Chemical industry snapshot

A heavyweight industry

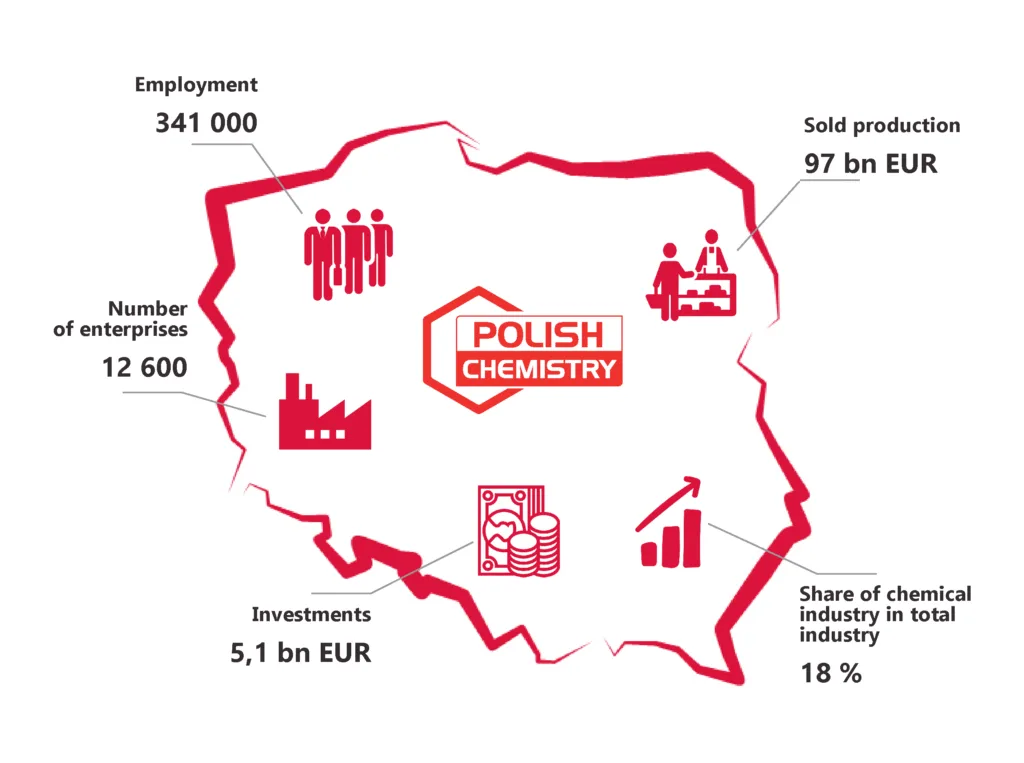

The chemical industry has a very high position among industrial sectors of the Polish economy. The share of chemical industry in the total industry is 18.0%.

The last decade shows that the chemical sector is one of the fastest growing areas in the Polish economy. The average annual growth rate of sales of the chemical sector in 2013-2023 amounted to 5.8%.

However, in 2023, the chemical industry in Poland, including the production of coke and refined petroleum products, pharmaceuticals, rubber and plastics, was affected by the war in Ukraine and the energy crisis, resulting in a decrease of 7% in sold industrial production compared to value in 2022. The total sales of the Polish chemical industry, in 2023, amounted to EUR 97 billion.

Production of the chemical industry in Poland is dispersed. Manufacturing plants of the largest domestic producers are located throughout the country. To reduce transport costs and increase competitiveness, processing plants are often located close to the companies manufacturing chemicals in primary forms.

A massive employer

In 2023, the chemical industry was the third-largest employer in Poland, employing 341,000 people. It represents 13% of total employment in the entire Polish industry, which is more than in other industry sectors such as automotive, furniture or mining.

A trade deficit

Foreign trade plays a very important role in the chemical industry in Poland. A large part of raw materials and semi-finished products is imported for processing and consumption or for export abroad.

The key export product in 2023 was plastic products, with a surplus over imports of 4.5 billion EUR. The product imported in the largest quantities was pharmaceutical products, with an import value of 10.5 billion EUR.

Poland still has a longstanding trade deficit in chemicals: in 2023 it was 10.1 billion EUR.

How are we doing?

The chemical industry, like other sectors of the economy, is shaped by global trends. The most important factors determining these changes are directions of new regulatory solutions and changes in consumer behaviour. The most important trends shaping the chemical industry include regulations, especially those related to the European Green Deal, green transition, energy and climate transformation, ecology, ESG, customisation, geopolitics, new business models, industry 4.0 and innovation.

Strengths

- High resource and energy efficiency, especially in manufacturing fertilizers and petrochemicals

- Well-educated and efficient labour force

- Good supplier and customer relations

- Good industrial R&D centres, university and technical university infrastructure

- Safety expertise

Challenges

- High energy prices compared to nearby countries

- Heat and power sourced from hard coal and lignite, with a big environmental impact

- Heavy reliance on imported raw materials

- High reliance on imports of gaseous fuels, however, the Poland’s gas fuel supply structure changed significantly in 2022. 2022 was the last year in which Poland imported natural gas under the long-term supply contract for the Yamal-Europe pipeline and the LNG terminals on the Baltic Sea are being further expanded.

- Lack of skilled young employees (regarding green transition and engineering skills)

- Poor rail infrastructure and high rail transport costs

Our contribution to a competitive Europe

Investments

In the coming years, enterprises plan to allocate the largest investment outlays for adaptation to environmental regulations as well as related to energy transition, modernisation and replacement investments. Polish chemistry needs greater transparency and predictability of regulatory solutions as well as increased availability of financial support instruments for dynamic growth of innovations and new investments.

From 2013 to 2023, investment outlays in the Polish chemical industry recorded a steady increase until they reached 5.1 billion EUR.

The chemical industry is constantly taking measures to reduce its impact on the environment. It is an integral part of the process of change and development of the sector. For plants, it is not only the modernisation of installations, recognition and monitoring of threats or increasing efficiency but also the improvement of safety in the production and distribution of chemical substances, as well as the implementation of modern, innovative, pro-environmental technologies.

The commitment of the entire chemical sector is reflected in many areas, but the most important are:

- delivering products and semi-products to nearly all sectors of the economy,

- creating and retaining jobs,

- providing pro-environmental investments and innovations,

- undertaking voluntary initiatives for the natural environment and local communities.

Sustainable development

Over the years, Polish chemistry has taken numerous measures to protect the environment, local communities, employees and build relationships with stakeholders. Polish chemical companies undertake also number of activities aimed at implementing the main pillars of the sustainable development policy.

It is a series of initiatives aims to environmental protection, job development, employee safety and support for local communities. Activities which are taken by representatives of Polish chemistry enable the achievement of Sustainable Development Goals. The implementation of activities of the 2030 Agenda is one of the elements of the stable development and growth of Polish chemistry.

Polish Chemistry is involved in initiatives for local communities and the environment. For example, as part of the long-term educational campaign implemented as a part of the Responsible Care Program in Poland – so far over 33.5 million PET bottles and 47 tons of other abandoned waste have been collected. As a result, almost 40 thousand trees have been planted. Chemical companies also involve local communities – so far nearly 273 thousand children, workers and volunteers have been involved.