Chemical industry snapshot

Basic macro-data on Slovakia

- Population: 5.43 million

- Area: 49 thousand km2

- GDP: USD 24 337per capita in 2023

- Currency: euro (€) as of January 1, 2009

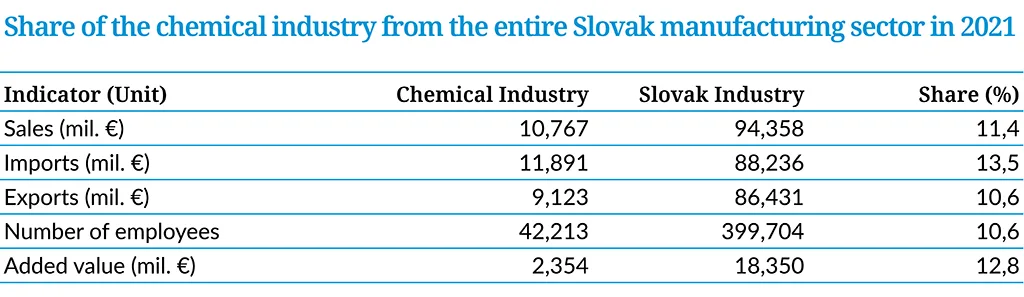

The chemical industry has traditionally been one of the largest sectors of the Slovak economy. Two of the strongest economic sectors — the automotive and the electronics industry — build a lot of opportunities for the suppliers of plastic components and rubber components (tyres). The chemical sector (including pharmaceuticals and rubber and plastics) is ranked third in terms of Slovak industrial production.

Data for 2023 shows that revenues generated by all companies in this sector amounted to €11 658 million. At the same time the Slovak chemical industry equalled output of 10.4% from the total industrial production (€ 112 056 million). Slovakia’s chemical exports is slightly decreasing by time (10,2 % of total Slovakia’s exports). The chemical sector accounts for about 12,6% of total Slovak added value

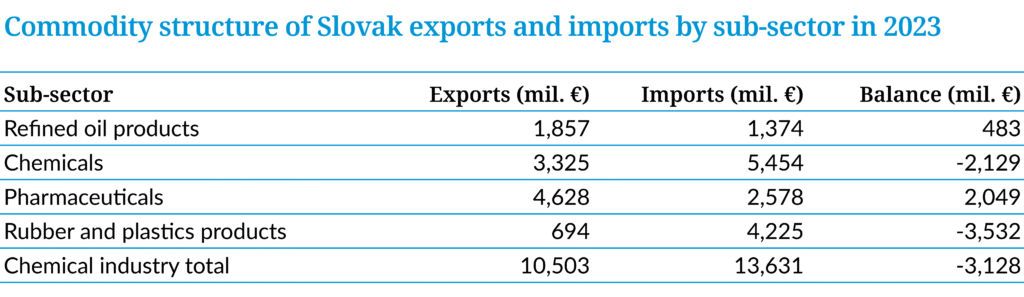

Foreign Trade

At the end of 2023, the sector employed 38 765 people in 278 companies with more than 20 employees (45,3% in small companies, 41,2% in medium size companies and 10,9% larger companies with 250 or more employees).

Situational analysis

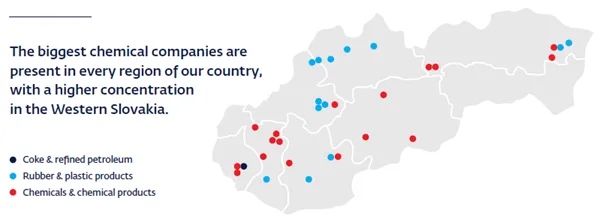

The biggest chemical companies are present in every region of our country, with a higher concentration in Western Slovakia (Bratislava, Trnava, Trenčín and Nitra self-governing regions) due to the availability of infrastructure and transportation. These Western regions have a 58,4 % share of Slovakia’s total GDP (statistics.sk). Central Slovakia is formed by the self-governing regions Žilina and Banská Bystrica, with a share of 20,3 %, and the Eastern part, formed by self-governing regions Prešov and Košice, with a 21,2 % share of total GDP with the biggest development potential. The highway connection between western and eastern of Slovakia is still not finished, which is a big drawback mainly for Prešov and Košice regions.

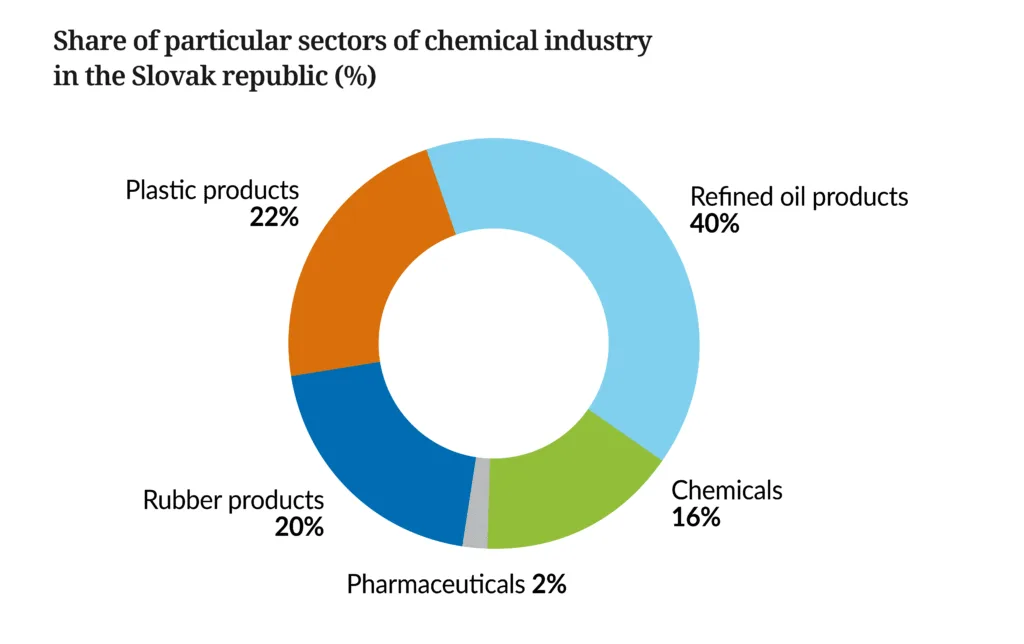

The Slovak chemical industry does not consist of one product or a group of few products, but includes a diversified portfolio of hundreds of different products, ranging from petrochemicals, agrochemicals, and primary organic/ inorganic chemicals, to rubber (tyres) and plastic products.

The chemical industry is also concentrated mainly in the Western part of Slovakia where oil refinery, production of primary plastics, rubber products (tyres), fertilizers, coatings, pharmaceuticals, plastic products are located.

Production mainly focuses on man-made fibres, plastic foils and other chemical products in Central and Eastern Slovakia. Many small- and medium-sized companies are geared to the production of rubber, plastic and other products for the automotive industry. There are four big car factories: Volkswagen, Peugeot-Citroen, Jaguar Land Rover and KIA, located in the Western part of Slovakia. A total number of over 1.00 million cars were manufactured in 2021, the equivalent of 184 units per 1,000 inhabitants, more than in any country in the world.

As far as the accessibility of universities and research technology organizations are concerned, there are three important universities for the industry: the Comenius University and the Slovak University of Technology both located in Bratislava, and the University of Technology in Košice in the Eastern Slovakia. There are five private R&D Institutes geared mainly to the chemical sector: R&D of chemical technology, petrochemicals, plastics, and man-made fibres. There is good co-operation between specialized faculties of the universities, R&D institutes and the Slovak Academy of Science, a state institution.

Slovakia spends only about 0.7 – 0.8 % of its GDP on R&D per year. The lack of state support for applied R&D is a significant issue for the Slovak chemical industry. In 2021 there were €918 million of financial means for the whole R&D in Slovakia, of which €348 million from public funds, €420 million from the private sector, which in total represented 0.95% of the Slovak GDP.As part of the “Slovakia Program” for the years 2021-2027, the government approved a total of almost 1.8 billion euros for science, research, innovation, industrial transformation, digitalisation, and support for the growth of small and medium-sized enterprises. Until now, Slovakia has invested only less than one percent of its GDP in science and research in the long term, while the EU average is 2.3 percent. More than €160 million will go to support Slovak scientists and improve the conditions for their research activities.

The biggest players of the Slovak Chemical Industry (base on revenues)

Production mainly focuses on man-made fibres, plastic foils and other chemical products in Central and Eastern Slovakia. Many small- and medium-sized companies are geared to the production of rubber, plastic and other products for the automotive industry. There are four big car factories: Volkswagen, Peugeot-Citroen, Jaguar Land Rover and KIA, located in the Western part of Slovakia. A total number of over 1.08 million cars were manufactured in 2023, the equivalent of 198 units per 1,000 inhabitants, more than in any country in the world.

As far as the accessibility of universities and research technology organizations are concerned, there are three important universities for the industry: the Comenius University and the Slovak University of Technology both located in Bratislava, and the University of Technology in Košice in the Eastern Slovakia. There are five private R&D Institutes geared mainly to the chemical sector: R&D of chemical technology, petrochemicals, plastics, and man-made fibres. There is good co-operation between specialized faculties of the universities, R&D institutes and the Slovak Academy of Science, a state institution.

Slovakia spends only about 0,8 – 0,9 % of its GDP on R&D per year. The lack of state support for applied R&D is a significant issue for the Slovak chemical industry. In 2022 there were €1 075 million of financial means for the whole R&D in Slovakia, of which €456 million from public funds, €619 million from the private sector, which in total represented 0.98% of the Slovak GDP. As part of the “Slovakia Program” for the years 2021-2027, the government approved a total of almost 1.8 billion euros for science, research, innovation, industrial transformation, digitalisation, and support for the growth of small and medium-sized enterprises. Until now, Slovakia has invested only less than one percent of its GDP in science and research in the long term, while the EU average is 2.3 percent.

How are we doing?

Strengths

- Strategic location in Europe with great export potential connecting territory between the North and the South, the West and the East of Europe

- Cost-effective labour force

- Euro-zone membership and Euro currency

- Sound and stabilized banking sector

- Well-educated and skilled people

- Tradition of chemical production in all regions

- Research and development capacities ready to join new projects

- Very favourable geographical location of the Slovak Republic

- Expanding dual education in companies, including foreign companies based in Slovakia

- Renowned university departments educating top chemists, pharmacists, chemical and pharmaceutical technologists and biotechnologists.

- Quality base of scientific and research workplaces with top experts

Challenges

- Slovakia is short of most raw materials that are important for chemical production, but there are some critical raw materials

- Uncompleted highway infrastructure

- Relatively high prices of electricity and gas

- Unfavourable attitude of the public towards chemical production (production facilities)

- The overall aging of the population will lead to a significant generational change in the workforce within the next 20 years.

Our contribution to a competitive Europe

In particular, the Slovak chemical sector can build its future progress on good cooperation between universities, the Slovak Academy of Science, the private R&D institutes and R&D departments of advanced manufacturing companies. Slovakia is praised as one of the most productive countries in Europe. Combined with cost‒effectiveness and high education level, Slovak labour force excels in the three areas that often concern investors — productivity, qualification and labour costs.

The Association of Chemical & Pharmaceutical industry of the Slovak Republic (ZCHFP SR) has cooperated within the Projects Nanoforce, FreeFOAM, INNOCHEM, ChemPharmVET, ChemMultimodal and ChemTube with partners from all of the Europe.