The case for hydrogen and low-carbon gas markets

Background

In December 2021, the European Commission unveiled its Hydrogen and decarbonized gas markets package. Building on the 2020 EU Hydrogen strategy, the package is a key steppingstone towards achieving climate neutrality while strengthening the resilience of the EU energy system. It also plays a significant role in decreasing Europe’s dependency on the import of natural gas. Natural gas represents over 20% of Europe’s primary energy consumption and, in 2021, the EU’s import dependency rate was 83%.

Cefic recognizes the importance of and supports the Commission’s ambition to develop both a competitive hydrogen market and a renewable and low-carbon gas market in the EU. To meet the climate neutrality targets set by the European Green Deal, our sector depends on the large-scale availability of renewable and low-carbon energy and feedstock, which should be supplied cost-competitively and securely across Europe. In particular, the chemical sector is projected to be one of the EU industrial champions in the use of clean hydrogen, so the future of the sector is closely intertwined with the development of a hydrogen economy.

The chemical sector and the need for gas

The European chemical sector plays, and will keep playing, a pivotal role in Europe’s energy transition. On one side, the sector is working tirelessly to further decrease its GHG emissions. At the same time, solutions developed by the chemical industry (e.g. composite materials for wind turbines, building insultation, EV batteries, chemical recycling technology) help other sectors achieve energy savings and reduce their GHG emissions.

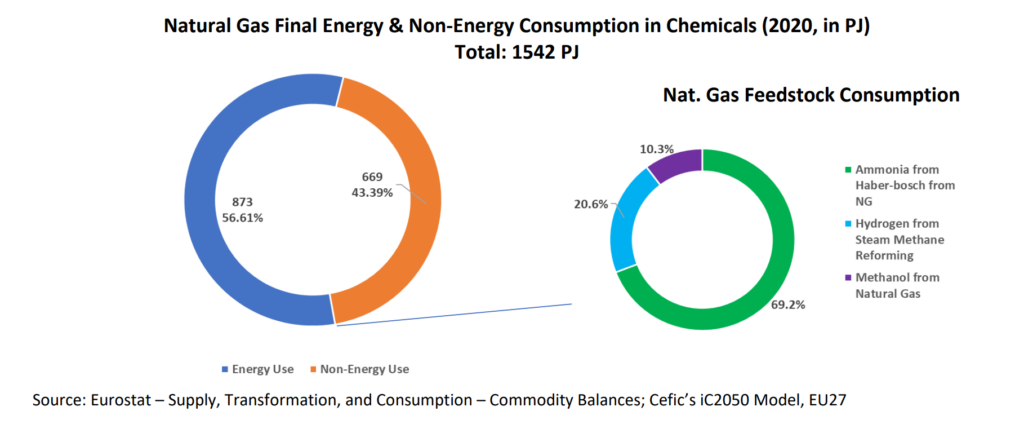

But, we are still dependent on specific molecules to create the key materials for a sustainable world. In the short-term, the chemical sector remains uniquely dependent on secure and stable supplies of natural gas, which is used both for energy and as a raw material. In fact, natural gas is a critical element to produce ammonia, hydrogen, and methanol.

In our forecast, we anticipate that our demand for renewable and low-carbon energy and feedstocks will continue to increase as we advance on the ambitious path to transform our processes. Low-carbon gases, such as biogas and biomethane, could progressively replace natural gas in the manufacturing of chemicals.

The chemical sector and the need for hydrogen

When looking ahead, hydrogen is expected to play a pivotal role for the chemical sector. The chemical sector is already a major consumer and producer of hydrogen, and the need for hydrogen is expected to become more and more relevant in the years to come.

“Hydrogen can replace fossil fuels in some carbon intensive industrial processes, such as in the steel or chemical sectors, lowering greenhouse gas emissions and further strengthening global competitiveness for those industries”

– European Commission, Hydrogen strategy

High purity hydrogen can be used during chemical processes both as a feedstock and as an energy carrier. The links between the development of a hydrogen economy and our sectors are so strong, that Cefic has been invited by the European Commission to facilitate the work of the European Clean Hydrogen Alliance Roundtable dealing with Industrial Applications.

Given the importance of a well-developed and vibrant market for hydrogen and low-carbon gases, Cefic has prepared some key policy recommendations.

Cefic’s policy recommendations:

1. Gas quality must be maintained in the scale-up of hydrogen production & supply

Gas quality’s needs vary across industries and use cases; specific needs and constraints make stable and guaranteed gas quality a must. In particular, the chemical sector has an absolute need for high-purity natural gas to run optimal operations and avoid damage to existing equipment. It is also important to keep in mind that possible fluctuations in gas quality caused by hydrogen blending may generate commercial and regulatory challenges, and, in some cases, even safety issues

Cefic recommends that, instead of a top-down approach on hydrogen blending, Transmission System Operators (TSOs) should be free to reject gas transmissions based on quality concerns.

2. Hydrogen purity levels must be ensured in the ramp up of the hydrogen market

We view competitive markets as the most straightforward pathway to an efficient roll-out of hydrogen volumes and infrastructure. However, it is essential that the unbundling of existing networks and the establishment of a third-party access (TPA) regime does not erode the high hydrogen quality on which industrial users rely.

3. Definition and certification of low-carbon hydrogen should be predictable and workable

To accelerate the deployment of low-carbon hydrogen, it is key to define a common methodology for low-carbon hydrogen certification. Moreover, to maintain investment confidence, any new certification scheme should avoid undercutting existing investments in low-carbon hydrogen.

4. Regulation of gases needs to remain market-centric, cost-reflective, and transparent

Cefic recognizes the necessity to develop an enabling industrial policy that can transform Europe’s industrial bases. To enable such a transformation, a new industrial policy should develop market-centric regulatory guidelines for gaseous energies and feedstocks. It should also detail the roll-out of renewable and low-carbon gases in a technology-neutral manner and develop a market-driven phase-out of unabated natural gas. In particular, it is key to plan natural gas phase out without undermining investments in CCUS and low-carbon hydrogen projects, which often rely on long-term natural gas supply contracts.