Chemical industry snapshot

A key contributor to the French economy

With a turnover of €108.5bn in 2023 (including active pharmaceutical ingredients) generated by more than 4,000 companies, France is the second largest European chemical producer.

Despite a deteriorated economic environment in Europe since the Covid-crisis and the war in Ukraine, the chemical industry in France continues to perform well in terms of foreign trade. In 2023, it remains the leading exporting industrial sector with €80bn in exports, ahead of the food industries (nearly €63bn) and aeronautics and space construction (€56bn).

The sector confirms its key contribution to the trade balance of the French economy, with a trade balance of €18bn, second behind aeronautics.

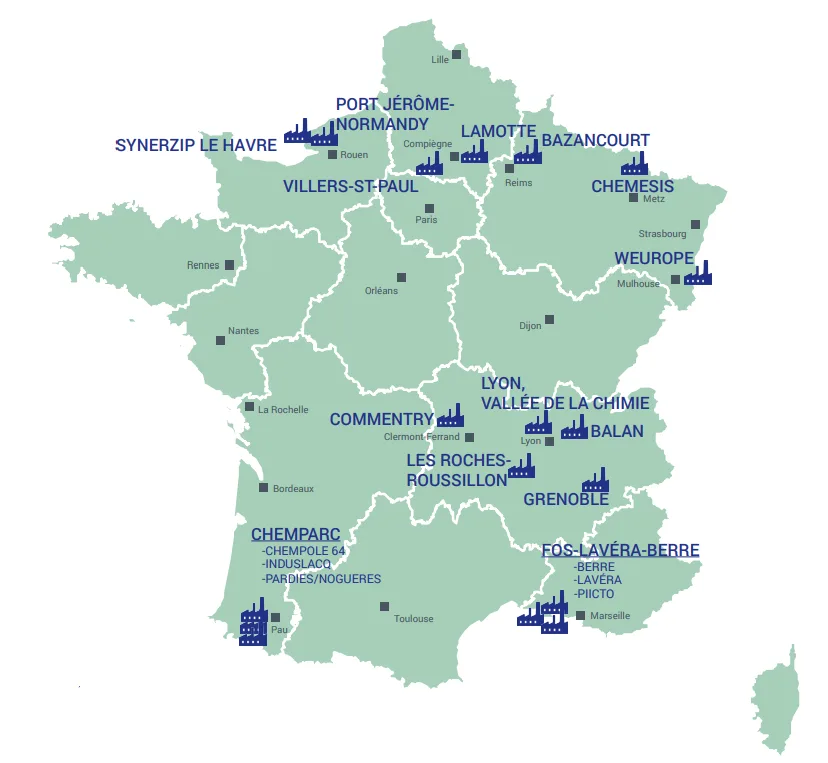

Thanks to its strong presence in many regions across France, more than 4,000 companies, some located at 19 chemical platforms, employ about 177,000 direct employees and an estimated 885,000 including indirect and induced jobs.

Mobilized in its ecological transition, the chemical industry in France aims to significantly reduce its environmental footprint:

- its greenhouse gas emissions by 78 to 81% by 2030 compared to 1990.

- its water withdrawals by 10% by 2030.

A leading employer

The chemical industry hires and offers high-skilled jobs. In 2023, the sector continued to experience a net growth in its workforce (+1.3%, corresponding to 26,000 hirings) and apprentices. Nearly 3,000 new jobs were created between 2022 and 2023, mainly in the perfumes, soaps and detergents sector.

The level of skills is high with companies offering long-term contracts (94% permanent contracts) and qualified jobs (71% of employees are managers, technicians or supervisors).

Women represent 39% of the total workforce, a slightly increasing share.

France Chimie sees alternated training as one of the best ways to meet the challenge facing to the chemical industry of renewing staff and skills. In 2023, the sector hired more than 8,000 alternated students (professionalization contracts and apprenticeships), corresponding to an increase of 34% over the past four years. A survey in the chemical sector showed that more than 60% of them continue to work in the sector at the end of their training program and nearly 40% within the same company.

A major international industry

Around 65% of the total chemical sales (including the chemical distribution) were exported in 2023. The European Union remains the leading partner for chemicals in France representing 56% of the total exports ahead of the United States (7%), United Kingdom (5%) and China (5%).

Investing in the future

Despite the health crisis and the energy crisis, the momentum of chemical investment in France was maintained in 2023. According to France Chimie’s survey of its members, capital expenditure increased by 21% in value in 2023 to reach a record level to €8bn. This performance has partly been driven by the French government support plans.

According to the survey, the share of growth investments (capacity expansions and new product introductions) rose to 39% of total expenditures in 2023, compared to 61% expenditures on maintenance and regulations (environmental protection and risk management).

Another €2 bn, almost 10% of its added value, was invested in research and development representing 8% of the total industrial research in France. Its staff in research activities continues to grow by 2%/year, a continuous growth since the introduction of the research tax credit.This effort and performance in innovation can also be illustrated by the French chemical sector ranking 4th in the world in the number of European patent filings, ahead of China.

Moreover, France Chimie and Bpifrance, the French public investment bank, are pursuing their partnership to reinforce a “ChemTech” community of more than 250 startups today in the Chemical industry. They represent a major area of innovation and excellence, active in different fields: Bio-based chemistry and industrial biotech, solutions for batteries and electrolyzers, chemical recycling and CO2 recovery, health applications, digital solutions for chemistry measurement, monitoring, process optimization…

Integrated into a network of competitive clusters and chemical parks

In France, about 30 competitiveness clusters have links with chemicals and materials. Six of them are totally or mainy dedicated to chemicals:

- AXELERA in Auvergne-Rhône-Alpes

- BIOECONOMY FOR CHANGE in Hauts de France

- POLYMERIS in Auvergne-Rhône-Alpes

- COSMETIC VALLEY in Eure-et-Loire

- EURAMATERIALS in Hauts de France

- XYLOFUTUR in Nouvelle Aquitaine

In addition to these attractive clusters in innovation, chemical companies can rely on highly competitive industrial parks. They have access to 19 chemical platforms throughout the country. They are excellent fields for new investments where chemical producers, suppliers and subcontractors come together to pool utilities and services (such as energy production, waste processing or water treatment, process and plant safety, environmental protection, security and fire prevention), covering all activities from planning to construction and operation of chemical plants.

In addition to these attractive clusters in innovation, the chemical companies can rely on highly competitive industrial parks. They have access to 18 chemical platforms throughout the country. These parks are excellent fields for new investments where chemical producers, suppliers and subcontractors come together to pool utilities and services (such as energy production, waste processing or water treatment, process and plant safety, environmental protection, security and fire prevention), covering all activities from planning to construction and operation of chemical plants.

The Chemical platforms in France

How are we doing?

In 2023, chemicals in France recorded a smaller contraction (-0.9%) than the European average (-8%), thanks to the strong growth of its perfumes and cosmetics and a relative resilience of the specialty chemicals. However, this performance masks a slowdown in basic chemicals activities like its European counterparts, as they are exposed to the same cyclical reasons (weak European demand and destocking effects) but also structural ones such as European energy prices higher than the rest of the world and global overcapacity in many segments.

Strengths

The chemical industry in France benefits from key assets which are sources of growth and performance for the global sector, with:

- Large and strong downstream sectors (energy, transport, aeronautics, cosmetics, pharmaceuticals, plastic processing, water treatment, food, packaging, construction etc.)

- High level of integration between upstream chemistry and chemicals intermediates, particularly on the chemical platforms

- Great location and excellent infrastructure supporting worldwide oriented exports

- Outstanding R&D (both public and private) supported by efficient tax incentive programs

- Highly qualified and productive workforce, highly educated young people and an effective training system

- Nuclear energy and low GHG emissions

- Competitive industrial parks or platforms, premises for new investments, pooled resources, such as energy, production or water treatment

- Renowned environmental, safety, security and process expertise

- A strong innovative ecosystem represented by many specialized SMEs (around 95% of the total companies) and a dynamic network of start-ups (ChemTech)

Challenges

- Dependence on imported raw materials and intermediate products

- Image of the industry in general, and of chemical products, upon the French public

- Over-transposition of EU directives in national regulation regarding chemicals and production sites (recent measures taken to remove part of them)

- Increasing tensions on the labour market for both low and high-graduated profiles, especially in the production and maintenance fields.

Our contribution to a competitive Europe

As an industry of innovation and high added value, the chemical industry is a key player in the French ecosystem. Its innovative solutions are a true asset for the development, both in France and in Europe, of strategic markets and key technologies, such as electric batteries and vehicle weight reduction, hydrogen technologies, chemical recycling of polymers, bioproduction, additive manufacturing, etc.

The French chemical industry also has a key role in contributing to the challenges of health sovereignty and security, with for example the supply for active and intermediate pharmaceutical ingredients.

This contribution to a competitive Europe being recognized, the sector benefited from a positive political momentum within the French national recovery plan and the economic stimulus package (France Relance). Investments were accelerated in critical activities such as active pharmaceutical ingredients, biobased chemistry, chemical recycling, and innovative materials for IPCEI projects (battery, hydrogen, semi-conductors…).

More than 250 business projects of chemical companies (half of which led by SMEs) corresponding to over €5Bn announced investments have been awarded financial support as part of France Relance.

The energy transition of the chemical industry in France is another priority both for the Government and industry players. After already reducing its CO2 emissions by 65% since 1990, the sector has consolidated a trajectory which could lead to about 80% by 2030 if all the key success factors are met. The Low-carbon strategy of the French Chemical sector relies on energy-efficiency, low carbon heat and less mature technologies such as carbon-free hydrogen, capture, storage or recovery of CO2, electrification of processes. The most important ones are : securing access to competitive low carbon electricity (to cover the 50% increase in electricity needed) and biomass; developing the associated infrastructure in time; preserving the sites from unfair competition during their transition.

The Government roadmap “France 2030” confirms a positive momentum for the Chemical industry in France to accelerate its energy transition and to grasp growth opportunities in the above listed strategic markets. Another round of calls of proposals has been launched to support projects in their different stages of development (R&D, scale-up or industrialization). Out of the 50 industrial start-ups granted support to build their first manufacturing site, 11 are from the Chemical industry (a larger share its weight in the industry sector).