Ireland

Key facts

Pharmaceutical companies

90M+

Annual export

116+ billion

Number 3 exporter (in Europe)

– pharmaceutical goods & medicines

– antisera & immunological products

Direct & Indirect employee

80,000

FDA approved pharma and biopharma plants

50

Noumber 2 exporter (in Europe)

vaccines

National contact

BioPharmaChem Ireland

Sinead Keogh

Director

sinead.keogh@ibec.ie

CHEMICAL INDUSTRY SNAPSHOT

Ireland’s leading exporter

Chemicals, referred to here as the biopharmachem sector, plays a pivotal role in the Irish economy. It accounts for over 60% of goods exported from the country. It employs more than 42,000 people, and supports a further 42,000 indirect jobs. More than half our workforce are university graduates.

Dominated by pharmaceuticals

In Ireland the industry is dominated by pharmaceutical companies engaged in either Active Pharmaceutical Ingredient (API) manufacture or and also dosage form manufacture (hence the term pharmachemical). As a centre for manufacturing biopharmaceuticals Ireland is second only to the United States. Recent investments amount to just under €12 billion – the majority from US-based companies including Bristol Myers Squibb, Alexion, MSD, Janssen, Merck and Eli Lilly.

A platform for global companies

Ten of the top 10 global pharmaceutical companies, many US-based, are located in Ireland. It is the second largest net exporter of complex pharmaceuticals in the EU.

Clustered around Cork and Dublin

Ireland is small and can be viewed as a single industrial policy region. There is a cluster of API plants around Cork – mostly engaged in high- end chemical synthesis. Dublin has a more diverse industry base including chemical synthesis, drug product formulation and biotechnology based manufacture – including fermentation, purification and formulation. Recent investments will make Dublin a leading global cluster for biologics (biopharmaceutical) manufacture. There are emerging clusters in the midlands and also in the South East of the country.

An international export platform

Ireland’s chemical and pharmaceutical industry exported €106 billion of products in 2020, 60% of the country’s exports.

The sector pays more than €2 billion of corporation tax each year.

A four-fold rise in jobs, with more to come

Employment in the sector grew from 5,200 in 1988 to 42,000 in 2022, supporting as many again providing services to the sector. Companies invested about €123 billion in capital projects during 2010-2022, creating more than 3,000 new jobs. Replacement value of the sector is estimated at €45 billion.

Reshoring of APIs and intermediates into the EU will present an opportunity for the European and Irish API sectors.

HOW ARE WE DOING?

Strengths

- Excellent levels of regulatory compliance (EHS/Quality), reducing manufacturing risk or risk of supply interruptions

- Depth of compliance experience

- Record of continual improvement helps companies bring product to market on time

- Very positive national perceptions of the industry

- Ranked seventh worldwide for competitiveness

- Recognised Global hub for biopharmaceutical manufacture

- Second largest manufacturer of pharmaceutical ingredient and medic

- A well-qualified workforce that has achieved critical mass

- A large and growing research skill base which will significantly assist the attraction and retention of high tech FDI now significantly increasing indigenous innovation

- 440 world class principal investor (PI)-led research teams

- 2 000 PhD graduates in total at an ongoing average rate of approximately 400

- 1 000 post-doctoral research training places

Weaknesses

- Cost base high – including labour and energy costs

- Dependent on inwards investment

- Responding to patent cliff issues

- Pressure on cost of healthcare

OUR CONTRIBUTION TO A COMPETITIVE EUROPE

The key policy driver nationally is the development of the national research base in order to harness and anchor innovation in the country. This led to the establishment of Science Foundation Ireland (SFI), which funds basic and applied research. The Programme for Research in Third Level Research Institutes (PRTLI) has invested in state-of-the- art research infrastructure.

Specific industry initiatives

Lighthouse Project – Factory 5.0

BPCI is working an industry consortium comprising API chemical companies and technology companies to incorporate the principles of Digitisation and Sustainability into the sector via the principles of Factory 5.0.

SSPC-2 – a centre specializing in reach into solid state chemistry and wet synthesis has been established. This €35 million research centre is part funded by Government (SFI), the industry and the university sector. It is an excellent example of industry-academic-Government collaboration. It will concentrate on near- to- industry research and innovation.

PMTC – The Pharmaceutical Manufacturing Technology Centre – funded by government through Enterprise Ireland will fund applied research conducted by the research community for industry.

NIBRT – The National Institute for Bioprocessing Research and Training – will support innovation in the biotech sector – part funded by industry and Government. A state-of-the-art facility.

CRANN – Research institute established by government specialising in nanotechnology.

Cell and Gene Therapy – Cell and Gene Therapy (CGT) supply and manufacture has been identified as an opportunity for the sector in Ireland. Investment in that infrastructure is planned.

Research Policy

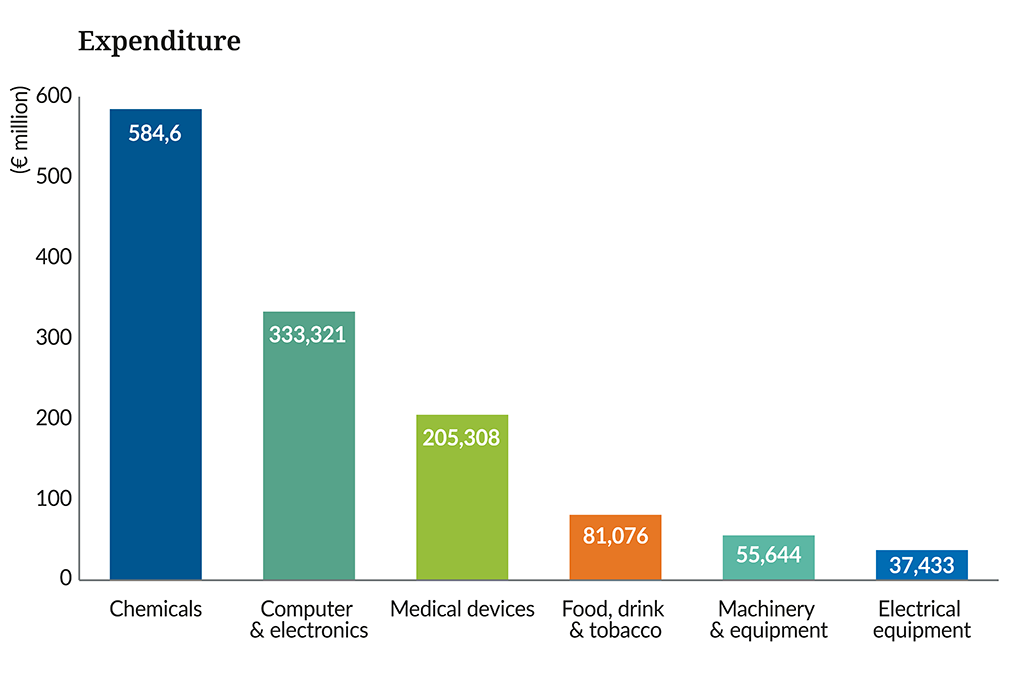

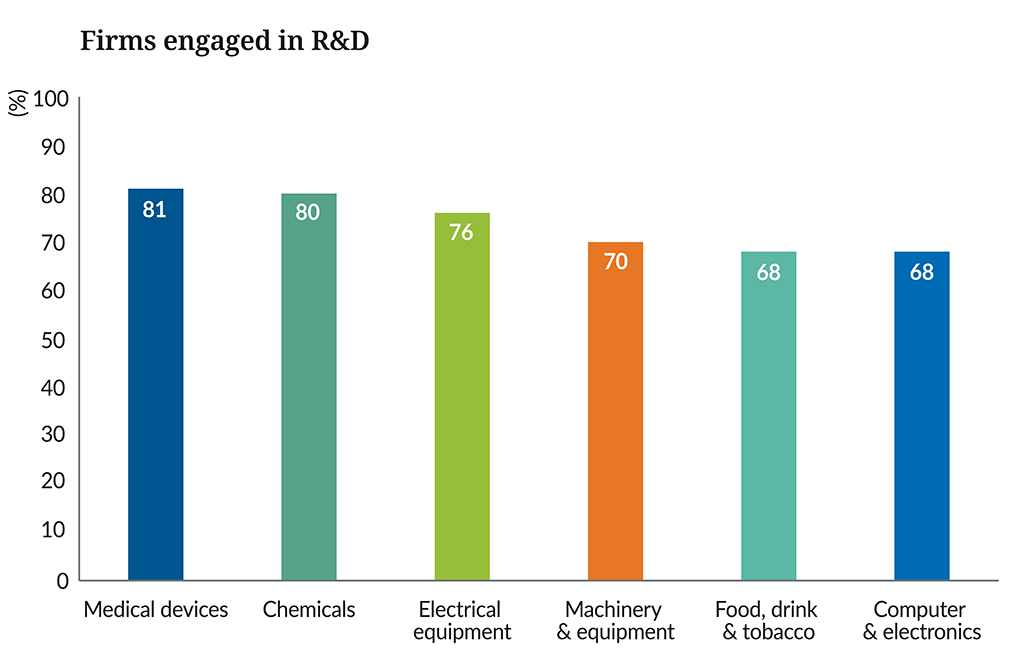

The pharmachem sector as demonstrated above is not only “high value” in terms of its expenditure on the Irish economy in terms of salaries but is also a major participant in private sector research and development. Just over 80% of pharma and chemical firms engaged in R&D in 2011, behind only medical device firms. This is well ahead of other manufacturing sectors including electrical equipment and computers. In this sense the pharma sector is not only a major manufacturing industry but also a very high value manufacturing industry, as R&D jobs tend to be of a better quality than more basic manufacturing.

To see the benefits of this for the economy one need only look at expenditure on R&D by the sector. In 2011 the sector spent almost €600 million on R&D – nearly twice that of other high tech sectors such as IT and three times as much as medical devices. Given the importance of R&D in economic growth and the high level of value attached to R&D positions, this is a major contribution to the Irish economy. By 2018 this figure rose to €1.8 billion.