Germany

Key facts

Turnover

€227.1 billion

Capital spending

€9.5 billion

Direct employment

473,194

Number of companies

2.228

R & D investment

€13.2 billion

National contact

Verband der Chemischen Industrie e.V. (VCI)

Wolfgang Große Entrup

Director General w.grosse.entrup@vci.de

Chemical and pharmaceutical industry snapshot

Third-largest industry in Germany

With a 2021 turnover of €227.1 billion, chemicals and pharmaceuticals are the third-largest industry in Germany, behind automotive and machinery and equipment.

Broad and strong

The German chemical industry is strong across all segments: basic inorganics, petrochemicals, polymers, agrochemicals, specialties, cosmetics and pharmaceuticals. It is also well spread across the country, although some regions are more specialised in basic chemicals, while others focus more on specialties or pharmaceuticals.

As an enabler of all other industrial sectors, the chemical industry has its role in all economic regions or clusters. To highlight just a few specific segments, technologies or regions would not be a suitable way to describe the strength of the German chemical industry.

In 2021 about 2,230 companies partly organized in 40 Chemical Parks employed 473,194 people. After the industrial recession in 2019 andthe setbacks due to the Corona pandemic sales increased again by almost 20. per cent to 227.1 billion euros. The pent-up demand from industrial customers for the Corona restrictions caused sales to rise.. 60 percent of total sales were generated with customers abroad.

The German chemical industry is looking back on a particularly difficult year 2022 that was marked by Russia’s war of aggression on Ukraine and the resulting energy crisis. Enormous energy prices and price increases for raw materials and inputs are making matters hard indeed for industry in Germany. Costs went up more sharply than sales prices, so that – according to a recent VCI member survey – meanwhile profits are falling at roughly 80 percent of businesses. Every fourth company is already making losses, with SMEs being particularly affected. Production dropped by 6 percent against the previous year. When excluding the pharmaceutical business, the decline was even around 10 percent. The last comparable slump in production was in 2009 in the wake of the global economic crisis.

Prospects remain bleak also for 2023. The energy crisis is forcing the German and European economies into recession. The decline in industry production in Europe will accelerate further, import pressure will continue to increase. Therefore, the challenges for the industry remain enormous next year: lack of orders, disrupted supply chains and high energy costs. As matters stand now, the VCI is expecting for 2023 a further major drop in production in the chemical-pharmaceutical industry. And it remains when the tides will change again, putting question marks behind the transition pathway.

Among the most important trends affecting chemical and pharmaceutical industry are sustainability, climate change, protection of natural ressources, and circular economy. The German chemical industry, together with its customers, is developing and implementing new processes and products e.g. with the aim to reach greenhouse gas neutrality by 2050, to use CO2 as an input or to use plastic materials via recycling as feedstock for the next generation of products.

New technologies such as nano- and biotechnology, the hydrogen economy and digitalisation are explored to find efficient ways to achieve these goals.

Areas of growth for the chemical industry lie in the topics addressed in the “High Tech-Strategy” of the Federal government. Due to digitalisation, process and organizational innovations are gaining in relative importance.

Progressing through research

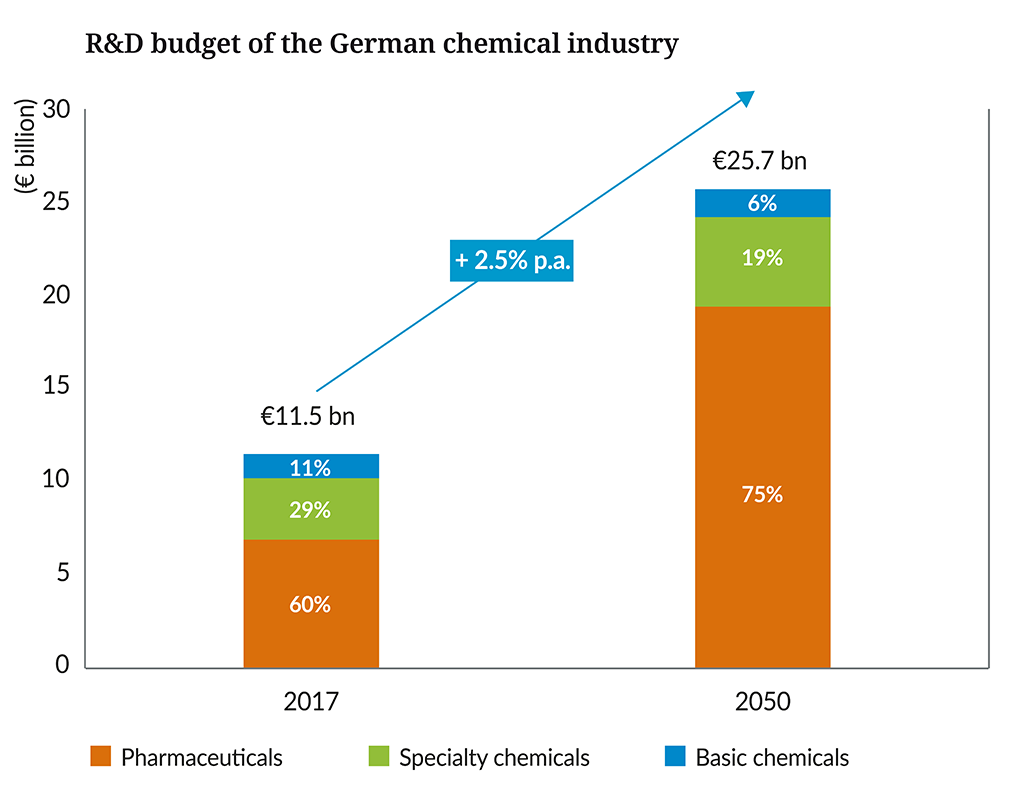

Almost 80% of German chemical and pharmaceutical companies have research activities, and R&D spending reached €13.2 billion in 2021. While German chemical companies get about 1% of their R&D expenditures through government funding, collaboration between industry and academia is well established: one third of chemical companies collaborate with academia in research projects.

To maintain its competitive edge, the German chemical industry will enhance its research effort by 2050.

Transport matters

Three states on the Rhine have the largest chemical industries: North Rhine Westphalia, followed by Rhineland- Palatinate and Hesse, with its strong pharmaceutical industry. Good access to transport infrastructure is one important locational factor for a successful chemical industry. In Eastern Germany, Saxony-Anhalt is the top chemical producer.

HOW ARE WE DOING?

Strengths

- Highly-integrated, globally competitive clusters and chemical parks together with other industrial sectors

- Highly-innovative chemical sector with a strong mindset to transform itself and its business models towards more sustainability

- Indispensible supplier of materials and solutions for the sustainable transformation

- Highly-specialised small and medium-sized enterprises

- Powerful protagonists in international value chains with activities in all centers of growth

- High resource efficiency

- Well-educated labour force (academic, non-academic, e.g. via dual education)

- Close supplier-customer relations

- Network of strong research and university infrastructure

- Capable physical infrastructure, positioned at the center of Europe

- Good cooperation between companies and unions (Social partnership)

- Long experience and focus on safety and protection of the environment

- Able to meet sophisticated consumer demand

- A leader in innovation in low carbon technologies and chemical recycling

- A leader in establishing processes of digitalisation of the chemical industry

- Positive public image

Weaknesses

- Energy prices are high and rising

- Reliance on imported raw materials and other inputs

- Dependence on the automotive industry as important customer

- Strong role of autocratic states in international supply chains

- Links to international suppliers and markets become vulnerable due to rising protectionism, global tensions and logistical problems

- Rather vulnerable to external shocks (scarcity in many raw materials)

- Demographic change will pose an increasing threat in the future, especially in rural areas

- Lack of skills for digitalisation

- Slow upgrade of IT infrastructure including high-speed internet

- Slow progress on new electricity grids to enable the “Energiewende” towards renewable energy

- Lengthy approval procedures with legal uncertainties

- A sceptical view on change and new technologies in some parts of society

OUR CONTRIBUTION TO A COMPETITIVE EUROPE

Creating a framework for success

The energy crisis also affects the long-term growth potential of the chemical industry. As energy prices will remain substantially higher than in other parts of the world, competitiveness of basic chemicals shrinks and the transformation of our industry is at risk. The consequences could be declining investments, relocation of production abroad and increasing import pressure. The threat of de-industrialization is real.

German policy tried to limit gas and electricity shortages with short-term policies e. g. new LNG-terminals, prolongation of nuclear power until April 2023 or implementation of strategic gas reserves. However, longer-term measures such as long-term gas supply contracts, expansion of domestic gas supplies, accelerating the expansion of renewable energies or extending the life of nuclear power plants have not yet been taken.

As a result, energy prices will remain extremely high in 2023 and 2024. To prevent structural breaks in the energy-intensive industries, an electricity and gas price brake will be introduced at the beginning of 2023. However, VCI expects that the effect of this remedy will be very limited due to unaccomplishable conditions – for big companies and for SMEs.

Meanwhile, the transformation challenge remains and is even heightened due the Inflation Reduction Act of the USA. German chemical companies use IPCEI, Horizon Europe and other programs for investments in new technologies and products. CCfDs will become another important element to facilitate transformation. However, these programs – European and national ones, are too restrictive, complicated, and slow compared to the US (and Chines) approaches.

The German chemical industry needs urgently renewable energy – but the build-up of new capacities is far too slow. Therefore, speeding up approval times for infrastructures, but also for production sites, is one of the main priorities of industrial policy for Germany.

Research, digitalization and development of skills are other important parameters. The policies in these areas are often too rigid regarding technological openness

With our initiative Chemistry4Climate, VCI contributes to the design of transformation policy in Germany.

Another field of industrial policy is the design of the Green Deal – it is putting too much emphasis on raising costs and limiting room for innovative manoeuvre. One example is CBAM, which will replace functioning carbon leakage protection by an instrument that is highly bureaucratic, raises costs for importers and reduces competitiveness for downstream sectors and exporters.

And its not only the Green Deal – it is accompanied by the taxonomy, CSDDD, national regulations as the BEHG: German companies are more and more handcuffed by new regulations.

Another element of German policy in 2022 is the development of a “national China Strategy” developing answers for the economic and systemic competition with China

Finally, German Minister of the Economy Robert Habeck announced that 2023 should be the “year of industrial policy”. We hope this announcement will be filled with a package that takes into account the European perspective, strengthening the single market by consolidating European programs to support transformation to make them more efficient and filling gaps where necessary and by re-evaluating the Green Deal regarding its effects on the industrial transformation and preparing a re-orientation of the Green Deal, focussing on enabling industry to manage its transformation as a global frontrunner and becoming an enabler for global industrial transformation.

Take a “low-carbon industrial project journey” through Europe: discover our map

Low-carbon technologies projects: mapping investments and projects of the European chemical industry