Chemical industry snapshot

An important industry suffering from competitiveness challenges

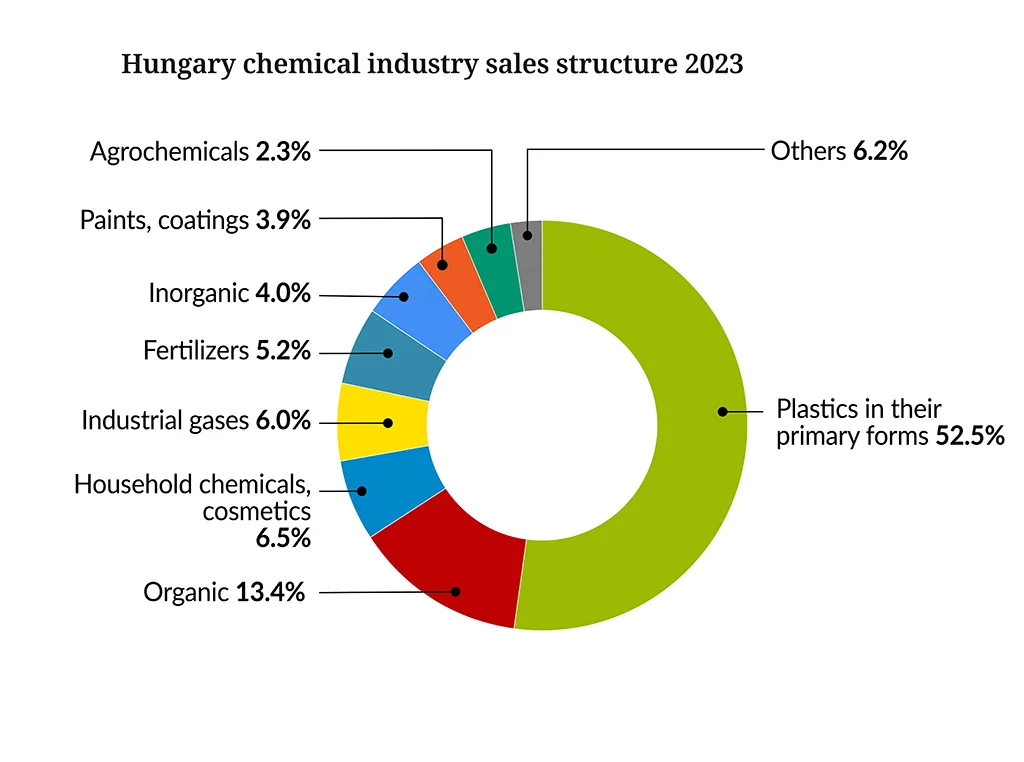

The chemical industry plays an important role in Hungary’s economy. Sales of Hungarian chemicals and chemical products nearly doubled between 2009-2021, registering a growth rate above the EU chemical industry average and touching level of pre-COVID period again. From the middle of 2022 Hungarian chemical industry have been facing permanent and serious competitiveness challenges. Chemical industry output, including the manufacturing of plastics in their primary forms, organic and inorganic chemicals, fertilizers and other agrochemical products, paints, home and personal care raw materials and other consumer chemicals dropped down from over 20% to 17,3% of the total processing industry of the country. The weight of chemical industry output has decreased both in domestic and export sales within processing industry performance. Hungary remained a leading producer of acryl based carbon fibers.

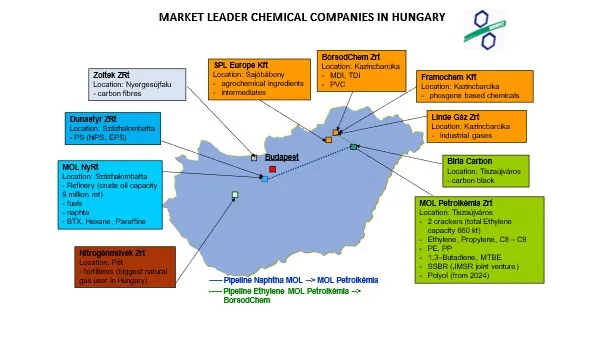

The industry has been on a continuous growth track between 2012 and 2021 due to expanding export markets and the high level of investments into production capacities and energy efficiency, and the further expansion of the chemical value chain, particularly in petrochemistry. This path has broken during the past two years. Anyway the leading Hungarian chemical companies remained in important regional player role in the Central European chemicals market of petrochemicals, polymers, carbon fibers, fertilizers and agrochemical active ingredients.

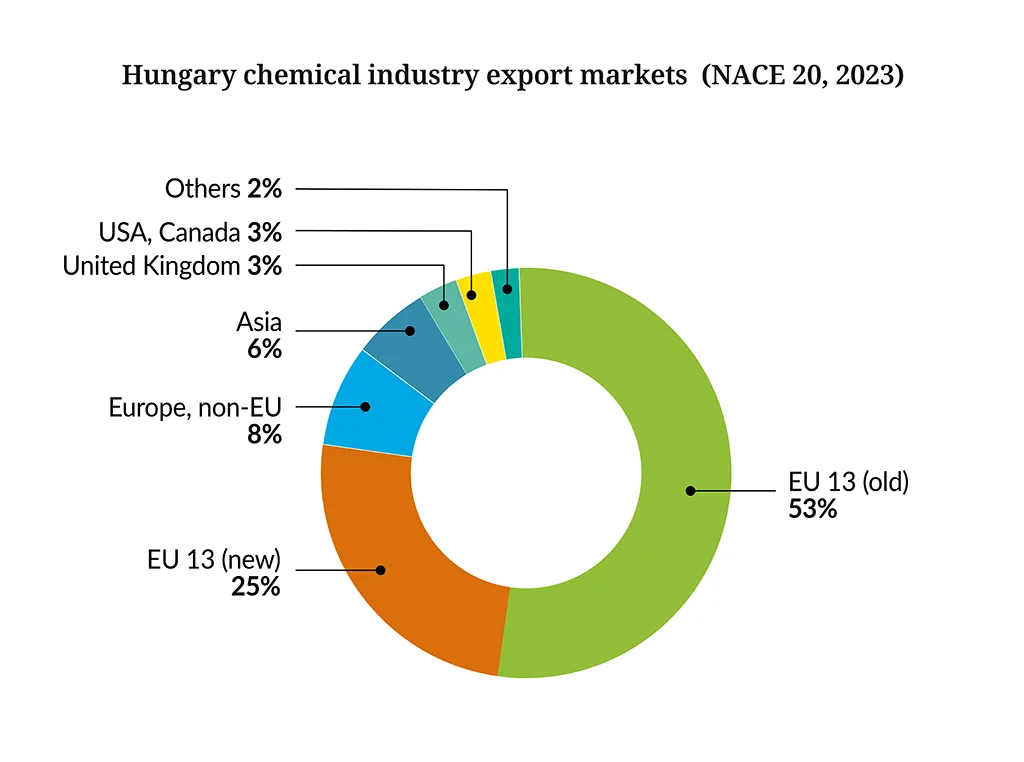

The performance remained export driven, in 2023: 62,7% of chemicals and chemical products manufactured in Hungary are exported and sold predominantly in the EU Single Market. Unfortunately there is a significant decreasing in export ratio compared to 2021 (67,2%).

After COVID-19 pandemic the Hungarian chemical industry reactivated and two years – from middle of 2020 until middle of 2022 –were successful,. During the first half of 2022 – despite the war between Russia and Ukraine and increasing energy prices– the trend of sales and production were continuous. From June-July of 2022 all trends turned worse and the Hungarian chemical industry lost their position. Production volume down by 12,3% in 2022 and by another 16% in 2023. No significant signs are visible of rapid recovery. Industry was effected by a new influence, the highest inflation of the past 30 years.

Backed by a strong research base

The chemical and pharmaceutical industries have a long history in Hungary, as do research, development and innovation, particularly essential to the competitiveness and sustainable development of the country’s chemical companies. The market leader companies operate their own laboratories and research centers. Several institutes of the Hungarian Research Centre of Natural Sciences, and also the technical universities of Budapest, Veszprém, Debrecen, Szeged and Miskolc engage in both basic and applied research projects in cooperation with chemical companies and/or under EU programs and projects.

An employer of highly trained workforce

The chemical industry is not a labor intensive branch of the economy, with only 16,7 thousand highly trained employees –7300 white collar and 9400 blue collar workers – it is an important contributor to the GDP of the country, distinguishing itself as one of the knowledge industries of Hungary.

The number of employed increased by 1,1 % in 2023 in comparison with the previous year due to new production facilities with the completion of investment projects in the sector and despite the production volume losses and inflation.

| Previous year = 100,0 | Previous year = 100,0 |

| Blue collar | 100,7 |

| White collar | 101,5 |

| Total | 101,1 |

Built upon infrastructure

Hungary has a developed infrastructure of motorways and roads. The recent development of intermodal logistic capabilities for the transportation of goods and the ongoing improvement of railways infrastructures and services are of particular importance for the sector.

Also, the country’s advanced communications network and energy supply systems provide the necessary background for the operation and development of the chemical industry.

In addition, the geographical location of the country makes it a natural choice for investments and operations in Central and South Eastern Europe.

There are many new infrastructural investments announced related to very intensive automotive and battery industry developments. Strong battery industry could be a new opportunity to reactivate chemical industry.

Important chemical clusters are located in three regions

How are we doing?

Strengths

- A strong petrochemical base, sound environment and supportive industrial policy for new investments

- Economies of scale, up-to-date technologies and high standard HSE practices in manufacturing

- Capacities developed and enlarged by investments to meet demand from automotive, batteries, electronics, construction industries, agriculture and home and personal care

- A location of choice for serving Hungary and Central and South-Eastern Europe

Challenges

- Despite recent and ongoing efforts for diversification, highly dependent on imported feedstock and energy sources, especially Russian crued oil and natural gas

- Due to fast industrial development there is a shortage of qualified employees in some specific areas

Our contribution to a competitive Europe

Focusing on talent

A supportive industrial policy and a less bureaucratic and financially much less burdensome regulatory framework at both the European and national level are prerequisites for the sustainability of the chemical industry. Education and training are vital. Hungary has a solid educational system, from elementary school to universities. The teaching of science subjects at all levels of education and the importance of the technical professions are increasingly recognized and slow-by-slow emphasized by government policies and supported at many levels by the industry.

Special efforts and programs have been undertaken by both chemical businesses and the Hungarian Chemical Industry Association in order to make natural sciences, and in particular, chemistry and chemical professions more attractive to the younger generations. They maintain close relations with vocational training schools, specialized high schools and technical universities to provide the succession to an ageing workforce and not less importantly, to have an influx of young, well-trained and highly educated people to operate new manufacturing facilities that emerge as a result of ongoing and further investments in the sector.