France

Key facts

Turnover

€97 billion

Capital spending

€4.1 billion

Direct employees

168,500

Number of companies

3,500

R&D Investment

€2 billion

National Contact

France Chimie

Magali Smets

Director General

msmets@ francechimie.fr

CHEMICAL INDUSTRY SNAPSHOT

A key contributor to the French economy

With a estimated turnover of €97 billion in 2021 (including active pharmaceutical ingredients), France is the second largest European chemical producer.

Year after year and despite the pandemic in 2020, the chemical sector remains a major industry with a strong contribution to the global economy in France. Its added value amounted to nearly €24 billion in 2021, accounting for almost 10% of the national manufacturing industry added value and ranking third behind the food and beverages and metallurgy.

Thanks to its strong territory presence, about 3,500 companies partly organized in 18 chemical platforms, employed directly 168,500 employees, and more than 842,000 including indirect and induced jobs.

After the Covid crisis, chemicals in France rebounded in 2021 with a production growth of 6% in volume (after -7.7%). It consolidated also its export leadership within the industrial sector, with a new record of €69 billion, and a key contribution to the trade balance of the national industry (ranking second with a trade surplus of €13 billion after aeronautics).

A leading employer

Despite the Covid crisis, chemical companies have preserved jobs in 2021. The impetus given by the French national recovery plan in the chemical sector (about 5b€ investment announced) and the aging of the workforce both explain the increasing need for recruitment. About 120 000 new hires are expected to join the chemical industrys within the next 5 years. Apprenticeship is a key option for the sector to integrate new competencies. The sector signed a branch agreement in 2021 to increase by 30% the number of people in alternated training or apprenticeship over the next five years (2022-2025).

A major international industry

Nearly 75% of the total chemical sales (including the chemical distribution) were exported in 2021. The European Union represented 54% of the total exports, a higher share than the pre-crisis level. And outside of the EU, Asia remainsthe first trading partner of France, accounting for 14% of chemicals exports.

Investing in the future

In 2021, the capital investment in chemicals accelerated according to the forecast of companies (+22% in 2021 compared to 2020) mainly due to their strong mobilization within the national recovery plan “France Relance” (high number of supported projects at the end of 2021). The capital spending recovered to around €4 billion (after a drop of 25% during the crisis in 2020), which represented an effort of 16% of added value for the chemical industry.

Another €2 billion, almost 10% of added value, was invested in research and development, which represented 8% of the total industrial research spending.The chemical industry can rely on a steady growth of skills and staff assigned to the research, especially researchers +4% on average over the last 10 years). Moreover, the France’s academic excellence in Chemistry is illustrated by 10 Nobel Prizes.

Thanks to its R&D intensity, the sector succeeded in its differentiation strategy on downstream segments (specialization and upscaling), furthermore driven by an excellence in R&D (10 Nobel Prizes), a technological leadership (e.g. materials for batteries) and the brand recognition of the “made-in-France” (perfumes and cosmetics).

Integrated into a network of competitive clusters and chemical parks

In France, about 30 competitiveness clusters have links with chemicals and materials. Six are totally or partially dedicated to chemicals:

- AXELERA in Auvergne-Rhône-Alpes (Lyon)

- POLYMERIS (merger of ELASTOPOLE in Centre-Val de Loire and PLASTIPOLIS in Auvergne-Rhône-Alpes )

- COSMETIC VALLEY in Eure-et-Loire (Chartres)

- EURAMATERIALS in Hauts de France (Villeneuve d’Ascq)

- BIOECONOMY FOR CHANGE in Hauts de France (Laon)

- XYLOFUTUR in Nouvelle Aquitaine (Bordeaux)

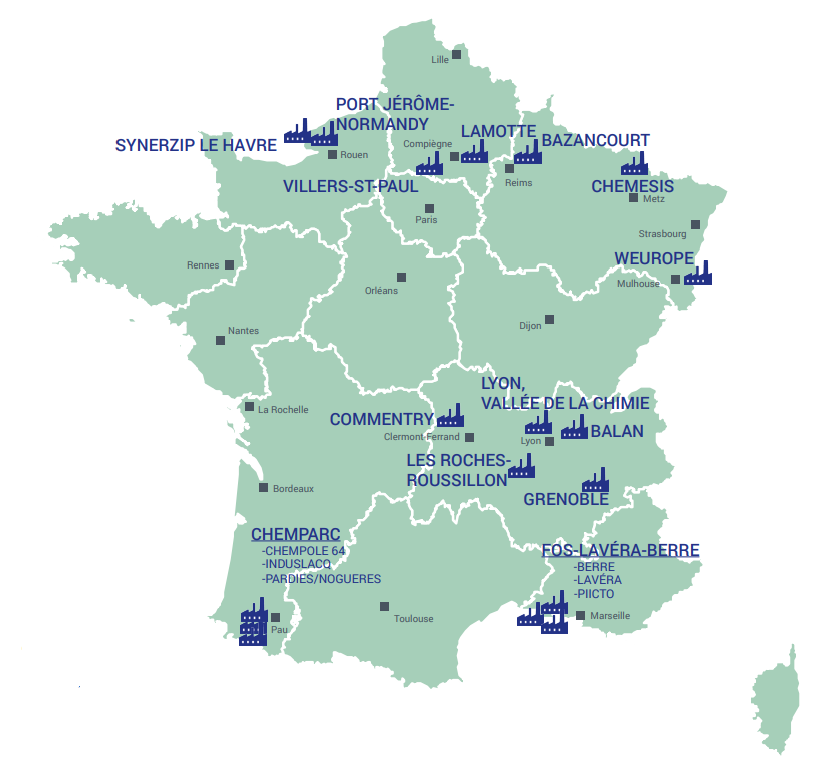

In addition to these attractive clusters in innovation, the chemical companies can rely on highly competitive industrial parks. They have access to 18 chemical platforms throughout the country. These parks are excellent fields for new investments where chemical producers, suppliers and subcontractors come together to pool utilities and services (such as energy production, waste processing or water treatment, process and plant safety, environmental protection, security and fire prevention), covering all activities from planning to construction and operation of chemical plants.

The Chemical platforms in France

HOW ARE WE DOING?

After a robust rebound in the second half of 2020, chemicals output slowed in the course of 2021 due to the resurgence of the pandemic in some European countries, the very high energy and feedstocks prices and also the rising supply chain and logistics issues. Consequently, despite a significant recovery by 6% in 2021, the average chemicals volumes were still below the pre-crisis level by 2.4%.

Moreover, since the second quarter of 2022, output and sales have faced increasing prices for commodities and energy feedstocks exacerbated by the conflict in Ukraine and a decreasing demand from key customer industries. The chemical trade balance continued to worsen in all subsectors except in Cosmetics and perfume.

Strengths

The chemical industry in France benefits from key assets which are sources of growth and performance for the global sector, with:

- High level of integration between upstream chemistry and chemicals intermediates, particularly on the chemical platforms

- Large and strong downstream sectors (energy, transport, aeronautics, cosmetics, pharmaceuticals, plastic processing, water treatment, food, packaging, construction etc.)

- Great location and excellent infrastructure supporting worldwide oriented exports

- Outstanding R&D (both public and private) supported by efficient tax incentive programs

- Highly qualified and productive workforce, highly educated young people and an effective training system

- Nuclear energy and low GHG emissions

- Competitive industrial parks or platforms, premises for new investments, pooled resources, such as energy, production or water treatment

- Renowned environmental, safety, security and process expertise

- A strong innovative ecosystem represented by many specialized SMEs (around 95% of the total companies) and a dynamic network of start-ups (ChemTech)

Weaknesses

- Dependence on imported raw materials and intermediate products

- Image of the industry in general, and of chemical products, upon the French public

- Over-transposition of EU directives in national regulation regarding chemicals and production sites (recent measures taken to remove part of them)

- Increasing difficulties to recruit both low and high-graduated profiles, especially in the production and maintenance fields.

OUR CONTRIBUTION TO A COMPETITIVE EUROPE

As an industry of innovation and high added value, the chemical industry is a key player in the French ecosystem. Its innovative solutions are a true asset for the development, both in France and in Europe, of strategic markets and key technologies, such as electric batteries and vehicle weight reduction, hydrogen technologies, chemical recycling of polymers, bioproduction, additive manufacturing, etc.

The French chemical industry also has a key role in contributing to the challenges of health sovereignty and security, with for example the supply for active and intermediate pharmaceutical ingredients.

This contribution to a competitive Europe being recognized, the sector benefited from a positive political momentum within the French national recovery plan and the economic stimulus package (France Relance). Investments were accelerated in critical activities such as active pharmaceutical ingredients, biobased chemistry, chemical recycling, and innovative materials for IPCEI projects (battery, hydrogen, semi-conductors…).

The energy transition of the chemical industry in France is another priority both for the Government and industry players. After reducing its CO2 emissions by 63% since 1990, the sector is confident in securing a trajectory of reduction of more than a quarter of its emissions in 2030 as compared to 2015. To go further and target the objectives of the National Low-Carbon Strategy to 2030 (-35%), less mature technologies will be needed (carbon-free hydrogen, capture, storage or recovery of CO2, electrification of processes, etc.). First projects are to be launched in the coming years to secure the expected technical and commercial deployment path.

By end November 2022, more than 233 business projects of chemical companies (half of which led by SMEs) representing €3,6Bn investments over the next three years, have already been awarded financial support as part of France Relance.

The Government roadmap “France 2030” confirms a positive momentum for the Chemical industry in France to accelerate its energy transition and to grasp growth opportunities in the above listed strategic markets. Another round of calls of proposals will soon be launched to support projects in their different stages of development (R&D, scale-up or industrialization).

Last year, France Chimie and Bpifrance, the French public investment bank, have joined forces to support start-ups that have emerged in the chemical sector. They represent a major area of innovation and excellence for the chemical industry, and this partnership aims at reinforcing this “ChemTech” community of already 100 start-ups and facilitating partnerships with our members (large companies or SME).

Take a “low-carbon industrial project journey” through Europe: discover our map

Low-carbon technologies projects: mapping investments and projects of the European chemical industry