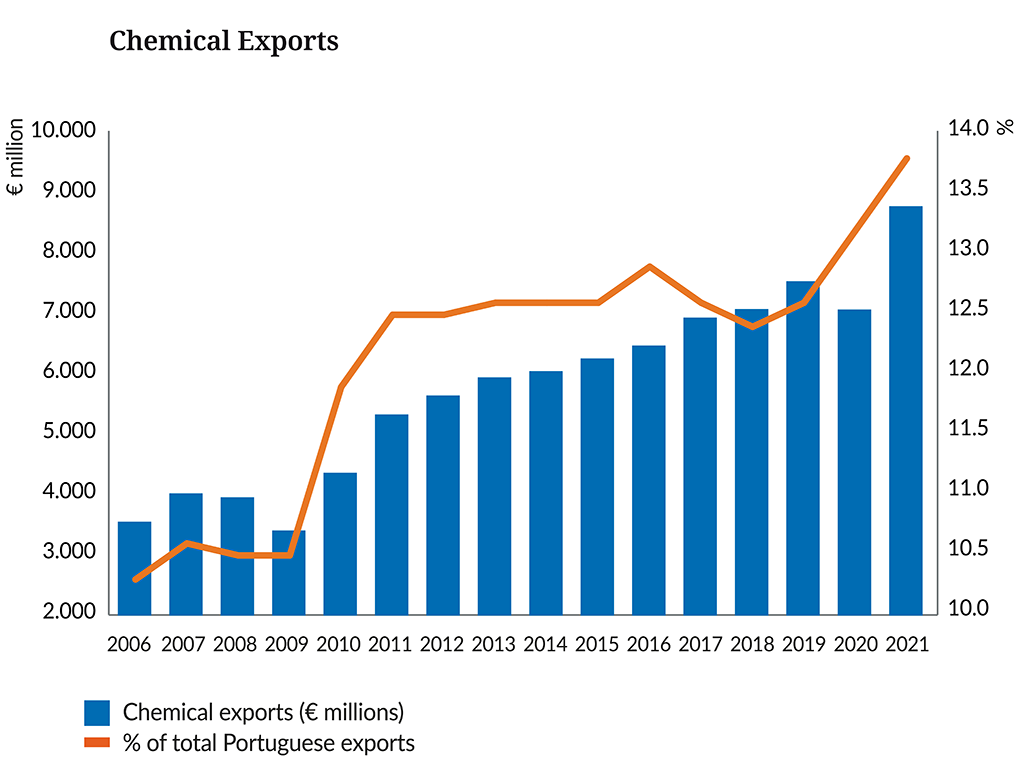

The chemical sector registered €8.8 billion exports in 2021, also restarting its year-on-year growth. The chemical sector accounted for 13,8% of total Portuguese exports in 2021, reinforcing its position as one of the country’s top exporters.

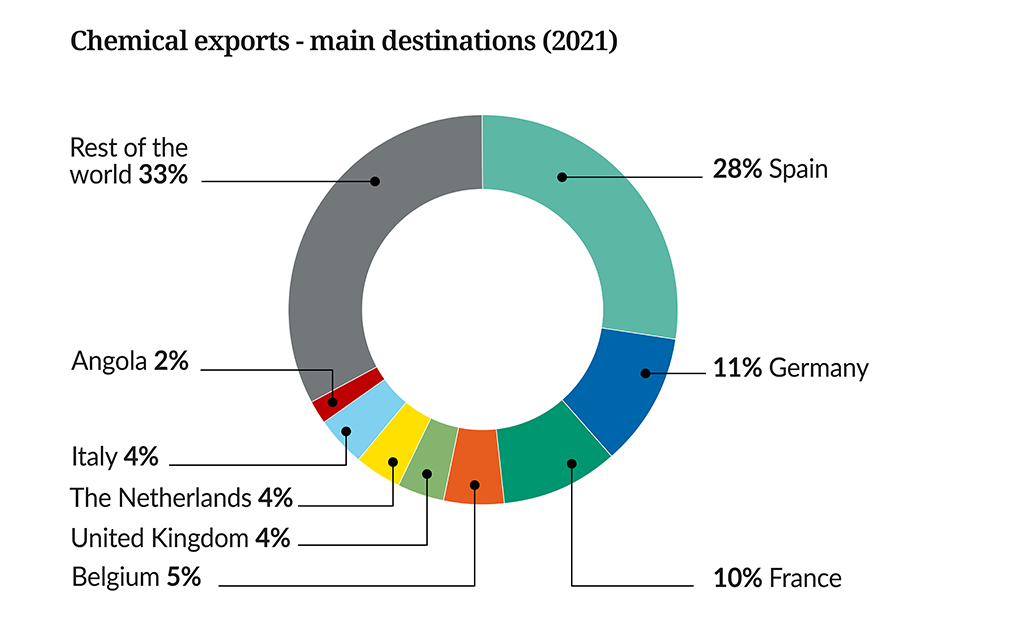

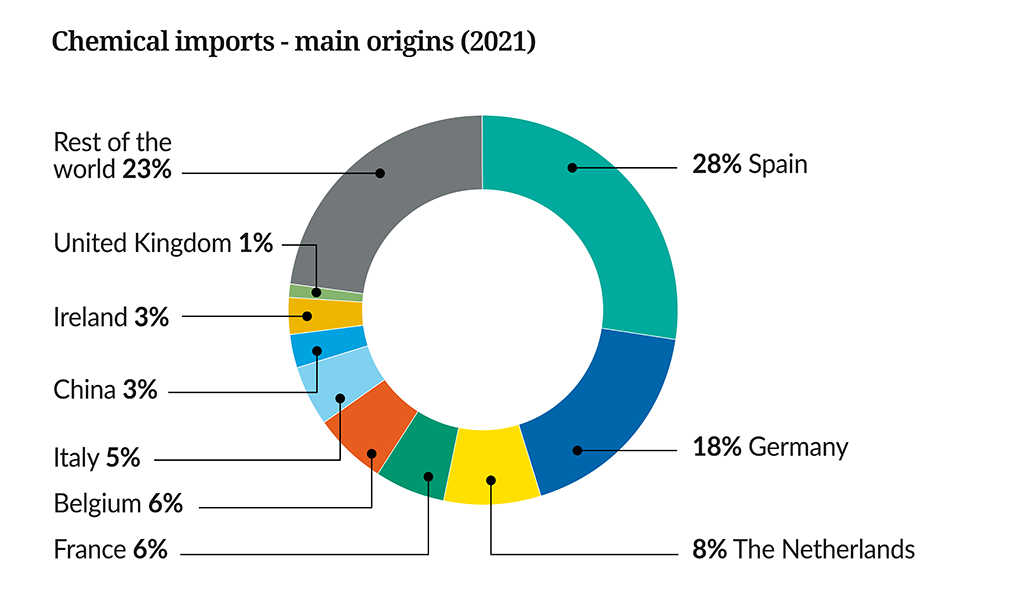

In 2021, the European Union (EU) reinforced its position as the main market for Portuguese chemicals, with both exports and imports becoming marginally more EU-centric.

Structure of the chemical industry in Portugal

Most chemical companies in Portugal are small and micro companies, mostly operating in the area of consumer products. Larger operators are active in basic chemicals, fertilizers, petrochemicals, polymers, fibres and specialties. There is also a small but very dynamic group of companies in the fine chemicals area, with a significant contribution to value-added exports. Overall, the chemical sector in Portugal is highly diversified, comprising multinationals, national industrial groups and companies, SMEs and start-ups.

Location of the main chemical industry hubs

Geographically, the chemical industry in Portugal is mostly located in two defined chemical industry hubs in Estarreja and Sines, and in the industrialized metropolitan areas of Lisbon and Oporto.

Porto Area

Following the decommissioning of the Matosinhos refinery at the end of 2020, PT refining activities were concentrated exclusively in Sines (cf. below). Currently several small industries, supplying chemicals for other industries, can be found in the Oporto Area, that together with the region of Lisbon is also strong in biochemicals and industrial gases.

Hub of Estarreja/Aveiro

This hub has a significant supply chain integration, accounting for 10% of the total Portuguese chemical industry. Methylene Diphenyl Diisocyanate, or MDI, is the most important output and is produced mainly for export.

Nitric Acid, nitrobenzene, aniline, hydrogen, carbon monoxide and chlor/alkalis, are also produced in this hub by different companies. Large quantities of these products are used in the production chain of MDI, but external sales are also significant. The output of this hub includes other less important products associated with the above main products.

Also located in the same area are other chemicals plants, producing PVC and urea-formaldehyde resins.

This hub is considered an efficient site, mainly export-oriented. It has good links to internationally recognized universities with strong training and applied R&D activities focusing on the chemical sector, namely in Aveiro (20 km), Porto (40 km) and Coimbra (80km).

Concerning logistics, the hub uses the port of Aveiro (25 km), railways and a motorway junction (enabling connections with the whole of Portugal, Spain and Europe). There are some points which can be improved, such as the railway connection with the harbour of Aveiro.

The strong dependency on one output (MDI) is the weak point of this hub, limiting its development strategy. However, the site is becoming increasingly diversified, with large industrial projects being launched in new areas related to green hydrogen/green ammonia production.

Lisbon Area

In the past there were two important hubs for chemicals in the Lisbon area. Since 1985, for competitiveness and environmental reasons, plants producing basic chemicals, which were the basis of these hubs, have been decommissioned.

The Lisbon area still has sizable chemical units, with several middle-sized plants producing fertilizers, fibres and reinforcement technical fibres, specialties, pharmaceuticals and biochemistry/biotechnology. Some of these units are currently under expansion, with new projects being launched, namely in pharmaceuticals. A major industrial project related to the lithium batteries for EV value chain is also being planned for Setubal.

However, these industries are not interconnected, with plants in different locations, so they do not constitute an integrated chemical complex. Their competitive edge comes from their increasing focus on high-growth emerging areas, with strong industrial symbiosis potential with other adjacent sectors and sites. They also benefit from Lisbon’s central location and its good logistics conditions – such as the ports of Lisbon and Setubal, railways, motorways – and the importance of Lisbon as a consumption centre for final consumers and downstream users.

Lisbon has two internationally recognized universities with strong technology curriculum and R&D units/activities.

The sales of the chemical industry in the Lisbon area are roughly estimated to represent about 35% of the national total.

Pole of Sines

Developed in the early 70s, Sines is a petrochemical complex at the coast and 150 km south of Lisbon. The construction started in the middle of that decade, with a 10 million tonnes refinery and an ethylene plant. The ambitious initial plan was affected by the two oil-crisis, and the growth of the complex was slower than planned. At present, in addition to the refinery and the ethylene plant, there are plants for the production of polyethylene, butadiene, and ethyl tert-butyl ether (ETBE). In the same complex there are also plants for the production of industrial gases, terephthalic acid (PTA) and urea formaldehyde resins. The refinery underwent a deep revamping and its competitiveness has been improved.

Recently, the Sines petrochemical complex has experienced a substantial growth with the launch of two new plants for the production of high value-added 100% recyclable polymers, as well as with the creation of the Sines Green Hydrogen Valley initiative focusing on high-scale green hydrogen production and several projects on eFuels.

The main logistic strength of the complex is a deep-water harbour (28 meter) capable of receiving ships up to 350 kt. This harbour, planned together with the refinery, now receives different kinds of bulk cargoes, including liquefied gases, liquids and solids. A container terminal was also added some years ago. The harbour is expected to quadruple its capacity from 2 million to 8 million TEU/year in 2030, with major investments already ongoing. Near the harbour there is a large LNG storage facility, linked to a LNG maritime terminal connected with the natural gas transport network. Under the current energy crisis, an expansion of the LNG terminal and storage facilities is also being planned. The complex has a railway connection and a broad network of pipelines.

HOW ARE WE DOING?

Strengths

Logistics

- Portugal, being a peripheral country in Europe, is well placed in relation to other continents – North America, South America and the Western and Northern coast of Africa.

- The expansion of the Panama canal in 2016 doubled its capacity and created a relevant route for larger ships, with most traffic between Asia and Europe expected to use it. Sines is its closest European (deep water) harbour.

- The railway connections between Sines and Europe are being upgraded and the general logistic conditions of this hub will improve considerably in the near future.

Know-How

- The chemical industry in Portugal benefits from the availability of a highly skilled labour force and relevant competences at the different levels, at reasonable cost. There are good chemical engineering schools and applied R&D centres. Research has been improving considerably for the last 15 years, as well as links between universities and companies and knowledge transfer.

- The chemical sector has one of the 17 Competitiveness Clusters recognized by the Portuguese Government, managing a state-of-the-art PhD Programme focusing on applied research in industrial environments.

Weaknesses

- The value chain in the Portuguese chemical industry has significant gaps, mainly in the field of intermediate products. Therefore, production processes are not fully integrated. Recent investments and projects are starting to narrow some of these gaps, namely under the new Recovery and Resilience national plan.

- In spite of recent improvements (some related to decarbonisation efforts, incl. energy efficiency and renewable self-consumption projects), energy costs are still higher than in most other EU Member States. Electricity grid connections between Iberia and the rest of Europe are planned to improve, but are still poor, making it difficult to develop a competitive market in Portugal and Spain.

- Portugal does not have natural gas reserves. There are good facilities to import LNG, but pipeline connections are limited to just one supplier (Algeria).

OUR CONTRIBUTION TO A COMPETITIVE EUROPE

The segment of chemical specialties for the manufacturing of pharmaceuticals has been quite dynamic in Portugal for the past few years. The number of companies in this segment is limited, but their growth, both in terms of number of patents, production and employment, has been substantial. The cost of energy and barriers to financing are not relevant for this segment, which supports its ability to grow in R&D&I and in the availability of qualified human resources at reasonable costs. This segment is also experiencing some relevant expansion investments.

Production of nanomaterials is being developed in Portugal, with several new smaller companies active in this field. Additionally, the Iberian Nanotechnology Lab, located in the north of Portugal, with its state-of-the-art facilities and top researchers from all over the world, is driving the widespread of nanotechnology throughout the industrial landscape.

A relevant group of start-ups in the area of biochemistry/biotechnology is also expanding, gaining scale and reinforcing its links to existing chemical companies.

The segments related to forest products, namely natural resins, are also relevant. Portugal has an extensive area covered by pine and eucalyptus woods which support industries as cellulose, paper and wood-based panel production. These industries induce the development of several chemical segments, namely specialties. Currently, they justify the existence of plants of Urea formaldehyde resins and are important consumers of the chlor-alkali products. Related with the pine woods, there are some chemical companies producing derivatives of its resins, which are quite competitive in the external market.

Complementing plans for value chain progression, several energy transition/decarbonization and circular economy projects are currently being developed by the Portuguese chemical industry. Portuguese chemical companies are taking part in several key initiatives, namely related to circular economy, batteries for EVs, hydrogen (including a Hydrogen IPCEI, involving Portuguese chemical sector companies). Universities and research centres active in the field of chemicals are also strongly involved in these efforts in direct connection to those companies.

Furthermore, the Portuguese Chemical Cluster is responsible for the only integrated PhD Program developed in industrial environment in Portugal. Already in its 14th edition, the Chemical Engineering PhD Programme (EngIQ) in an innovative partnership between 5 universities, 11 R&D units and over 10 industrial companies. It is based on an innovative demand-driven model, with the participating industrial companies responsible for proposing the PhD project themes to be developed onsite, aligned with their R&D agendas.

Currently, the Portuguese chemical sector is also working alongside the Portuguese Government and other key energy-intensive sectors in the development of green transition scenarios for the industry.

Take a “low-carbon industrial project journey” through Europe: discover our map

Low-carbon technologies projects: mapping investments and projects of the European chemical industry